Currency Pair

All transactions on the Forex market are typically recorded using currency pairs. This approach significantly simplifies external perception and, at the same time, reduces the recording time.

A currency pair is an abbreviated notation for the relationship between the exchange rates of two currencies; the notation uses a special ISO code consisting of three letters.

Typically this entry is written as AUDCAD or AUD/CAD, both options are correct.

This approach shortens the quotes and is easier for a trader or banker to understand.

A pair consists of two currencies, one of which is the base currency, and the other acts as the quote currency. For example, in the USD/JPY (US dollar/Japanese yen) pair, the US dollar is the base currency, and the yen is the quote currency.

Typically, in stock trading, a lot of different indicators are used that characterize a given entry.

Indicators characterizing a currency pair

• Quote rate – can be determined by one or two indicators; if we are talking about the rate set by the central bank, then this is one value. In the same case, if a commercial rate is given for a certain currency pair, then the buy and sell indicators are already used.

For example, the Central Bank today set the dollar to ruble exchange rate USD/RUB at 30.00 rubles per dollar; in the same case, if we are talking about the forex exchange, you will already see the message - USD/RUB Bid 29.00 Ask 31.00; from this entry we can judge that the US dollar is bought at 29.00 rubles and sold at 31.00 rubles; the difference between these two indicators is called the spread.

• Spread – the difference between the purchase and sale of the base currency in a currency pair, usually this is the commission of an intermediary in a foreign exchange transaction (bank or broker).

Spread sizes for brokers on different assets - http://time-forex.com/vsebrokery/spred-broker

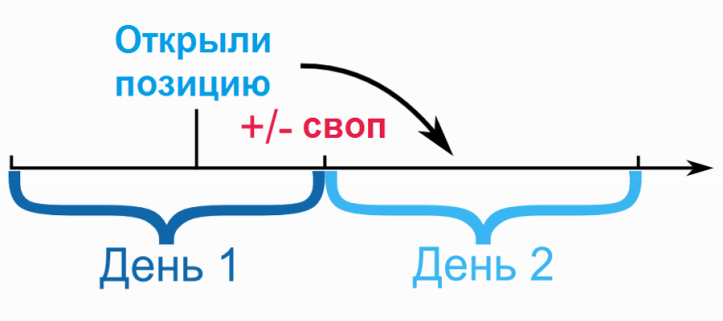

• Swap - a fee that you will have to pay if you transfer a transaction to the next day, calculated as the difference between the currency rates, the most interesting thing is that the swap can also be positive, in which case the trader is awarded a reward.

• Direct or inverse – if the USD/RUB currency pair is a direct quote that shows how many rubles are given for a dollar, then everything is clear. However, sometimes it is necessary to express the inverse ratio, how many dollars can be obtained for one ruble. In this case, the inverse quote RUB/USD is used (in practice, this notation is usually not used).

The underlying asset in a currency pair can also be an instrument such as precious metals; in this case, you will encounter the notation XAU/USD, XAG/USD, where the first case shows the ratio of gold to the US dollar, and the second - silver.

Currency pairs are a universal tool that is used not only in trading on the Forex market, but also in other currency markets.

Read also on this topic:

All about currency pairs traded on Forex - http://time-forex.com/pary

Liquidity of currency pairs - http://time-forex.com/terminy/likvidnost-valuty