What is a cross rate and the most popular cross pairs in Forex?

The exchange rate is the price of the monetary unit of one country expressed in the monetary units of another country.

However, due to circumstances, it is not always possible to exchange two currencies, due to the lack of direct quotes; in these cases, a cross rate is used.

A cross rate is the exchange rate of one currency against another, expressed through a third currency.

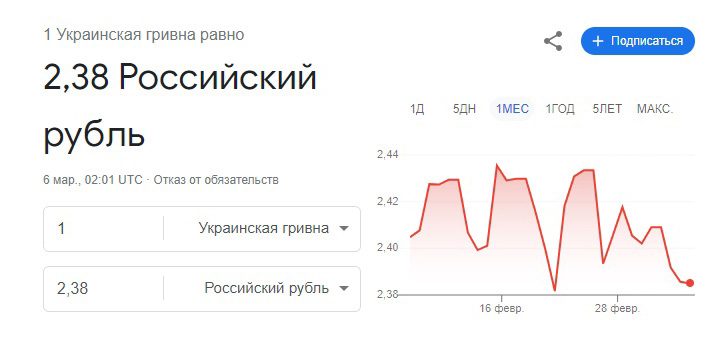

For example, it is currently impossible to directly exchange the Ukrainian hryvnia for the Russian ruble, but circumstances vary, in which case a cross rate using the US dollar is used to determine the exchange rate between the two currencies.

After this, it is not difficult to calculate that 1 Ukrainian hryvnia costs 91.64 / 38.42 = 2.38 Russian rubles, for 100 hryvnia you get 238 rubles:

If you want to know how many hryvnias are exchanged for 1 Russian ruble, calculate 38.42 / 91.64 = 0.42 Ukrainian hryvnias. This means you'll get 42 hryvnias for 100 rubles.

Cross rates allow you to convert one currency into another without having to convert it into US dollars. This is a distinct advantage, as if you first convert one currency into dollars at the selling price and then buy another at the buying price, the price will change to your disadvantage.

A cross rate allows you to exclude from your calculations the spread charged by intermediaries during exchange transactions. Unfortunately, most banks convert currencies when paying with a card in another currency without using cross rates, so it is better to use multicurrency cards.

Forex cross pairs

When it comes to Forex trading, so-called cross pairs are used, which are currency pairs that do not include the US dollar.

Thanks to the use of cross rates, the spread on such currency pairs is practically no different from that on major currency pairs with the US dollar.

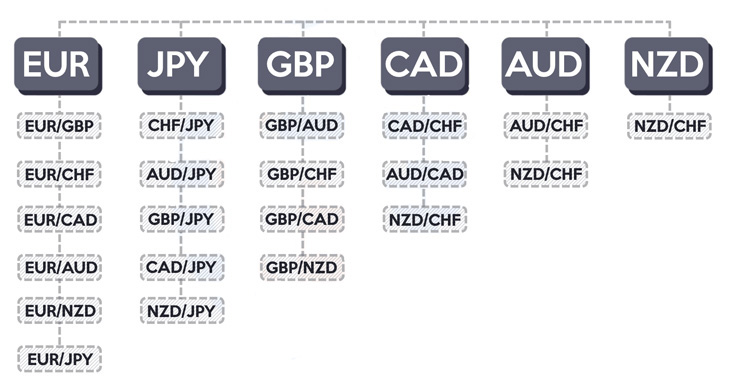

The most popular currency cross pairs usually include pairs formed by the euro and other popular currencies: EUR/GBP, USD/CHF, AUD/JPY, EUR/JPY, GBP/JPY, NZD/USD, CAD/JPY, EUR/AUD, GBP/CHF:

Photo 2

Cross-pair trading is a rather interesting trading option, and is ideal for those who trade during the European or Asian trading sessions .

Most of these assets have fairly high liquidity and a small spread, but at the same time are quite volatile, which allows for good profits.

Cross pairs are often used in the carry trade to profit from the difference in interest rates or to hedge risks.