Determination and calculation of forex collateral

Forex Margin is the amount of funds that the brokerage firm freezes when opening an order; it is usually written as “Funds on Collateral” in your trader’s trading terminal.

Forex Margin is the amount of funds that the brokerage firm freezes when opening an order; it is usually written as “Funds on Collateral” in your trader’s trading terminal.

This implies that this amount is used to secure the transaction; you cannot use it in trading or withdraw it from the dealing desk.

The peculiarity of using this moment is that even if you open a transaction of the maximum available volume relative to the amount of your deposit, you will still have free funds.

For which one or more transactions can be opened will all depend on the remaining amount.

Acceleration of a small deposit, large profits with minimal risk

The topic of deposit acceleration is quite popular among Forex traders; sometimes this technique is used in other markets.

In short, deposit acceleration is a risky tactic using high leverage.

Its essence lies in the fact that the trader opens a large number of short-term transactions, earning only a couple of points from each.

This is due to the fact that huge leverage simply does not allow you to hold an existing position for a long time, and losses quickly destroy the deposit.

This trading option has many advantages and even more disadvantages, so some are an ardent supporter of accelerating the deposit, while others do not recognize its use at all.

How to buy and sell oil on Forex.

The fall in oil prices has attracted the attention of quite a large number of people who are not always familiar with stock trading and do not suspect that one can make good money from this process.

suspect that one can make good money from this process.

How to buy and sell oil on Forex?

This is the question most often asked by site visitors. The question itself is not asked entirely correctly, you cannot trade oil on Forex, it is a currency exchange, but for trading you can use a standard trader’s terminal, which, in addition to currencies, contains such trading instruments as metals, raw materials and indices.

That is, in order to buy and sell oil on the stock exchange, you don’t need to invent a wheel at all, just follow a few simple steps:

Why I choose intraday trading

Surprisingly, it is intraday trading that ranks first in terms of volume among other operations.

It is intraday trading that is most popular among most traders who trade Forex.

The share of short-term transactions is several times higher than the indicators of transactions whose duration is more than one day, but this is not surprising because it is in short-term transactions that the maximum leverage is used.

I am also no exception to the majority and a significant portion of my transactions on the stock exchange are short-term transactions that are closed by the end of the day.

What is the reason for this choice and why is this particular trading option considered more profitable?

Short-term trading or long-term investment

All people who come to the stock exchange have the same desires and different opportunities, therefore the methods of earning money should also be different.

Some people start their journey as a trader with only a hundred dollars in their pocket, while others want to increase their fortune to several million.

Depending on the amount of initial capital, you should choose your main earnings strategy, since otherwise the risks are simply not commensurate.

Currently, all exchange trading can be divided into two parts - trading and investment.

Trading - you constantly open new transactions, monitor trends, and develop strategies.

Investments - at the initial stage, you select the most promising asset, purchase it and then only monitor further price changes.

How to choose the best metatrader 4 indicator for forex trading?

Tools such as indicators of technical analysis of the Forex market have found their use quite a long time ago.

For more than twenty years they have been successfully used to analyze various markets or as a basis for creating advisors.

It is not surprising that over such a long period, a simply huge amount of these indicators was created.

On the one hand, this is good, since you can find a tool that meets the requirements of the most demanding user, but on the other hand, there is the problem of choosing from thousands of existing ones.

How to find the most effective of them, at the same time having simple settings that a novice trader can understand?

“Do not offer jobs in Forex” or why people are afraid of this word

Over time, it is amazing to observe how a person’s opinion and his judgments about certain things change.

Most people were glad about the arrival of capitalism in the territory of the former Soviet Union, and assumed that they would take a more attractive place in the new society.

But practically nothing has changed, the janitor remained a janitor, and the employee was an employee and people again wanted to live under socialism.

The same metamorphosis occurred with the attitude of our citizens towards engaging in stock trading, and Forex in particular.

At first, the emergence of the opportunity to trade on the stock exchange aroused keen interest among those who wanted to earn a lot and quickly, but as it turned out, this activity is easy only in films.

Is it worth reading old books about the stock market?

Like any learning process, learning the basics of stock trading is simply inconceivable without reading books about trading .

Yes, something useful can be gleaned from a huge number of articles on countless websites about Forex, but printed or electronic books still remain one of the main sources of information.

Their main advantage is that it is always clear who wrote the content and how much you can trust it.

Many of the works were written by truly outstanding traders or analysts who have many years of experience on the stock exchange.

