Scalping without indicators is one of the most profitable options

Every trading technique has its advantages and disadvantages. Scalping is a highly profitable trading style achieved by capitalizing on market noise and intraday price fluctuations.

trading style achieved by capitalizing on market noise and intraday price fluctuations.

Every market noise and the slightest deviation in quotes allows a trader to enter positions and take a few points of profit.

However, few of you have probably considered that market noise is very difficult to predict, and the high volatility that occurs during news releases can seriously shake you and your nerves, not to mention the possible risks incurred.

The strategy involves dynamic trading with a large number of trades. Therefore, when talking to professionals in this field, almost everyone will tell you that 90 percent of a scalper's success depends on thoughtful capital management and the ability to quickly and ruthlessly cut losing orders.

Scalping without indicators on the news

The most common method of scalping without indicators is, of course, trading on the news. I think it's no secret that to make successful trades, the market must first and foremost be moving, and the higher the volatility, the greater the chance of snagging a profit. News is the fuel that drives prices to new heights.

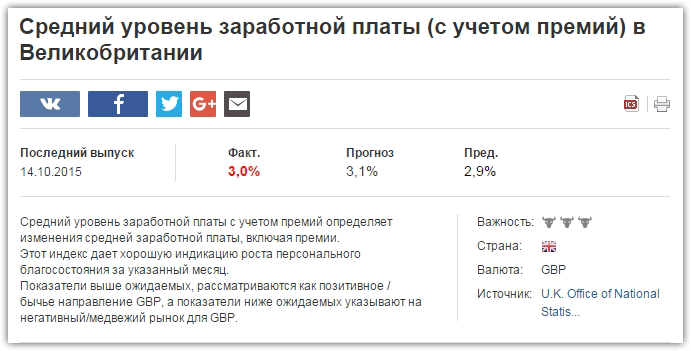

So how do you scalp the news? First, you need to select the news you'll be working with, as well as know the exact release time, the previous price, and have a rough idea of the market's expected direction after the release.

To do this, you need to consult the economic calendar, which you can find on any broker's website. Typically, all news items on the calendar are categorized as low-volatility, high-volatility, and medium-volatility.

Your task is to select the news that has the greatest impact on the market. These aren't necessarily major macroeconomic indicators like GDP or interest rates; you can successfully trade a variety of indices. Almost any news release moves the market by 10-15 pips at the time of its release, which is what you, as a scalper, need to take advantage of.

What if you don't know how news will impact the market and you're new to this approach? I suggest using an economic calendar .

Once you've identified and sorted the news, it's time to start trading. You need to clearly understand how you'll act based on the data release, as the market reacts to it instantly, and you could miss out on profits. Let's take the German Consumer Price Index as an example.

This news has a profound impact on the EUR/USD currency pair. After learning that the previous value was -0.2% and the actual reading is 0%, you decide to open a buy trade. There's one minor caveat when scalping without indicators using news.

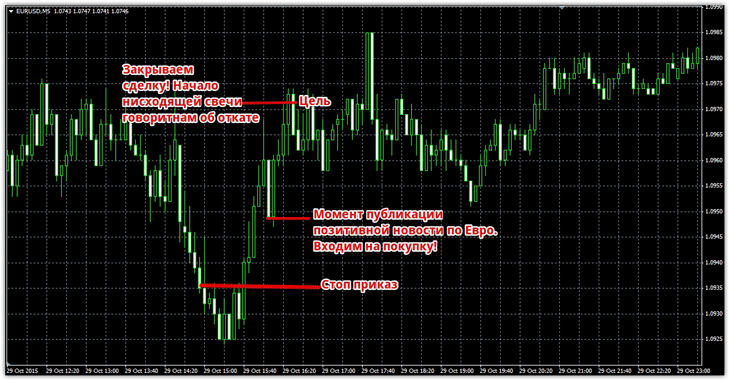

Scalpers don't hold positions for long, so make it a rule to enter the market for 2-3 candles (10-15 minutes on M5) and exit at the first sign of a pullback. Don't forget about stop orders, because if the price goes against you, a sharp spike could cause you to lose more than you expected. Here's an example of a news-driven trade:

Using Japanese candlesticks.

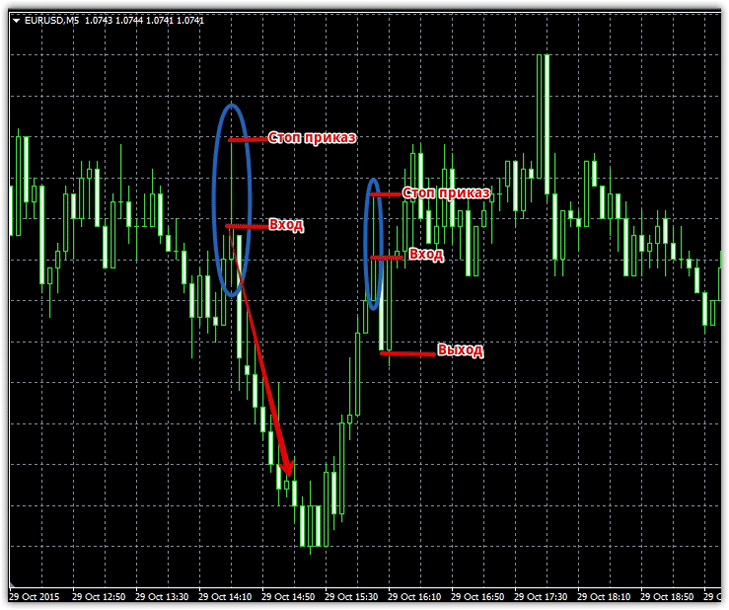

Many traders catch pullback candles, also known as pins. They occur during news releases or in the midst of a news event. The entry point seems extremely simple. You see a large candle of an unusual size, but the same candle begins to shrink, leaving a large tail.

The candlestick's size tells us that players attempted to push the price up or down, but they lacked the strength to do so, and the candlestick shrank, leaving a large tail. This situation provides an excellent entry point for a market reversal, as the large tail indicates that players currently lack the strength to push the price, and it will therefore reverse.

Trading pullbacks is considered risky, so targets are typically set at 1-2 candlesticks, and stop orders should be placed at the edge of the candlestick's tail. Therefore, we buy if a bearish candlestick has formed a large downward tail, and we sell if a bullish candlestick has formed a large upward tail. The strategy is described in more detail here: http://time-forex.com/skalping/skalping-svechi

An example of inputs is shown below:

Trading during a flat market.

The idea is very simple: when the chart begins to move sideways within a narrow range, you need to mark its boundaries with two lines. If the chart breaks the upper boundary of the range, open a buy position; if the price breaks the lower boundary of the range, open a sell position.

A stop order is placed at the center of the designated channel or at local extremes. See the image for an example of a position:

To summarize, scalping without indicators is no less effective than using various complex trading systems. So, don't complicate things for yourself; sometimes simple solutions are much more effective than they seem at first glance.