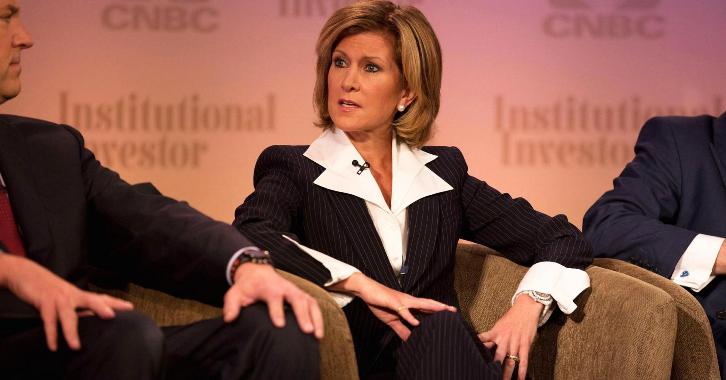

The Woman Manager - Mary Erdoes

It is no secret that very few representatives of the fairer sex choose an education related to the exact sciences.

This can be seen especially clearly in the auditorium of any technical university, when the overwhelming majority of boys occupy all the desks and only a few girls brighten this sad picture of those present in the auditorium.

This is why most people have a stereotype that only men work in the stock exchange environment, and women are nothing more than service personnel.

However, stereotypes are meant to be destroyed, and Mary Erdoes's biography is an excellent example of a woman who would be the envy of at least most men on Wall Street.

Mary Erdoes was born on August 13, 1967, to Catholic parents of Irish descent. She spent her childhood and youth in Winnetka, Illinois, growing up in a wealthy and highly educated family.

Her father and mother were partners (owned shares and served on the board) of the investment firm Lazard Freres.

However, it was my grandmother who truly instilled in Mary a love of the stock market and banking from childhood. Interestingly, my grandmother had a rather outdated outlook on life, believing that it was enough for Mary to marry well and not work.

However, her granddaughter's pride and competition with her friends' children got the better of her, so she closely studied her granddaughter's mathematical education, spent a lot of time with her, and was the first to introduce her to a checkbook.

Mary's education was mathematically oriented from the start. She initially attended and graduated from the private Catholic Sacred Heart Academy for girls.

It was there that she first demonstrated her love for mathematics and her competitive spirit with her classmates. To further develop her abilities, she enrolled in Georgetown University's mathematics department.

In one of her memoirs, Mary Erdoes admitted that she was the only girl in her entire class, so it was truly difficult for her to compete with the boys. However, this didn't stop her from successfully graduating from university and receiving a bachelor's degree.

Career ladder

When Mary's career in investing began, her grandmother was once again to blame. While her father instilled in her a love of trading and gave her some insight, it was her grandmother who found her first job.

So, when she was still a student, a caring relative called all her acquaintances and got her a job at the investment firm Stein Roe & Farnham.

At her first job, she was nothing more than a courier, whose responsibilities included sorting papers and delivering them to their destinations. However, it was there that she gained an insight into the inner workings of the organization, which motivated her to move on.

After her first job, she enrolled at Harvard Business School, where she earned her MBA. With such a degree and her initial work experience, new opportunities opened up for her, so she moved to Bankers Trust, where she began working in asset management, specifically debt securities (bonds).

She also had a short stint at Meredith, Martin & Kaye, where she was a personal consultant and asset manager.

She truly blossomed as a manager at JP Morgan. At her new position, she had 15 people reporting to her, and her job was to head the bond and distressed asset trading department.

She managed to establish a good reputation and improve the performance of an already profitable and efficient department.

Climbing to the top

In 2005, she became one of the most powerful women in the world as she took over as CEO of JP Morgan Private Bank and also became the main successor to JPMorgan Chase & Co as CEO.

Today, this fragile woman manages approximately two and a half trillion dollars, while Mary Erdoes' personal salary in the company is 15 million a year.

The most interesting thing is that her salary is an order of magnitude lower than that of most of the hedge fund heads who report directly to her. However, this doesn't bother her in the least.