But at the same time, some of the readers ask the question “How relevant is everything that was written many years ago?”, After all, most of the books were created decades ago.

Why is trading cryptocurrency with a broker better than trading cryptocurrency on an exchange?

The cryptocurrency space is currently extremely popular. News that Bitcoin (or another digital currency) has reached another milestone comes not only from the Internet. Even television program hosts report this.

And the desire of traders who already have some understanding of the foreign exchange markets to join this type of earnings is understandable.

And the desire of traders who already have some understanding of the foreign exchange markets to join this type of earnings is understandable.

After all, in fact, trading cryptocurrency using an algorithm is not very different from, for example, Eurobucks or oil.

And at the same time, the question logically arises: where to trade cryptocurrencies?

Will we remain regular and loyal clients of brokerage companies or will we still turn our attention to specialized exchanges specifically created for trading digital money?

Technical Analysis for Beginners Made Easy

To find the direction of transactions in the foreign exchange or stock market, two types of analysis are used - technical and fundamental.

And if at first glance trading based on news seems as simple as possible, difficulties always arise with the use of technical analysis.

But the reason for these difficulties is that a novice trader immediately faces the most complex methods of technical analysis.

Which require lengthy study, and in practice are not always effective.

Technical analysis for novice traders involves the use of simple techniques with which you can quickly assess the current state of the market.

How many currency pairs to use when trading Forex

The main objects of Forex trading are currency and crypto currency pairs; at the moment, up to 50 such assets are available in the trader’s terminal.

Therefore, the trader experiences difficulties in choosing a currency pair, but even after making a choice, he asks the question - How many currency pairs should he use in his trading?

Some advise focusing on only one pair, others even recommend paying more attention to the situation on the market, and not to the object of trade.

We will try to find a middle ground in this matter and, thanks to this, achieve work efficiency.

To begin with, it should be clarified that we are not talking about the number of simultaneously open transactions on different assets, but whether it is worth focusing on one currency or making several assets work at once.

Can you trust a robo-advisor in Forex?

Trading robots are no longer news to anyone. They appeared in trading a long time ago, and during their existence they acquired a double reputation.

On the one hand, experts note an increase in demand for robot assistants.

Thus, according to experts, the size of investments that will be managed by special programs in the coming years will increase more than 10 times, and will reach $8.3 trillion.

At the same time, distrust of robot advisors is growing, and for good reason.

There are already precedents when, due to the fault of programs, companies suffered multimillion-dollar losses; failures in their work even caused trading stops on stock exchanges.

So, let's figure out how such automatic systems work and whether they can be trusted.

Is it possible to hack a trader's account?

Exchange trading is full of dangers, but in addition to the risk of unfavorable changes in exchange rates, other troubles may await the trader.

One of which is hacking an account and stealing money stored on deposit by transferring it to someone else’s account or payment system wallet.

Such troubles, although they do not happen often, do happen and it is better to try to avoid them, especially since they are quite easy to do.

It is enough to follow a few important Internet safety rules, which we will discuss below.

The main options for hacking accounts:

• Stealing passwords from your personal account is one of the easiest ways to gain access to your account, and if it does not provide additional protection.

Popular Forex strategies

There are two types of novice traders: the first, having entered the stock exchange, tries to find or create an exclusive and extremely profitable earnings strategy, the second is simply the most popular.

Moreover, the second category is on a more correct path; why reinvent the wheel if it has already been invented a long time ago.

It is much easier to trade like the majority, earn stable profits and not waste time looking for tricky solutions.

And in most cases, this approach turns out to be correct; the main thing is to strictly follow the basic rules for applying a particular strategy.

What strategies are the most popular in Forex at the moment?

As one would expect, the greatest demand is for trading options that are easy to implement and bring greater profits.

What is the difference between locking and hedging?

Most novice traders mistakenly believe that locking and hedging open positions are no different.

In fact, these techniques have an identical purpose - risk diversification, but the methods for achieving the task are fundamentally different.

What is hedging and how to use it?

Hedging involves opening two or more trading positions on assets with a zero correlation coefficient, that is, the pricing of these financial instruments does not depend on each other.

To understand the principle and feasibility of using hedging in practice, several examples should be considered:

1. The simplest and most well-known strategy for trading stock assets is “ Buy and Hold ”.

Is it possible to trade Forex without drawdowns and losses?

Anyone who has been trading on the Forex currency exchange for more than a few months knows that the main troubles for a trader are caused by drawdowns and withdrawals of the deposit .

It is drawdowns that spoil the mood, and complete loss of the deposit that forces you to start all over again.

