Where is it more profitable to trade cryptocurrency: an exchange or a broker?

Over the past few years, cryptocurrency has become one of the most popular assets among traders who profit from changes in its price.

Trading strategy has also changed significantly in recent years; now few people just buy and hold until the price rises; most players make short-term trades.

A large number of transactions places high demands on the place where you trade, and sometimes the size of your profit depends on this.

Currently, you can exchange cryptocurrency on a crypto exchange, through a stock broker, and directly in your wallet.

We won't consider a cryptocurrency wallet, as it's completely unsuitable for speculative trading due to high fees. A wallet is simply a place to store digital money, nothing more.

Which is more profitable: a cryptocurrency exchange or a stock broker?

Let's compare the main criteria typically considered when choosing a trading platform for earning cryptocurrency.

Security – here, stockbrokers with bankruptcy insurance ; in the event of bankruptcy, their clients receive compensation of 20,000 euros.

Cryptocurrency exchanges offer virtually no insurance against risks, and in the event of trouble, their clients must rely solely on miracles and a quick response when withdrawing funds.

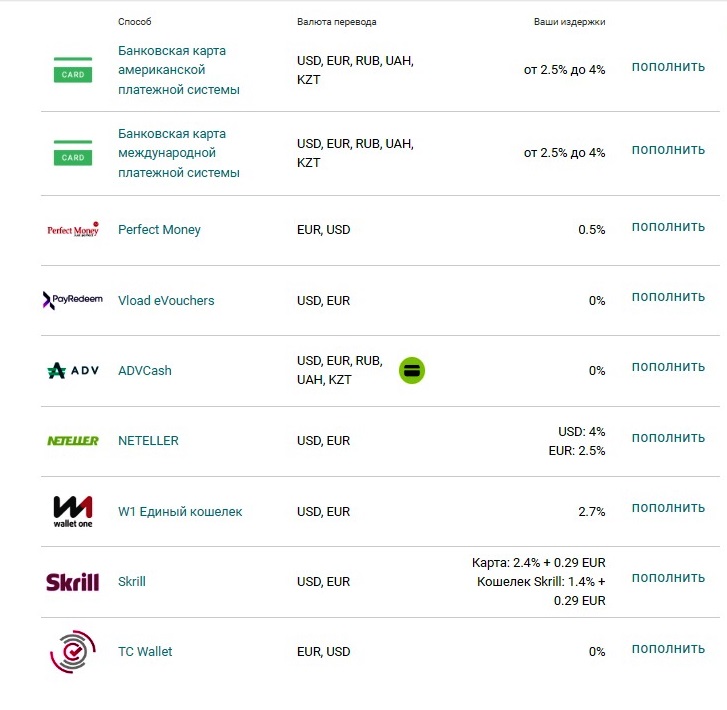

Deposit options – in order to trade crypto, you first need to fund your account.

When it comes to crypto exchanges, the options are quite limited. You can usually fund your account only via bank transfer, credit card, and sometimes PayPal . Commissions range from 1 to 4 percent for both deposits and withdrawals.

Stock brokers offer a much wider selection, typically a dozen different options, and may even charge no commission for deposits or withdrawals:

In addition to traditional bank cards, various payment systems are available here.

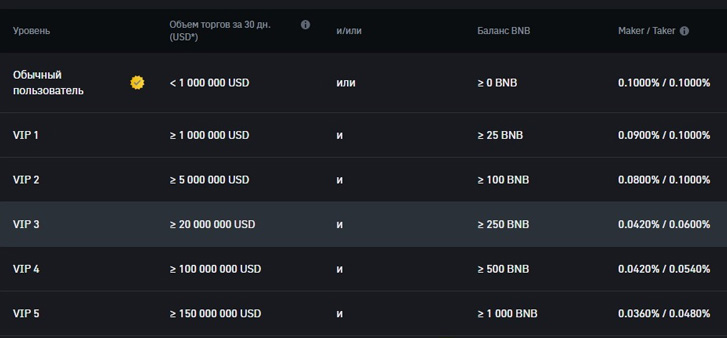

Trading fees – this is how much you pay when opening a trade to buy or sell cryptocurrency.

Exchanges - The commission for opening and closing trades on a crypto exchange depends on a number of factors, the most important of which are trading volume and execution type:

Moreover, the commission size for margin trading can range from 0.025 to 0.1 percent per transaction.

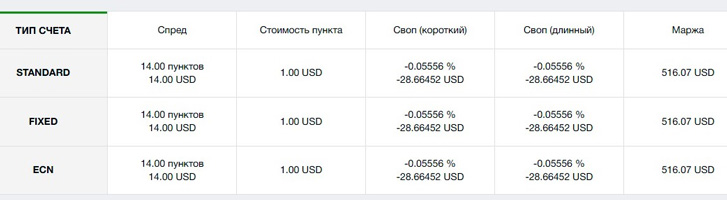

Brokers charge a commission only when opening a trade; the spread size directly depends on the account type and the liquidity of the asset:

Depending on the broker and account, the commission for opening a trade is, on average, $14 per bitcoin.

It is quite easy to calculate that the percentage will be equal to 14/51600 x 100% = 0,027%

Difficulty of trading – perhaps it’s a force of habit, but I find it quite difficult to understand the options for opening trades that crypto exchanges offer.

With brokers, everything is much simpler, and you can always contact customer support for clarification.

Number of assets – this is where exchanges clearly win; even the most advanced brokers have no more than 50 cryptocurrency pairs.

While on exchanges you can open trades on thousands of different assets, and new assets often appear on exchanges.

Support is much better with brokers; you might not get a response from the exchange at all, whereas with a brokerage company, you'll be assigned a manager who responds fairly quickly.

A personal manager will also help you with training on the technical aspects of the trading platform.

Which crypto exchange or crypto broker should you choose?

Each option has its own advantages and disadvantages, it all depends on your trading experience and the strategy you are going to use.

For beginners, I would definitely recommend cryptocurrency brokers. This option is also suitable for those who want to scalp cryptocurrencies , as these companies offer high leverage. And their commissions are no higher than those on crypto exchanges.

Recommended cryptocurrency brokers - https://time-forex.com/kriptovaluty/brokery-kriptovalut

If you want to make money on new cryptocurrencies and your trading is more like investing than speculative trading, the clear choice is crypto exchanges.

Because only there can you buy less liquid cryptocurrencies and try to make money in the hopes of their growth.