Widening the spread on holidays, myths and reality

Almost before every holiday, we receive warnings from our brokers about possible widening of spreads.

For this reason, it has become common belief that trading on these days is unprofitable, as the spread size is simply off the charts.

I myself remember the times when, Alpari's spread on the EURUSD pair was 100 points, and this was with a four-digit quote.

But what is the situation today? How significant is the spread widening on days when asset liquidity on the exchange decreases?

Here, everything is quite individual and depends on the holiday and the type of asset you are going to trade.

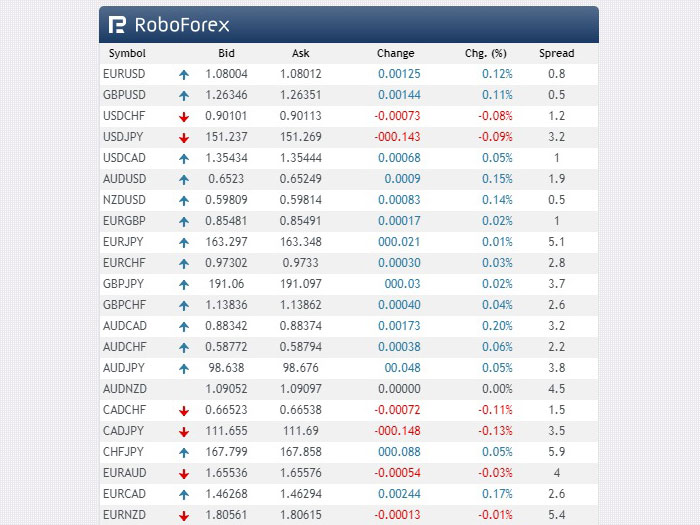

For example, the average spread on EURUSD is 0.5 pips, widening to 5-6 pips before the holidays. The spread size today :

Before less significant holidays, the spread may barely widen at all. For example, today, two days before Easter, such a widening is barely noticeable, as you can see for yourself by looking at the chart above.

This is because, thanks to new algorithms, the liquidity of assets on the foreign exchange market is much higher, including during holidays.

On such days, closing trades early carries a greater risk, as you'll have to pay swap fees for several days, and it's unclear how the price will change during the holidays.

If we talk about strategies, it is clear that at this time it is better to refrain from using scalping , since the widening of the spread significantly affects the overall result of scalping trading.

As a result, it can be said that if you have time to trade, especially on these days, then you should not deny yourself the pleasure; the main thing is to control the spread size before each trade.

Spread indicator - https://time-forex.com/indikators/indik-spred-monitor