Moreover, many simply cannot imagine their trading without these two events, not even imagining how easy it is to start trading without major losses.

Which not only cause depression, but also become the main reason for making new mistakes.

In fact, if you put aside force majeure circumstances, reducing losses to a minimum is quite simple, the main thing is to follow simple rules and moderate your appetites a little.

When to switch from demo account to real account

The career of most Forex traders begins the same way; almost everyone is confident in their competence and immediately starts from a real account.

But after the first deposit is lost, the beginner becomes more careful and moves on to trading on demo accounts .

So several months of trial and error pass and finally, successful transactions begin to appear, every day there are more and more of them, the deposit gradually increases.

Successful trading on a demo makes you want to quickly switch to a real account, because virtual earnings could turn into real profits.

In fact, the amount of profit for a month or other reporting period does not fully characterize your skills as a trader and is not always a guarantee against repeating mistakes.

When will Forex be banned?

The tightening of requirements for the provision of Forex trading services over the past few years has led many to uneasy thoughts.

This is not the first year that Russian traders have been wondering when Forex will be banned and in what form this will happen.

How will this affect this service sector and will it be possible to circumvent this ban using technological progress?

While the government's actions do not inspire optimism, decrees designed to protect gullible citizens are increasingly restricting the activities of brokers.

So, the future of trading in Russia:

How to add a new asset to the trader's terminal.

The trader terminal allows you to trade not only currencies, but also many other assets - oil, gas, cryptocurrencies , gold, copper, enterprise shares and indices.

But sometimes traders, trying to add chart windows for the selected asset, simply do not find it in the “Symbols” window, although the broker has information on the website that they can trade this asset.

Why does the broker's specification indicate a currency pair or index, but it is not present in the terminal?

In fact, everything is not entirely true, it’s just that by default only the most popular assets are added to “Symbols” and often you won’t find cryptocurrencies or some indices there.

Methods for taking profits in Forex

Many traders sin on entry points, because they are confident that their profitability directly depends on entering the market. However, in practice, often the inability to correctly record profits leads to a decrease in the balance.

The fact is that most traders, even if they do not admit it, have an inferiority complex in terms of taking profits.

Unfortunately, this complex appears almost at the very first stages of a trader’s development, so even pros may not suspect the reason for their losses.

Each of you who is actively trading has more than once noticed a situation where a multi-day profitable position along a trend becomes negative in one second after the publication of some news and causes damage to your balance.

If you are affected by this situation for the first time, you are a lucky person, but when a trader, to put it mildly, is repeatedly taken out of a profitable position by the footsteps, fear and fear of losing profits appears.

Should I choose bonus or leverage?

Currently, it is difficult to find a broker that does not offer a bonus when replenishing an account; the range of offers is quite wide and ranges from 10 to 100 percent.

and ranges from 10 to 100 percent.

That is, according to the terms of the promotion, if you top up your account with $500, you will receive up to another $500 as a gift. Are bonuses so important and necessary when replenishing an account , why are they better than regular leverage and is it worth contacting them?

First of all, let’s try to figure out what gives you a bonus in Forex trading.

1. Less risk?

Analysis is not to blame

In recent years, Forex trading has become much simpler from the technical side, but this has not made making money on the foreign exchange market simpler.

Most traders, having received theoretical knowledge and started trading, are disappointed with the financial result, which is very different from what was expected.

Almost every beginner cannot come to terms with the fact that the number of unsuccessful trades is less than the number of profitable ones.

And the fact that the deposit is melting before our eyes also becomes an unpleasant surprise. This is where accusations against analysis come into force, some blame the imperfections of technical analysis for their mistakes, others talk about the uselessness of fundamental analysis.

The trader finds himself in a psychological dead end, experiences depression, it seems to him that everyone here is making money except him and the stock exchange is not his occupation.

How to become a Forex broker.

Many traders who understand how difficult it is to trade on the stock exchange come up with the idea of becoming a broker, because unlike trading, the risk is minimal and the earnings are more stable.

the risk is minimal and the earnings are more stable.

How much do such companies earn? You can calculate the approximate profit using a simple example - a client opens only 20 transactions per month, each with a volume of 1 lot, the spread is 1 point per lot or 10 dollars.

It is not difficult to calculate that the profit for the month is $200. It’s easy to imagine how much 100 clients will bring. Moreover, regardless of the financial result of transactions, the main thing is that the trader opens transactions more often and in as large a volume as possible, hence the leverage of 1:1000 or even 1:2000.

