Scalping during a flat market

For most market participants, the onset of a flat market is almost always associated with losses. It so happens that our upbringing as traders is focused on trend-following trading, with the emphasis always being on the trend being our friend.

that our upbringing as traders is focused on trend-following trading, with the emphasis always being on the trend being our friend.

In theory, following the trend is always a profitable tactic, but in recent years, the forex market has seen mostly sideways movement with emerging micro trends that both emerge quickly and quickly transition into sideways movement.

This market situation has thrown many traders off track, as the constant problem of stop orders being triggered by a strong, wide flat prevents trend-based strategies from fully realizing their potential.

While the vast majority suffer losses, there are those who, on the contrary, make money during the flat, using scalping to rake in profits even on the slightest fluctuations in the chart.

By scalping during a flat market, you have an excellent opportunity to end the day with a profit, since while your trend-following trading strategy is losing money, a strategy that targets a sideways trend will generate profits.

One of the most popular scalping trading tactics is channel trading .

This isn't due to the traders' desires, but to the nature of a flat market, which resembles a saw blade, with all peaks and troughs at roughly the same level. To construct a channel, two lines must be drawn—specifically, support and resistance—at two or three points that the price constantly encounters.

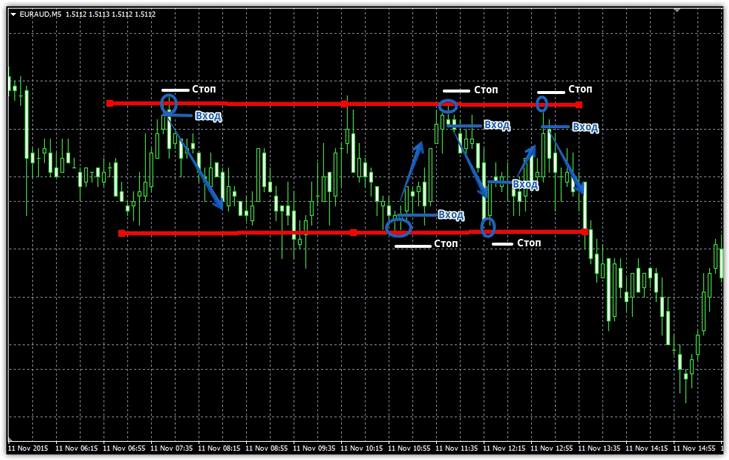

However, for some reason, many people are under the misconception that a flat market moves strictly horizontally. In fact, this isn't true, as a flat market is a kind of accumulation of market participants' strength, and the price chart may be tilted in the direction of the prevailing strength. However, let's first consider a typical sideways trend on a five-minute chart:

The image shows a wide flat, which offers every opportunity to make money by scalping. As you may have noticed in the example, the price forms a sort of range within which it fluctuates, and since market participants have not yet decided on the price's future course, the chart may remain in this state for a long time.

Therefore, very simple signals arise: buy when the price touches the lower channel boundary and sell when the price bounces off the upper channel boundary. The exit target is the opposite channel boundary, and the stop order should be placed a few points from the channel edge.

More precisely, the exit point is the appearance of a signal in the opposite direction. More details are provided in the example below:

However, flats don't always have such a wide price range as shown above. Very often, there are areas of so-called consolidation of forces, where the price fluctuates within 5-10 pips. The tactics for working with such flats remain the same, but in this case, we don't scalp, but rather scalp, plucking a few pips from the market.

However, flats don't always have such a wide price range as shown above. Very often, there are areas of so-called consolidation of forces, where the price fluctuates within 5-10 pips. The tactics for working with such flats remain the same, but in this case, we don't scalp, but rather scalp, plucking a few pips from the market.

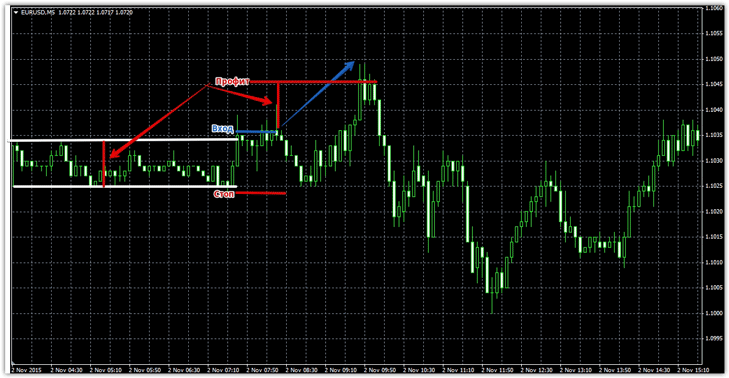

From my personal experience, I can say that when such a narrow flat occurs, it's best to sit it out and enter a position on a breakout of one of the boundaries. So, if you see a very narrow channel, buy when the upper channel line is broken and sell when the lower line is broken. A stop order should be placed beyond the opposite side of the channel, and our target is the size of the constructed channel.

For example, if the chart fluctuates within a 10-point range, the minimum profit should be set at 10 points. When this target is reached, the price will most often continue to move, so it's necessary to partially close the position or move the stop order to breakeven. For more details, see the example below:

When scalping in a flat market, it's crucial to pay close attention to the channel width. Historical observations show that the wider the range, the more effective these types of strategies are. A strong narrowing of the channel indicates a potential explosion, so if you see a gradual narrowing, be prepared for a strong breakout and an exit beyond the channel boundaries.

When scalping in a flat market, it's crucial to pay close attention to the channel width. Historical observations show that the wider the range, the more effective these types of strategies are. A strong narrowing of the channel indicates a potential explosion, so if you see a gradual narrowing, be prepared for a strong breakout and an exit beyond the channel boundaries.

Remember, to scalp in a very narrow channel, you must open an account with a broker with a minimum spread .