Arbitration and assets to which it can be applied

Most stock trading strategies are based on fundamental or technical analysis , but there are also those that do not involve the use of these methods of market study.

One such strategy is arbitrage, a trading strategy that is based on exploiting the difference in prices of the same asset in different financial markets.

This trading option allows traders to profit from arbitrage opportunities that arise from temporary or structural inconsistencies in the market.

Basically, arbitrage trading is a form of profiting from the difference when you see that the price of product A is lower in this market, you buy it and sell it (product A) in another market at a higher price.

The same approach can be applied to regular currencies, when you buy currency at one online exchange office for less and sell it at another for more.

In other words, arbitrage can be called ordinary speculation, only speculators here prefer to trade not in clothes or products, but in assets such as currencies, cryptocurrencies or precious metals.

You can often find descriptions of stock arbitrage online, where an investor buys shares on one exchange and then sells them on another. However, in my opinion, such a deal is unlikely to pay off due to high overhead costs.

You also won't be able to use arbitrage on the MetaTrader trading platform, as most trades are made using CFDs .

Therefore, it remains to use only options that involve the actual purchase of an asset followed by an actual sale.

When it comes to earning money through arbitrage, with luck, this strategy can yield between 1% and 5%, as overhead costs, such as transfer fees and shipping costs, must also be factored in when calculating profits.

Assets that can be used for arbitrage

There are not many assets that can be successfully used for arbitrage, and each has its own strategy:

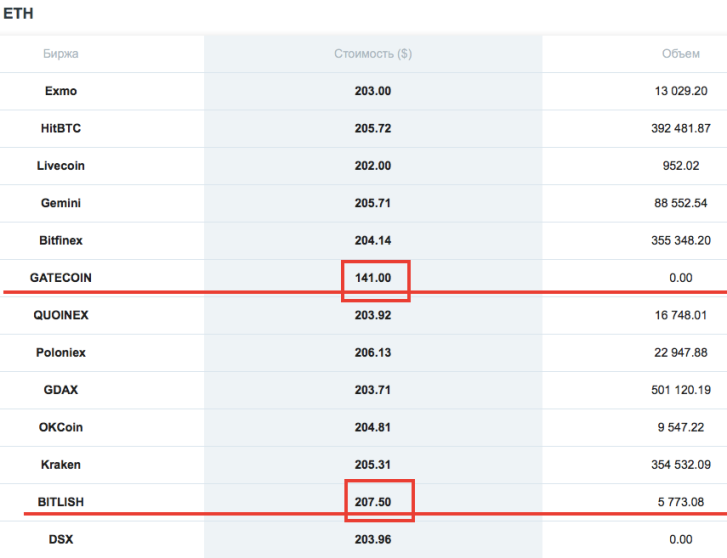

Cryptocurrency arbitrage – when arbitraging cryptocurrencies, you first create accounts on several exchanges and then monitor the price of the chosen asset.

When it is discovered that a cryptocurrency is cheaper on one exchange than it is being purchased on another, a purchase is made, transferred to another exchange, and sold.

A detailed description of cryptocurrency arbitrage can be found in the article: https://time-forex.com/kriptovaluty/arbitrag-fx

Currencies – when choosing this option, you buy currency at a lower price and sell it at a higher price at another bank or exchange office.

Today, there's no need to run from bank to bank checking exchange rates; everything can be done online. However, I would recommend using online exchange services as well as banks for arbitrage; this will allow you to find a favorable rate faster.

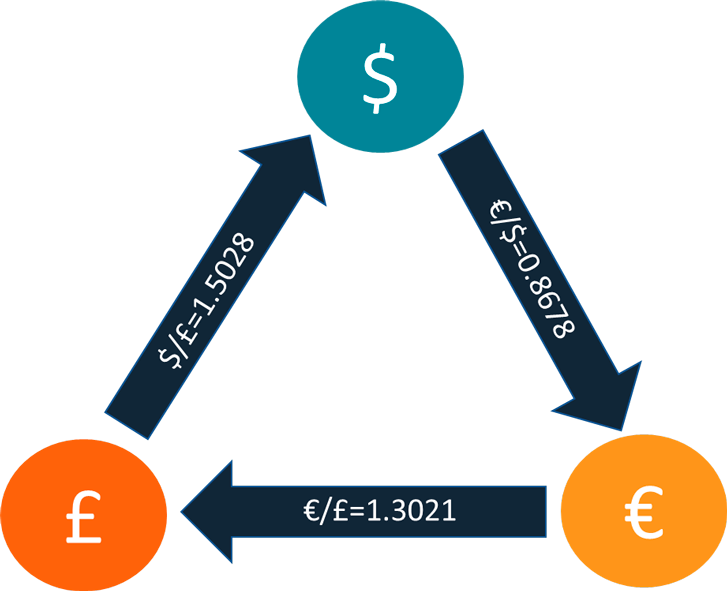

You can also use double exchange; situations often arise where you can win by first exchanging one currency for another, and then for a third.

Gold – I once discovered that the selling price of gold bars in Ukraine was 10% lower than the buying price in Poland. Now the situation has changed, and gold in Poland is cheaper than in Ukraine.

It is possible that similar price differences are observed between other countries.

However, with gold arbitrage, it is no longer possible to conduct the entire transaction online; a physical purchase and delivery of the precious metal will be required.

Is arbitrage risky?

It would seem that there is no risk here, you bought cheaper and sold more expensive, the transaction itself rarely takes more than a few minutes, but still, this strategy has its risks.

Exchange rate risks – even within a few minutes, an unfavorable price change can occur, especially if you're dealing with cryptocurrencies. As a result, you'll end up with losses instead of profits.

Liquidity risk the liquidity drops sharply . For example, you buy gold bars, bring them to another country, and they refuse to buy them, even though the banks' websites list the buy-back price.

Transaction risk – in these turbulent times, payment systems and banks tend to block transfers and freeze accounts.

It only takes the appearance that your transactions are suspicious and connected to money laundering or terrorist financing.

In conclusion, arbitrage is a rather interesting strategy for making money, but its implementation requires large sums of money and, as with any trading strategy, there is a high probability of losses.