Leverage for scalping.

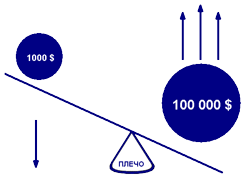

Some traders, when deciding to scalp, think that the key to this strategy is the minimum trade duration, but in fact, the key factor is the amount of leverage.

in fact, the key factor is the amount of leverage.

Leverage for scalping should allow you to maximize profits in the shortest possible time.

There's always a pattern: the shorter your trade duration, the greater your leverage, and therefore the trade volume you can use.

For greater clarity, let's look at some specific examples.

1. Trading on a one-minute M1 timeframe.

If you analyze the candlestick size on this timeframe, you'll find that the currency pair's movement range on M1 is rarely wider than 40-50 pips with a five-digit quote. This indicator will serve as a guideline when choosing leverage and, subsequently, trading volume.

Next, consider the value of 1 pip: on average, with a volume of 1 lot , a pip is equal to one dollar. Keep in mind that this is a five-digit quote. This means that with a one-lot trade in a minute, you can lose or gain $40-50.

Now, consider the size of your deposit. For example, if you have only $100 in your account, it's unlikely you'll lose half your funds in a single trade. Reduce your requirements by at least five times, meaning the recommended volume for a $100 account is no more than 0.2 lots. The maximum possible loss from a single trade is $8-10.

To open a 20,000 euro/dollar trade, we need approximately 23,000 dollars. We divide this amount by our deposit of 23,000/100, which gives us 230, or 1:230. So, to keep things simple, we use a leverage of 1:300 for M1.

We calculate leverage for other timeframes similarly.

2. Trading on a five-minute M5.

Here, you can already see candlesticks as wide as 100 pips, so if you expect to maintain a trade for five minutes or more, you should reduce your trading volume.

If we're still trading with a deposit of $100, but the range has doubled, then the trading volume should be halved to 0.1 lots. As a result, you'll lose no more than $10 per trade.

However, the leverage itself doesn't necessarily need to be adjusted when the volume decreases; this isn't a factor.

Obviously, calculating scalping trading volume based on planned risk is a highly individual matter. Some traders are more cautious, while others scalp with leverage as high as 1:500.

Since the planned risk indicator doesn't necessarily mean you're obligated to hold a losing trade until you lose 100 pips, this benchmark can only be used to set a stop loss .