Scalping on the move.

As has been noted many times, the main problem with scalping is market entry. It's quite difficult for a trader to understand the basis for a trade's opening decision.

a trade's opening decision.

Some rely on intuition, while others use scalping indicators . However, trading based on intuition almost always ends badly, and indicators often provide false signals.

You can learn to scalp if you understand the main principle of opening trades when scalping and learn to apply it.

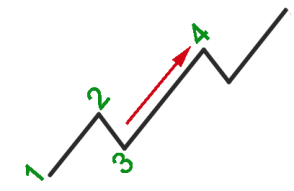

The simplest entry option when scalping is to catch pullbacks and enter after the start of a trend. This method can only be used in a stable trend without sharp price movements.

These moments most often occur during flat trading or between important news releases.

Afterward, all you have to do is identify the trend and monitor the price. For example, if there's an uptrend , wait for the price to fall and open a buy trade when it resumes its rise. This needs to be done as quickly as possible, so it's a good idea to prepare an order in advance so you can simply click buy afterwards.

The trade is held until the next decline and closed using " One-Click Trading ."

Riding the wave.

The second entry option is riskier, but it can sometimes yield several dozen profits from a single trade.

You've often noticed that after the price sharply moves a long distance, it then retrace at least 30% of the previous move.

This is the move you need to catch, but don't get carried away; as soon as the price moves 20%, you can close the trade. If the price moves against you upon entry, the trade closes with a loss of no more than 10 pips.

The only drawback is that you need to constantly monitor the terminal, so it is advisable to combine this technique with another entry strategy so as not to waste time.