NewMartin Advisor: A Completely New Look at Martingale

Martingale, as one of the most popular capital management models that allowed one to beat the casino in the short term, was quickly adapted to the stock market and later to the forex market.

However, despite the fact that the model itself has been used for decades, only a few traders have tried to change their approach to its application.

Currently, two martingale variations are common: a trend-based martingale, in which a new order is opened in a new direction with an increased lot size.

And a flat-based martingale, in which a trade with an increased lot size is opened in the same direction until the advisor makes a profit on Forex.

The most interesting thing is that either martingale scheme loses in a trend or in a flat, depending on the direction of the martingale.

The NewMartin Advisor is a fully automatic robot for the MT4 trading platform, based on indicator-free strategy based on a flexible martingale order distribution system.

A notable feature of the robot is the ability to arbitrarily change the direction of martingale trades, which allows for more stable parameters that will ensure long-term operation without draining the deposit.

It's worth noting that NewMartin can trade any trading asset, but there is one limitation: it only trades one currency pair per account!

The choice of time frame depends entirely on the trader's preferences and desired profitability.

Installing the NewMartin Advisor

The NewMartin trading robot, specifically its first version, was first published in the MT4 developer library.

It's worth noting that there are virtually no differences between the first and latest versions. However, at the end of the article, you can download the latest update, while the first version is installed through the library.

Thus, the robot can be installed in two ways, namely through the library and through the data directory.

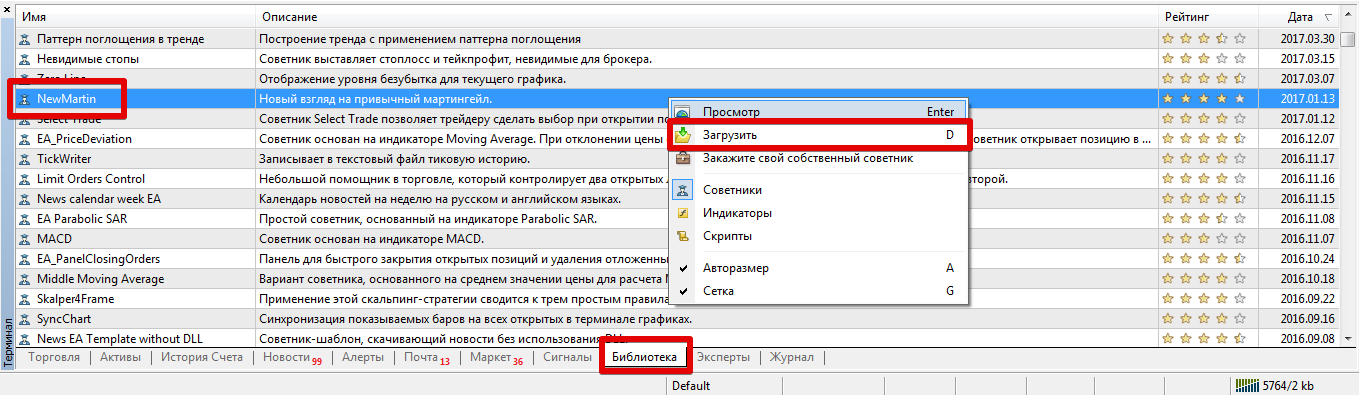

To install an advisor through the library, simply launch your trading terminal, open the "Tools" panel, and go to the "Library" tab. Then, perform a simple sorting process to ensure the list displays only advisors, rather than a jumble of scripts and indicators.

After sorting, find NewMartin in the list and use the additional menu as shown in the image below to download it.

If installing the robot through the library is not possible, or you want to use the latest version, you can install it using the standard installation method.

To do this, simply scroll to the end of the article and download the EA file, then place it in the appropriate folder in the terminal data directory.

After you've copied all the files to the appropriate folders, you'll need to update the trading terminal in the "Navigator" panel or restart it.

