What are fractional shares, their advantages and disadvantages?

Today, there are quite a few companies whose stock prices exceed $1,000, for example, one share of Pendrell Corp costs $150,000, and Mechanics Bank $23,000.

This significantly increases the required investment amount, especially if you want to diversify your investments and buy securities of several companies at once.

But thanks to a recently introduced opportunity, it is not necessary to buy a security in its entirety; you can buy part of it.

Fractional shares are shares of a company's stock that can be purchased for any amount, even if it is less than the full price of the share.

This allows people with small capital to invest in shares of their favorite companies.

This asset has both its advantages and some disadvantages.

This asset has both its advantages and some disadvantages.

Benefits of fractional shares

They allow you to invest in expensive stocks even with a small budget. This can be useful for small investors just starting out in the stock market.

Purchasing a fraction of a security allows you to diversify your portfolio. This allows you to spread your capital across shares of different companies, reducing the risk of your investments.

However, fractional shares also have some disadvantages.

Firstly, commissions for opening trades on such assets may be higher than usual. Brokerage firms often charge additional fees for buying and selling fractional shares.

Secondly, fractional shares may be less liquid than regular securities. This low liquidity can make them more difficult to buy or sell, resulting in larger spreads.

Where to buy fractional shares?

The first option is to use brokers who split up expensive securities. Such companies include Charles Schwab, Fidelity Investments, and Vanguard.

After registering, verifying, and funding your account on the websites of these companies, you will be able to purchase 0.1, 0.2, or 0.5 of a security.

The disadvantages of this option, in my opinion, are that the brokerage companies are located in the USA, so not everyone will be able to open an account, there is also a high commission and no leverage.

The second option is to use the capabilities of our MetaTrader 5 trading platform, in which case you can also buy fractional shares.

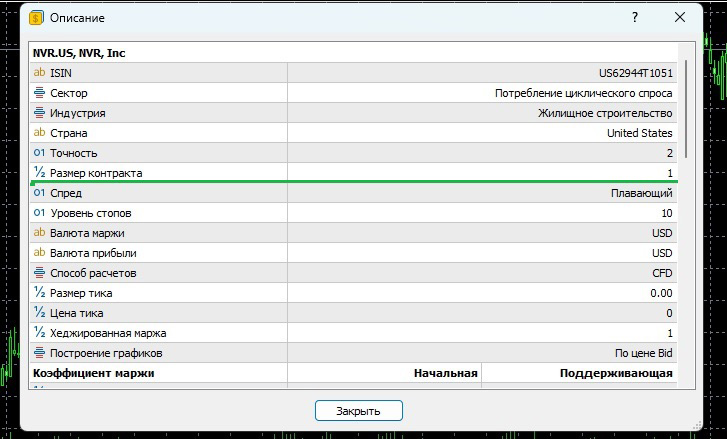

For example, one share of the American company NVR Inc (NVR) costs 6244 US dollars, the contract size is 1 share:

That is, with a one-lot transaction, you buy 1 share of NVR Inc for $6,244, and if you open a 0.1 lot position, you are already buying 10% of the share and pay only $624.4, accordingly, when buying a hundredth of an NVR share in 0.01 lots, you will need to pay $62.44.

Stock trading brokers – https://time-forex.com/vsebrokery/brokery-fondowogo-rynka

And this is without taking into account the possibility of using leverage; its size for an asset such as securities is usually between 1:2 or 1:20.

It's clear that this option isn't without its drawbacks: it's not always possible to find the desired company's stock on your chosen broker's trading platform, and a swap fee .