Order Flow: A Universal False Signal Filter

Order flow is a truly powerful tool that allows most traders to see through the market.

allows most traders to see through the market.

The ability to recognize a major player and the size of their order, and an understanding of who is really in the market, namely the bulls or the bears, always allows for a general understanding of the future price movement.

However, as with trading any instrument, false signals always arise, which must be properly filtered. In the forex market, you won't be able to see the order flow as such, except for information shared by the dealing centers themselves. However, the topic of a universal filter for eliminating false signals is relevant, regardless of your trading style.

Every trader, when receiving a signal based on their trading strategy, has two options for entering a position: entering at the current price of the asset or waiting for the candle to close and then entering the position.

If we enter a position at the current price, the market is typically prone to sharp changes, and the strategy's signal can easily be cancelled out by a sudden price surge in the opposite direction. Therefore, the principle of entering a position on a closed candle is increasingly used.

However, this principle is also quite aggressive, so I would like to introduce you to more conservative entries that will allow you to cut out many false signals.

Signal bar breakout

Unlike the aggressive classic entry on a closed candlestick, opening a position on a breakout of a signal bar is more conservative. The idea is that the position is entered not on a closed bar, but rather on a breakout of the high or low of the signal candlestick.

To summarize, when a buy signal occurs, entry into a position occurs when the price breaks through the maximum of the signal candle, and when a sell signal occurs, entry into a position occurs when the price breaks through the minimum of the signal candle.

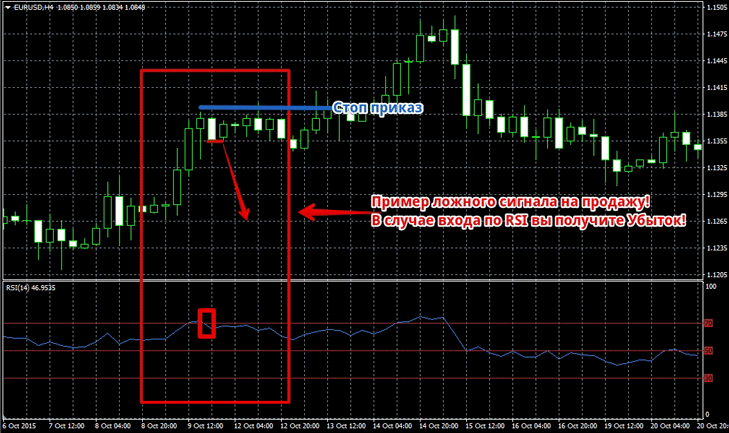

You might say that the entry is too late, but this method allows you to eliminate many false signals. As an example, let's look at a typical false signal from the RSI indicator and simulate the situation as if you entered a position on a closed candle. See the example in the image:

The example clearly shows that if you entered a position on a closed bar or at the current price when the signal was received, you would almost certainly be thrown out of the market by a stop order and incur a loss. Now let's look at the same signal if you entered on a breakout of the signal candle's low:

The example clearly shows that if you entered a position on a closed bar or at the current price when the signal was received, you would almost certainly be thrown out of the market by a stop order and incur a loss. Now let's look at the same signal if you entered on a breakout of the signal candle's low:

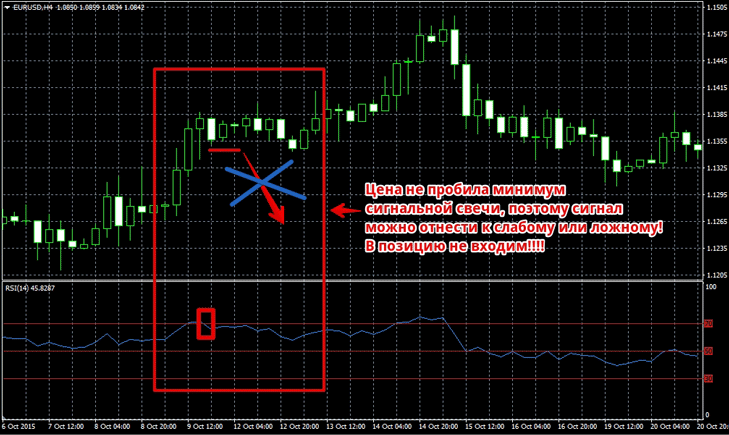

The image clearly shows that if we had entered the position on the breakout of the signal candle, the signal should have been ignored, as the price never broke through the candle's low. There's also an even more conservative entry method called "Second Candle Confirmation.".

The image clearly shows that if we had entered the position on the breakout of the signal candle, the signal should have been ignored, as the price never broke through the candle's low. There's also an even more conservative entry method called "Second Candle Confirmation.".

Unlike the previous option discussed, to enter a buy or sell position, in addition to breaking the signal candle's low or high, you must wait for the second candle to close. If the price breaks the signal candle's low and the second candle closes below that low, you can safely enter a sell position.

To filter a buy signal, the price must break the signal candle's high, and the following candle must close above that high. However, this filter is only relevant for traders who use trend-following strategies and hold their positions for a long time.

Using this filter, you find only strong signals, but you lose at least the size of one candle in pips, so this method is not relevant for scalping and pipsing tactics.

Conclusion

In general, the proposed trade entry options are relevant not only for trading using order flow but for any trading strategy. It's worth noting that many traders add various candlestick patterns as a filter. For example, if a buy signal occurs during a bearish pin bar, it should be ignored.

If a sell signal appears on a bullish pin bar, it should also be rejected. In general, there are many different options for creating a filter against false signals in your trading strategy . As the example shows, this doesn't necessarily have to be an indicator, but a simple price movement pattern will suffice.