After updating the platform, NewMartin will appear in the list of EAs. To start trading, drag it onto the hourly chart.

Trading Strategy. NewMartin EA Settings.

As we noted at the very beginning of the article, the EA is based on a simple martingale with flexible settings for the direction of martingale trades after a stop is triggered.

When a new candle forms, specifically at its opening, the EA places either a buy or sell order, depending on the specified stop loss and profit code.

If the order is closed by the stop loss, the EA doubles the position size for the next trade according to the EA setup.

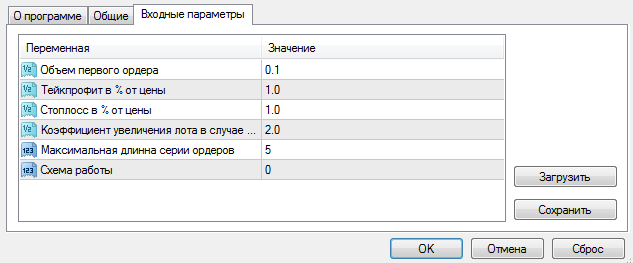

The NewMartin Expert Advisor has very simple settings that are easy to optimize later. For example, in the "Order Volume" field, you can set the lot size for your first trade in a martingale series.

In the " Take Profit from Price" and " Stop Loss as a % of Price" fields, you can limit losses by setting the percentage by which the price can deviate from the value at the time of position opening, as well as set the desired profit percentage.

The "Lot Increase Factor" variable allows you to set a multiplier for each new order in the scheme if the trade is closed by a stop order rather than by profit. The "Maximum Order Series Length" variable limits the number of multiplications if the Expert Advisor creates an unsuccessful series.

The "Operation Scheme" variable allows you to specify the sequence in which the robot will open buy and sell orders. For example, if you set 0, the Expert Advisor will buy, and if you set 1, it will sell. By setting the combination, you define its operating logic, specifically the martingale.

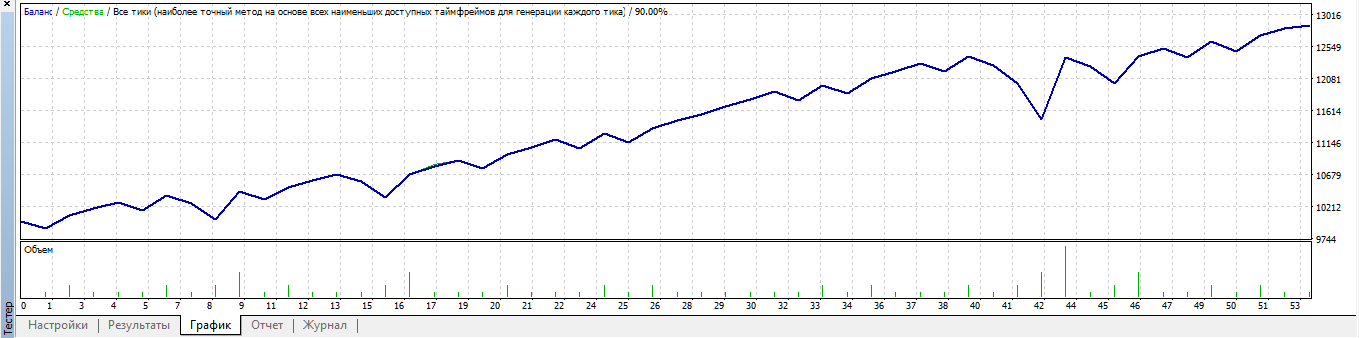

As a simple experiment, we tested the NewMartin robot on the EUR/USD currency pair.

The testing was conducted on an hourly time frame for 2017. The robot's settings were set to default, and the results are shown below:

Finally, it's worth noting that NewMartin, unlike the classic Martingale, allows you to customize your order opening pattern, specifically the direction of trades, which in turn allows you to build a more flexible capital management system.

Download the NewMartin advisor .