Basic reversal patterns.

Reversal patterns are a fundamental element of graphical analysis. They signal an imminent trend reversal, allowing trades opened in line with the current trend to be closed promptly.

The search for reversal patterns should be preceded by an understanding that the previous trend not only existed, but was also clearly defined. The first signal that a pattern has been identified correctly is a breakout of important trend lines.

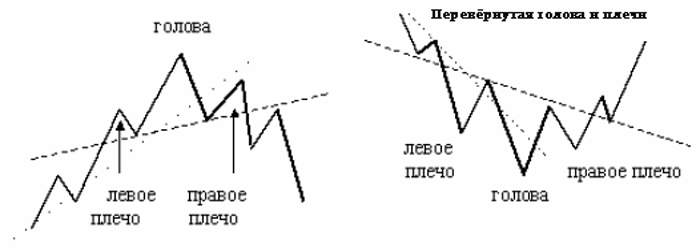

The most famous reversal pattern for a bullish trend is called the "Head and Shoulders." It is characterized by two shoulders and a head. An additional check for its correct identification is to compare the ideal and actual trading volumes.

The appearance of a "Head and Shoulders" pattern indicates a reversal to a downtrend.

If we analyze the downward movement from the left side, we should observe an increase in trading volume. If we analyze the upward movement, the volume should decrease. At the point where the head ends, the number of assets traded (when the price moves up) should be significantly smaller than during a bearish move.

Confirming the end of this pattern is fairly easy. This is indicated by a breakout of the "neck." This event will indicate that the entire pattern has ended, and a downtrend .

The next pattern is the "Inverse Head and Shoulders." It can appear at the bottom of a bear market. If this occurs, a bullish trend can begin. It's essentially the same as the previous pattern, only in reverse.

Weaker patterns include the "Triple Bottom" (possible subsequent price rise) and the "Triple Top" (possible subsequent price decline). They are similar to the "Head and Shoulders," except that all movements are contained within the area bounded by two parallel lines.

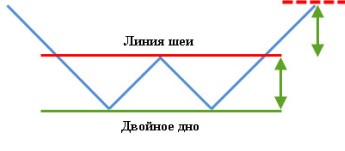

Very similar patterns are the "Double Top" (possible uptrend reversal) and "Double Bottom" (possible downtrend reversal). However, in this case, the signal is even weaker.

Advice from experienced traders: If you use reversal patterns to open new trades, you should first confirm the validity of your theory before deciding on subsequent actions (opening a sell/buy trade, etc.). The easiest way to confirm is to use Forex technical indicators .