Forex and Stock Market Terms

This section contains key terms related to Forex trading, which will help a novice trader quickly understand the essence of the work.

Forex terms describe key aspects of the currency market. There aren't many of them, so it's a good idea to familiarize yourself with their descriptions before you begin. This will make trading more understandable and easier. Each term is described in detail, with practical examples of its use.

Risk notification.

One of the reasons for forex trader bankruptcy is inattention and a rather superficial approach to trading. When exploring the website of any dealing center, you'll inevitably encounter the term "Risk Disclosure." This page is mandatory reading. A

forex risk disclosure includes a set of rules for exchange trading and warns traders of potential issues that could lead to financial losses.

Sometimes reading this document can completely discourage trading, but it's worth reading anyway. A link to the "Risk Disclosure" is usually located at the bottom of the broker's website.

Stop loss (stop loss) installation and parameters.

No aspect of Forex trading generates as much controversy and disagreement as setting a stop-loss order, but almost all traders agree on one thing: it must be set without fail.

Stop-loss is a pending order to automatically close a position once the price reaches the specified trigger parameters. It is designed to limit losses and prevent a complete loss of funds in the trader's account.

Swing trading (swing trading).

Determining the optimal duration of trades when trading Forex is one of the main tasks of a trader. This article will discuss a well-known strategy called swing trading, which is designed for medium-term trading.

Swing trading is a trading style that involves opening forex trades lasting from one to four days. Swing trading is based on the cyclical price fluctuations that occur over the course of a week.

Forex trading instruments.

The main instrument used to profit from trading on the Forex currency exchange are currency pairs.

currency pairs.

These are the objects of buy and sell transactions. Traders don't go into detail when describing what is being bought or sold for what. Typically, the transaction is simpler, such as a buy transaction of 1 lot of EURUSD.

This, in simple notation, translates to buying 100,000 euros for US dollars.

For abbreviation and ease of notation, ISO codes adopted by the global banking system are used in the quote.

Scalping on Forex (scalping).

There are a huge number of trading strategies on the Forex market, but any trader will tell you that scalping is the most profitable, as it allows you to turn a few thousand dollars into a million.

Scalping is a trading strategy that maximizes profitability through the use of high leverage. It is characterized by short trade durations and relatively high risk.

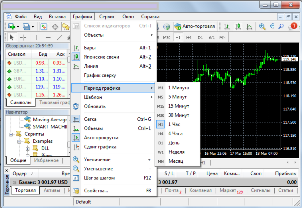

Timeframe in Forex trading

Trading on the Forex currency exchange takes place using a special trader terminal, with price movements displayed on currency pair charts, each of which has two lines.

A vertical one, which displays the price value, and a horizontal one, divided into time intervals (time frames).

Timeframe – a time period characterizing price movement. It is designed to simplify and standardize data display across various trading terminals.

Very often, novice traders mistakenly assume that the name of the time frame in trading characterizes the duration of the time interval, but in fact, it is the period of one candle.

Support level (support level).

Typically, the price of a currency pair moves according to a certain pattern, sometimes rising, sometimes falling. Regardless of the trend direction, there is always a conventional boundary at which the price reverses upward. In trading, this boundary is commonly referred to as a support level or line.

A support level is a line on a currency pair chart drawn along significant price lows over a specific time period. It characterizes the price level at which the market enters an oversold state and the price moves upward.

Technical analysis (technical analysis).

Attempts at random trading quickly end in a drawdown or a lost deposit, after which the novice trader begins to wonder how to predict price movements using a scientific approach. Technical analysis methods for the Forex market .

Technical analysis is a method of assessing the current market situation based on the analysis of statistical data on the history of the price movement of a currency pair and the volume of transactions carried out.

Forex trading session.

It's commonly said that Forex trading operates 24 hours a day, excluding holidays and weekends. However, there are also trading sessions, whose opening hours coincide with the business hours of the major financial exchanges.

A trading session is a period of time during which an exchange platform operates and trading takes place.

What is Forex Trading?

Forex trading has become quite popular lately; no other business can offer such a large profit in such a short period of time.

Most beginning traders are attracted by the opportunity to work from home and the availability of training materials.

Forex trading is speculative trading on the currency exchange, through a special trading platform, to generate profit from exchange rate differences.

Earning money doesn't require a large amount of funds; the increase in transaction volumes occurs through the use of broker leverage.

