Exchange-traded assets with the smallest spread

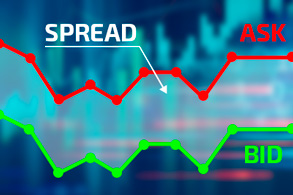

Every trade opened on the exchange incurs a fee, whether it's a volume commission or a spread for opening a trade. In either case, the amount paid is reflected as a deduction from the deposit balance.

Moreover, the fee for opening an order can vary by tens of times, depending on the brokerage company or the asset being traded.

It is clear that it is most profitable to trade assets with the smallest spread for opening a trade; this will allow you to implement any exchange strategy.

It is generally accepted that the cheapest way to open a trade is with currency pairs, as currencies have a virtually zero spread.

Typically, brokers indicate the average spread size in the specification, but it would be more objective to use the Spread Monitor indicator and then calculate the required volume.

Currency pairs – the cheapest pair here is EURUSD, with an average EUR/USD spread of $2.00 per $100,000 trade:

However, such a spread size can only be achieved by trading on ECN or PRO accounts. Furthermore, the trading session must also be taken into account.

Cryptocurrencies are one of the most popular exchange-traded assets today, and the asset with the lowest spread among cryptocurrencies is Bitcoin:

The contract size for Bitcoin is 1 coin, so at today's price, the cost to open a $100,000 trade would be approximately $150.

Gold is a precious metal beloved by investors. Surprisingly, opening a gold trade on the stock exchange isn't all that expensive:

Taking into account the indicator readings and the fact that 1 lot of the XAUUSD pair is 100 Troy ounces, a trade of $100,000 would cost only $20.

Oil is the most popular futures contract, and therefore the most liquid, meaning you can expect a small spread on this asset:

For example, let's take Brand crude oil, with a contract size of 1,000 barrels. When opening a trade for $100,000, the spread will be approximately $120. However, it's worth noting that, if desired, it's possible to achieve a spread half that.

Company shares – the stock market leads in terms of transaction volume, so it's quite interesting to find out how expensive trading is:

It's not that simple here. At first glance, it seems that the spread of $0.1 per share of Adobe Systems Inc. is not much, but considering that this share costs only $344, when converted to a volume of 100,000, the commission comes out to $29.

As a result, it can be said that the minimum spread size is indeed present today for currency pairs, followed by gold and securities.

Therefore, these assets are ideal for intraday trading and scalping .