What is a sideways trend in the stock or currency market?

In stock trading, a trend is the movement of an asset's price. Depending on whether the price rises or falls, the trend can be upward or downward .

But sometimes traders encounter the concept of a sideways trend, which is not always clear to newcomers to the exchange.

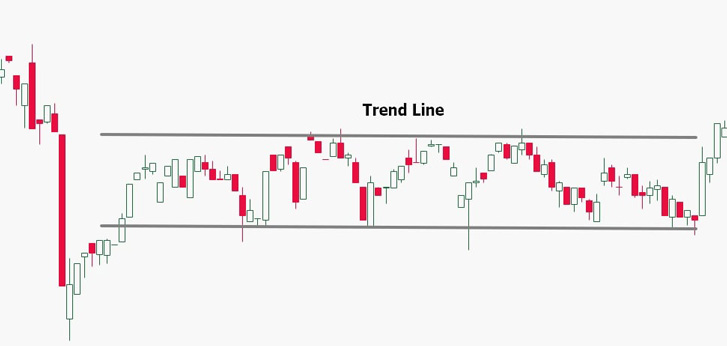

A sideways trend is a situation where asset prices fluctuate within a small range without a clear downward or upward direction.

On the chart, the situation looks like a horizontal or slightly sloping price movement corridor.

In this case, the price does not move up or down, but only sideways, which is what gave rise to the name of this term.

- Market uncertainty. In a climate of uncertainty, investors are reluctant to make large trades, leading to sideways price movements.

- A balance of power between buyers and sellers. When buyers and sellers balance each other, prices cannot move in any specific direction.

- Technical factors. In some cases, a sideways trend can be caused by technical factors, such as consolidation or a trend reversal.

Is it possible to trade during a sideways trend?

Here, everything depends on how wide the corridor formed by the price is; its width can vary from a few points to hundreds of points.

Trading in a sideways market is quite challenging because there's no clear direction for price movement. However, there are some strategies that can help traders profit in such conditions.

One popular strategy is range trading, which involves tracking a pattern whereby the price bounces off one of the range's boundaries and moves toward the opposite one. As the price approaches the other boundary, the pattern repeats.

Moreover, trades rarely last longer than a few minutes, allowing for high leverage. This trading option is ideal for scalping .

Another strategy is breakout trading, in which case the signal to open a new trade is a breakout of one of the boundaries.

But in this case, you don't trade directly during a sideways trend, but rather open a trade after it ends. Strategy description - https://time-forex.com/strategy/proboynay-strategiy

Advantages and disadvantages of a sideways trend

A sideways trend can have both advantages and disadvantages for investors.

Advantages:

A sideways trend can be profitable for traders who can correctly identify the direction of a price breakout.

A sideways trend can be a good time to buy stocks or currencies that are in a long-term uptrend.

Flaws:

This type of trend can be challenging to trade, as there's no clear direction for price movement. Using a narrow price range trading strategy only allows for profits with high leverage, which is quite risky.

If a trader decides to open a breakout trade, they are forced to wait for the price to break out of the price channel . This wait can be lengthy, and during this time, funds will be "frozen" and will not generate profit.