Trailing stop.

A position with a stop-loss order placed may not always close at a loss when the trend reverses. If desired, you can preserve your profit by moving the stop-loss order to the breakeven zone. This isn't necessary; it can only be done manually; a management script called a trailing stop has been developed specifically for this purpose.

Trailing stop is one of the functions of the trader's terminal, which, when activated, allows a previously set stop-loss order to follow the price movement of a currency pair.

Forex trend.

This term is often identified with the concept of a trend; in some ways they are similar, but in others there are differences.

A Forex trend typically characterizes the overall sentiment in the currency market, taking into account a fairly long period of time.

It's advisable to consider this factor when opening medium- and short-term trades. This approach will help avoid mistakes in choosing trade direction, thereby reducing the number of losing orders.

There are several ways to categorize Forex trends:

Financial betting.

The diversity of stock market speculation is simply astounding in the number of options available. Besides being categorized by asset type (currencies, stocks, metals, commodities), there's also a division by transaction method. Sometimes, these methods resemble betting at a casino or bookmaker.

metals, commodities), there's also a division by transaction method. Sometimes, these methods resemble betting at a casino or bookmaker.

Financial betting is one such type of transaction. Its essence lies in the trader's attempt to predict the price of an asset within a certain period of time.

For example, you bet that the price of gold will be higher in an hour than it is now. If your prediction is correct, you receive a reward; if it's wrong, you lose most of your bet.

Trend Forex

Trading recommendations often recommend trading only with the trend. What is a Forex trend, and how can it be used when choosing a trade direction?.

Trend Forex is the predominant direction of exchange rate movement over a specific timeframe. It shows the current direction of the currency pair's price.

It is characterized by such indicators as strength, duration, speed and dynamics.

Futures.

Most people perceive Forex as an opportunity to trade currencies. On the one hand, this is true, but on the other, almost all dealing centers offer their clients a variety of equally interesting instruments to choose from.

dealing centers offer their clients a variety of equally interesting instruments to choose from.

Futures are one such instrument. Predicting the direction of a currency's exchange rate is quite difficult, as a huge number of factors influence the exchange rate of a currency unit. With futures, however, everything is much simpler.

A futures contract is a contract to purchase a specific asset, and this asset can be familiar commodities such as corn, oil, gas, wheat, and gasoline.

Upward trend in trading and how to determine it

The price movement of a currency pair always has its own direction, which is the basis for choosing between short or long transactions.

If the base currency rate only rises over a certain period of time, we can talk about the presence of an upward trend in Forex.

An uptrend is an increase in the price of a currency pair over a certain period of time. It is formally believed that in such a situation, each subsequent minimum and maximum price will be higher than the previous one.

For example, the price of the EUR/USD currency pair first rose to 1.1215, then fell to 1.1200, and then rose again to 1.1220 dollars per euro.

In other markets, an upward market trend implies an increase in the price of the underlying asset; for example, in the stock market, this would be an increase in the price of securities.

Downward trend (downward trend on the currency pair chart)

There are many reasons, both external and internal, why a certain currency's exchange rate declines, and if this currency is listed first in the Forex currency quote, this phenomenon causes a downward trend.

Downward trend – characterizes the market segment in which the base currency in a currency pair is depreciating.

Downward trend – characterizes the market segment in which the base currency in a currency pair is depreciating.

If you look at the chart of a currency pair during the formation of a downward trend, the exchange rate curve will be directed predominantly downwards.

However, this concept is applicable only to a specific time period, since the same price movement trend may not always be observed on different time frames.

Fundamental analysis (fundamental analysis).

There are two types of market analysis in Forex: technical and fundamental. While the former has been covered in numerous books and articles, the latter is usually much less well-covered.

Fundamental analysis is the analysis of external factors that may influence exchange rate movements. These factors typically include changes in the economic, social, and financial systems of the country issuing the currency in question, as well as external factors that may increase or decrease demand for the currency.

ForexCopy (Forex copy).

There are several ways to make money on Forex without much effort, one of which is using the Forex Copy system.

ForexCopy (forex copy) is a system for copying the trades of professional traders, which copies the trading instrument, time, and direction of the trade.

At the same time, the trader can independently set the scaling of the operations carried out.

Page 3 of 3

- To the beginning

- Back

- 1

- 2

- 3

- Forward

- To the end