Trend continuation patterns

We often encounter a situation where the price begins to pull back from the main trend with renewed vigor. At this point, you're faced with the age-old question: will the price continue in the new direction and end the trend, or will it return to the trend after a minor pullback?

trend with renewed vigor. At this point, you're faced with the age-old question: will the price continue in the new direction and end the trend, or will it return to the trend after a minor pullback?

Traders face this situation daily, and unfortunately, many make the mistake of entering a position hoping it's the beginning of a new trend or, conversely, hoping for a pullback and holding on until profits are completely wiped out.

Today, I'd like to introduce you to two of the most common trend continuation patterns, which will help you predict the future development of a trend with a high degree of certainty.

Almost all traders are familiar with various trend reversal patterns, as the long-held dream of entering at the bottom always haunts traders. However, only true pros know that reversals aren't worth chasing; they should instead seek out strong trends and entry opportunities along them.

The first and most famous trend continuation pattern is the Flag.

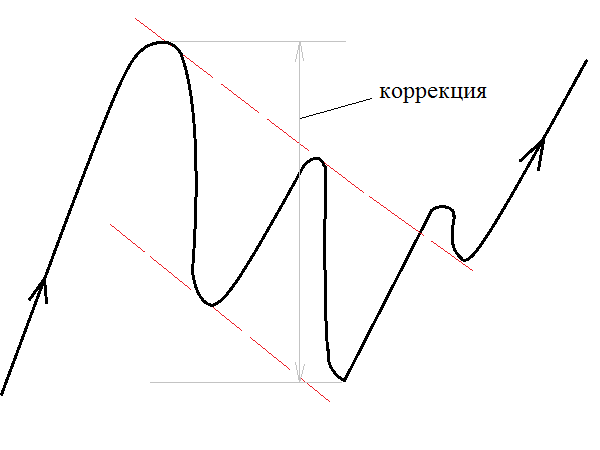

It forms after a sharp price surge, followed by a gradual pullback. Moreover, the pullback moves purposefully against the main price movement. To represent this pattern on a chart, the pullback should move evenly, with two parallel lines drawn on both sides along the price highs and lows, as is done when constructing a channel.

The flag's stem is a sharp impulse from the underlying trend that preceded the pullback. You can see an example of a Flag trend continuation pattern in the image below:

There are flags for both bullish and bearish trends. So, how do you trade this pattern? If you see a flag in a bullish market, the signal to enter a buy position is a breakout of the upper resistance line. The profit is set equal to the size of the preceding impulse, and the stop order is at the nearest local low.

There are flags for both bullish and bearish trends. So, how do you trade this pattern? If you see a flag in a bullish market, the signal to enter a buy position is a breakout of the upper resistance line. The profit is set equal to the size of the preceding impulse, and the stop order is at the nearest local low.

A sell signal occurs if a flag forms in a bearish trend and the price breaks the lower resistance line. The stop order is set at the local high, and the profit is equal to the preceding price impulse. You can see an example of entering a position using a flag pattern in the image below:

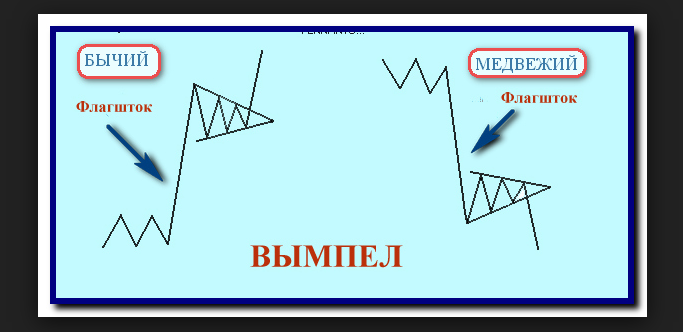

The second well-known trend continuation pattern is the Pennant. The Pennant forms according to the same principles as the Flag pattern after a sharp price surge and a pullback. However, instead of two parallel lines, the pullback forms a symmetrical, contracting triangle. You can see an example of a Pennant pattern in the image below:

Entry signals are virtually identical to those using the Flag. If you see a Pennant in a bullish market after a price spike and subsequent pullback, the entry signal is a breakout of the upper trendline.

Entry signals are virtually identical to those using the Flag. If you see a Pennant in a bullish market after a price spike and subsequent pullback, the entry signal is a breakout of the upper trendline.

Entry occurs only after the candle closes and is outside the triangle. A stop order is placed at the nearest local low, and the profit target is equal to the size of the previous spike or, as shown in the image, the size of the flagpole.

A sell signal occurs if a Pennant forms in a bearish trend, and entry occurs after a breakout of the lower trendline and a consolidation outside the triangle. A stop order is placed at the nearest local high, and the profit target is equal to the length of the previous spike (flagpole). You can see an example of a position entry in the image below:

Many who have at least once studied trend continuation patterns have probably noticed that I haven't mentioned the Triangle pattern. This is because most people mistakenly believe that this is also a trend continuation pattern. However, in practice,

Many who have at least once studied trend continuation patterns have probably noticed that I haven't mentioned the Triangle pattern. This is because most people mistakenly believe that this is also a trend continuation pattern. However, in practice,

the Triangle can be considered a pattern of uncertainty, since the price usually moves in the direction it breaks through the triangle's boundaries, which is why breakouts against the main trend can also occur, as with reversal patterns. Therefore, when you see a triangle, be prepared for the price to act very unexpectedly.

In conclusion, I want to say that the Pennant and Flag patterns are extremely common in everyday trading, so it's important to carefully examine the chart and react to their signals accordingly.