Why Forex strategies don't work.

It would seem that trading on Forex is as simple as possible - you studied the work in the trader’s trading terminal, chose the appropriate strategy and just open trades, and the profit itself will flow into your account.

strategy and just open trades, and the profit itself will flow into your account.

But while knowledge of a trader’s terminal is usually easy, a lot of questions arise when using strategies, most of them simply refuse to bring profit, although the trader thoroughly follows all the recommendations given.

Why don't Forex strategies work anymore?

Let's try to figure out a similar question below. 1. Trading tool - most strategies are written for a specific currency pair, but not all traders pay attention to this.

Forex pros and cons.

The prospects for quick and easy money attract people of any age; one of these categories includes trading on the Forex currency market.

trading on the Forex currency market.

What lies behind the apparent simplicity of trading and how realistic is the earnings in this field of activity?

First of all, a beginner is concerned with the question: Is Forex not another pyramid scheme for pumping money out of the population and how realistic is it for a novice trader to make money there? 1. Forex is not a pyramid - firstly, it should be noted that the exchange itself has existed for about 50 years, trading on it is carried out not only by domestic dealing centers , but also by large banks in countries such as Switzerland, Germany, Austria, etc. The only difference is the requirements for the client’s initial deposit; if in our Dealing Centers you can start trading with literally a couple of dollars, then European banks prefer large clients with deposits of 10,000 dollars or more.

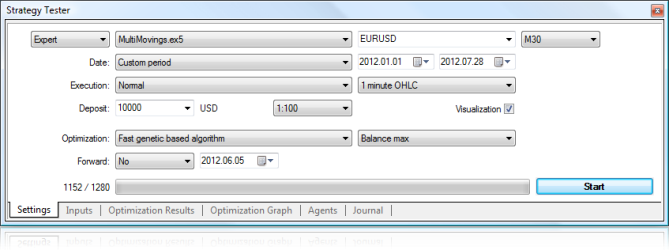

The effectiveness of the strategy tester.

Having purchased or downloaded an advisor for automatic trading for free, you immediately want to check its performance and find out whether the robot can really bring profit without the participation of a trader.

Testing on a real account is quite risky, so it is recommended to use a strategy tester for these purposes.

You can launch it in the trader’s terminal by simply clicking the “View” button in the top menu - Strategy Tester.

Specialty trader.

After the release of several American films telling about the work of a trader, the number of people wishing to master this profession has increased significantly.

this profession has increased significantly.

True, not everyone knows that there are several options for this profession. The majority of people are attracted by high earnings; a trader is one of the few professions where you can earn money without having initial capital.

The most valuable skill is considered to be trading on the stock exchange. How to become a trader - there are several answers to this question; which option is right for you will depend on your age, financial situation and individual qualities, as well as the goals that you set for yourself.

What does profitable trading depend on?

Many beginners wonder why, despite all their efforts, they cannot succeed in stock trading.

What does profitable trading depend on, why does someone make millions on the stock exchange, and someone loses it there, what basic conditions must be met to make a profit?

Let's move on to an overview of the reasons that are the basis for profitable trading on the Forex exchange:

When does a trader start making money?

Most people are accustomed to the fact that income comes immediately, for example, worked for a month - received a salary, sold goods - received money, that is, the interval between the start of work and the financial result should not exceed a month.

money, that is, the interval between the start of work and the financial result should not exceed a month.

If you decide to become a trader, you will have to change your attitude towards work and earnings. A newbie on the stock exchange can only earn money by accident, his earnings are more like winning the lottery, yes it happens, but very rarely.

When will a novice trader start making money?

What to do if a flat comes to the market?

Many traders wonder whether it is possible to trade during a flat, or whether it is better to postpone trading until it is over.

There are quite a few answers to this question, so each trader will be able to choose the most correct solution for himself.

And so, a flat is practically the absence of vertical price movement; for a long time the rate remains almost unchanged; how can you make money at such moments?

Forex trading using bonuses.

Competition among Forex dealing centers is growing every day; the fierce struggle for clients is forcing companies to come up with more and more new marketing tactics and carry out various promotions.

more and more new marketing tactics and carry out various promotions.

One of these PR moves is the provision of bonuses when replenishing an account; in some DCs the percentage of incentives reaches 70%, which cannot but raise questions and doubts.

But in order to check the validity of providing large bonuses, you should first find out how much brokerage companies earn on Forex .

Why such big bonuses?

Page 5 of 7

- To the begining

- Back

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- Forward

- In the end