FGF Advisor

It's no secret that any trading advisor is based on a specific algorithm of actions, namely a Forex trading strategy.

Typically, the desire to simplify their lives as much as possible motivates traders to create expert advisors based on their trading tactics. However, more often than not, the creation of expert advisors stems from the desire to test a specific indicator-based trading strategy over a long historical period, which is virtually impossible to achieve with manual trading.

The FGF advisor is an expert advisor used to implement a popular trading strategy among traders called FGF.

The advisor itself is based on an indicator-based trading strategy for trading on an hourly chart, so it can safely be considered a multi-currency advisor.

FGF installation

To use the Expert Advisor, you must not only install it in MT4 but also install a number of custom indicators, which form the core of the strategy, in the terminal. To do this, download all the necessary files at the end of this article. Open the submenu named "File" in your MT4 and find the line "Data Catalog."

After opening the data catalog, you'll see a list of various folders. Among them, you should find a folder named "Indicators" and move the strategy indicators into it. You should also move the "Expert" folder and move the FGF Expert Advisor into it. After restarting the terminal, all files will be automatically updated. To continue working, simply drag the Expert Advisor onto the hourly chart of the currency pair.

Strategy and Settings

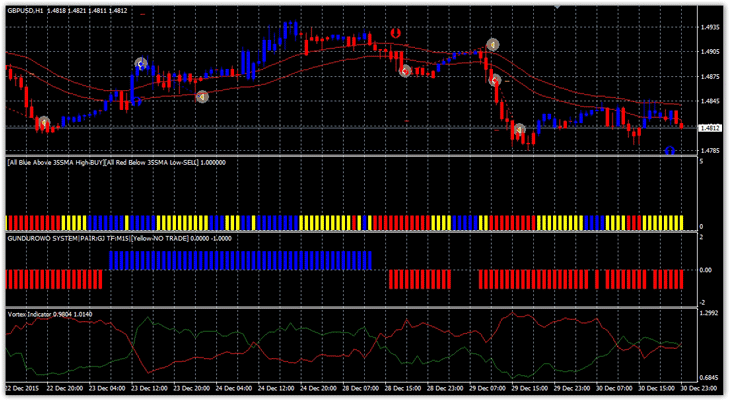

: The strategy is based on an arrow trading strategy based on a channel of two moving averages. The advisor opens a position when the moving average channel is broken and the trade direction is confirmed by a number of additional technical indicators. The strategy itself and its operating principle can be seen in the image below:

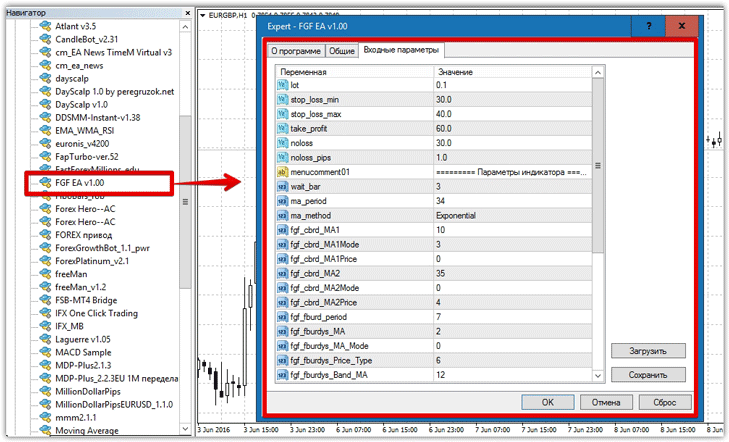

The EA settings include a full range of strategy element parameters, meaning you can optimize both the EA and the strategy itself. The Lot line specifies the EA's working lot , while the Stop Loss min and Stop Loss Max lines specify the minimum and maximum stop loss orders in points.

The Take Profit parameter specifies the profit in points, while the noloss line specifies the breakeven point in points. The noloss pips line specifies the breakeven level (the number of points from zero your breakeven point will move).

A very important filter parameter in the strategy, as well as in the EA itself, is the wait bar parameter. Here, you set the maximum number of bars after the arrow appears. If all strategy conditions are not met, the signal will be considered false. In the Ma period line, you can specify the moving average period from which the channel is formed, and if it is broken, a buy or sell order is initiated.

In the fgf cbrd MA 1 and 2 lines, you can change the settings of the FGF_CBRD indicator, which displays buy and sell signals on the chart using arrows. In the FGF_FBURD lines, you can change the parameters of the indicator, which is displayed as bars in the second additional window. In the FGF_BURD lines, you can change the parameters of the indicator that colors the candlesticks red or blue depending on the trend direction.

In the Vortex period and Vortex level lines, you can change both the period and level of the Vortex indicator. The EA also contains other technical parameters that are responsible for price slippage and for identifying only its own open trades.

Backtesting the EA:

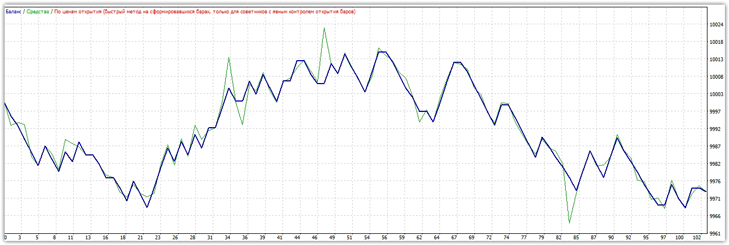

The FGF EA was tested for the entire year of 2015 with default settings on an hourly chart of the EUR/USD currency pair. The preliminary test result is below:

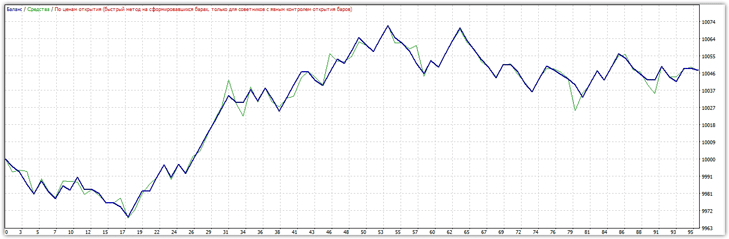

During the first preliminary test, we saw that the expert advisor closed with a minor loss of $26 on a balance of $10,000 trading 0.1 lots, despite the expert advisor making 103 trades, the drawdown of which did not even reach 1%. These statistics suggest the advisor has great potential, so the first parameters we decided to optimize were the profit level and stop loss. The test results after simple optimization of the stop loss and profit are shown below:

A simple optimization for volatility and fluctuations yielded noticeable results, demonstrating the trading strategy's profitability as a whole, as we didn't change any of the strategy's indicator parameters.

Overall, the FGF Expert Advisor is a profitable and stable development that doesn't employ any risky Forex capital management and has extremely low risks. Using the Expert Advisor with its default settings isn't recommended, but after a simple optimization of the main parameters, the robot will be ready to conquer the Olympus. We've included its settings for a preliminary test along with the Expert Advisor.

Download the FGF Expert Advisor