Pivot points

Many traders perceive these tips as the purely personal opinions of experts who base their calculations solely on their own strategy.

However, almost all of these analysts use fairly simple formulas to calculate turning points, and most of their forecasts are similar.

Are you conducting technical analysis on Forex and don't know how to calculate turning points?

After reading this article, you'll never have to worry about finding these levels again.

Calculating five-level pivot points

First, you need to calculate the central turning point using the formula: CRP = (Previous day's high + previous day's low + daily closing price)/3.

To consolidate this formula, I suggest calculating the central turning point for euro/dollar pairs = (1,1392+1,1325+1,1353)/3 = 1.1356.

Next, we calculate the first support using the formula: (Central pivot point * 2) - the previous day’s maximum.

For the euro dollar this value looks like this: S1 = (1.1356*2)-1.1392 = 1.1320.

We calculate the first resistance level using the formula: R1 = (Central Pivot Point * 2) – the previous day's low. For the euro/dollar currency pair, R1 = (1.1356 * 2) - 1.1325 = 1.1387.

Once you have calculated the centerline and the first support and resistance, you can calculate the second support and resistance, which will give you a total of five pivot points.

The second support level is calculated using the formula: S2 = Central Pivot Line + (Resistance Level 1 (R1) – Support Level 1 (S1)). For the EUR/USD currency pair, S2 = 1.1356 + (1.1387 - 1.1320) = 1.1423.

The second resistance level is calculated using the following formula: R2 = Central reversal line - (Resistance level 1 (R1) - Support level 1 (S1)).

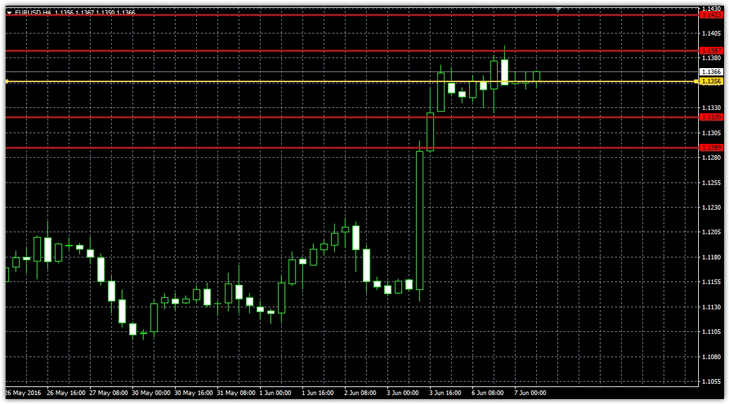

For the euro/dollar, this value looks like this: R2 = 1.1356 - (1.1387 - 1.1320) = 1.1289. After we have calculated all five points, we plot them on the chart as horizontal lines.

The result for the euro/dollar is shown below:

There's also a formula that complicates the calculation of these pivot points. While the calculation of the first and second support and resistance levels remains the same, the basic formula for calculating the Central Pivot Point changes and looks like this: (Today's opening price + low + high + closing price)/4.

The opening price in the forex market is the previous day's closing price.

Pivot points according to DeMark

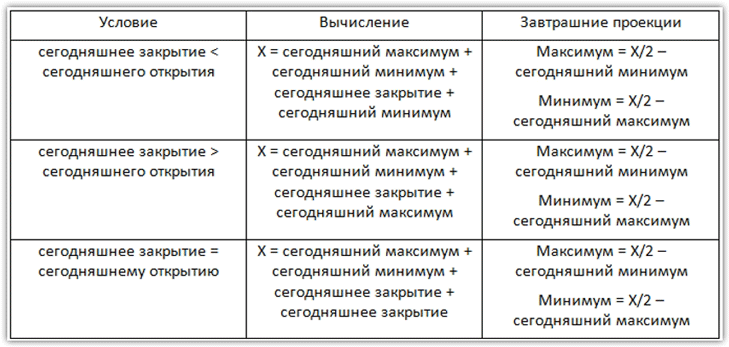

In addition to the method discussed above for calculating pivot points, there are dozens of other methods and approaches, but the most popular alternative is the method proposed by Thomas DeMark.

The method's essence lies not in a simple formula calculation, but in the fulfillment of a specific market condition: the ratio of the closing price to the opening price relative to each other.

To avoid describing dozens of formulas, I suggest familiarizing yourself with DeMark's pivot point calculation system in the table below:

Practical Application of Pivot Points.

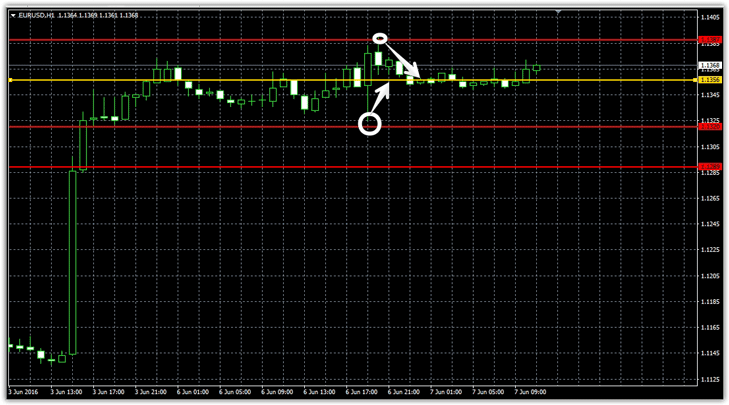

Pivot points are so named for a reason, because reversals often occur near them. Essentially, pivot points are support and resistance levels and are traded in a similar manner. Here's

an example of behavior within a formed range based on the pivot levels we calculated for the EUR/USD currency pair:

When using pivot points, they are typically traded for breakouts or rebounds. The midline typically acts as a filter for the main trend direction: if the price is above this line, the market is ascending, and if the price is below this line, the market is descending.

In addition to providing immediate entry signals, pivot points give traders an idea of the likely future course of events, specifically where the price will move after breaking a certain level and where a slowdown may occur.

Thus, pivot points allow traders to intelligently determine targets and stop order . It's also worth noting that pivot points are calculated daily, so at the end of the day, you need to delete all the levels you've applied and calculate new ones based on the newly generated data.

Generally, finding and calculating pivot points is not difficult, but there's no point in engaging in a daily routine these days, as there are dozens of different indicators that embody these formulas and display support and resistance levels.