The relationship between interest rates and the stock exchange price of gold

Gold is one of the most popular precious metals in the world. It is used as an investment, jewelry, and in industry.

But in order to earn the maximum, you should buy the precious metal at the most opportune times, when the price of gold is at its minimum.

In order to determine this minimum and whether the price of the metal will rise or fall, you need to know the factors influencing the price.

One such factor is interest rates, or as they are also called, national bank discount rates . The most influential factor is the interest rate on the US dollar, which is set by the Federal Reserve System of the United States.

How do interest rates affect the price of gold?

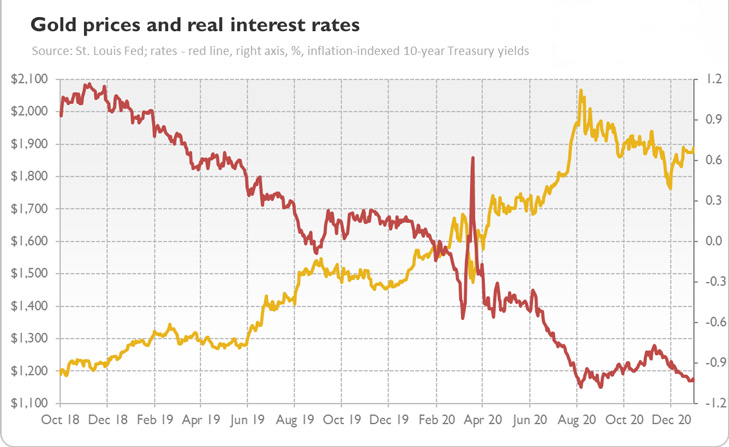

Looking at the charts, we can see that there is a negative correlation between gold prices and interest rates.

Higher interest rates typically lead to a decline in the price of gold. This is because gold is an alternative investment instrument that acts as a safe haven during periods of volatility, uncertainty, and high inflation.

When interest rates rise, investors begin to look for higher-yielding assets, such as bonds or bank deposits. The drop in demand leads to a decline in the price of precious metals.

Lower interest rates cause the price of gold to rise. In this situation, gold becomes more attractive to investors as a safe haven asset. Because low interest rates reduce the yield on bonds and deposits.

In addition, a large amount of cheap money stimulates the growth of inflation, and precious metal has always been considered the best protection against inflation.

This situation leads to increased demand for gold, which becomes a more attractive option for investors seeking protection from inflation and other risks.

Furthermore, interest rates can also indirectly affect the price of gold. For example, rising interest rates cause the US dollar to rise. This can reduce demand for gold in other currencies, leading to a decline in its price.

Here are some specific examples of how interest rates have affected the price of gold:

In early 2022, the US Federal Reserve began raising interest rates in response to high inflation. This led to a decline in the price of gold from $2,070 per ounce in January to $1,600 per ounce in September.

In 2008, during the financial crisis, the US Federal Reserve cut interest rates to a record low. This led to a rise in the price of gold from $700 per ounce in September to $1900 per ounce in August 2011.

In 1980, the US Federal Reserve raised interest rates to 20% in response to high inflation. This led to a decline in the price of gold from $850 per ounce in January to $375 per ounce in December.

How will interest rates affect the price of gold in the future?

Overall, interest rates have a significant impact on the price of gold. When forecasting the price of gold, it's important to consider the current level of interest rates and possible future changes.

Predicting how interest rates will impact gold prices in the future is difficult. However, given the current financial market situation, it's safe to assume that rising interest rates will put pressure on gold prices.

This is because inflation remains high and central banks in the US and other countries continue to raise interest rates in response to it.

However, if inflation begins to decline, this could lead to lower interest rates. In this case, the price of gold could begin to rise.

Thus, interest rates are an important factor to consider when predicting the price of gold.

At the same time, other factors must also be taken into account, such as inflation, the geopolitical situation, and economic policy. Sometimes, economic and geopolitical instability can have an even greater impact on the gold price than changes in interest rates.