Methods for taking profits in Forex

Many traders blame entry points, believing that their profitability directly depends on their market entry. However, in practice, failure to properly take profits often leads to a decrease in balance.

The fact is that most traders, even if they don't admit it, have an inferiority complex when it comes to taking profits.

Unfortunately, this complex appears almost at the very first stages of a trader's development, so even professionals may not suspect the cause of their losses.

Anyone who actively trades has often noticed a situation where a profitable position following a trend for several days becomes negative within a second of a news release, causing damage to your balance.

If this is your first time experiencing this situation, you're lucky. However, when a trader is repeatedly stopped out of a profitable position, fear and apprehension about losing profits arise.

Basic methods of profit-taking

All profit-taking methods can be roughly divided into manual and automatic. Manual profit-taking refers to the early closure of an order manually, without the intervention of a broker or your MT4 software. Therefore, when it comes to manual profit-taking methods, there are two main ones: partial position closing and positive order locking.

Partial closure

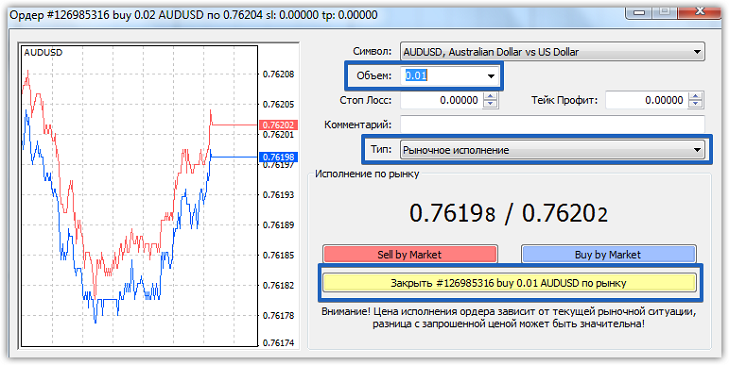

Forex traders using the MT4 trading platform don't even realize that they can close a position partially, rather than entirely. For example, if you opened a position with 1 lot and, after making a certain profit, doubt the price will continue to move, you can lock in part of the position, say 0.5 lots, and leave the other half open.

To do this, double-click on your order, and a window will appear where you can modify the order. Select market execution in the "Type" tab. Next, enter the position volume you want to close in the "Volume" field, and then select "Close.".

This approach allows you to protect part of your profit from unforeseen situations, but if you abuse this method of fixing, you can lose a significant portion of your funds due to your fears and anxieties.

Positive Locking

Some traders believe that locking orders is a method of limiting losses. However, in reality, you can also lock in your profits using a lock. To do this, you'll need to open an order in the opposite direction equal to your position. Since one order will result in a loss and the other in a profit, your profit will be locked in at the same level.

When discussing the advantages and disadvantages of this approach, the disadvantage is the loss of commission when opening an order. The advantage of this approach is that, with experience, you can skillfully open a lock near strong support and resistance levels, turning a protective order into additional profit.

Fixed profit

Fixed profit is a standard feature of your trading terminal, available both when opening an order and when modifying an order after it's closed. Locking in profit using Take Profit is the simplest, yet most effective, method. However, to effectively use this method, you need to carefully analyze historical data to tailor your strategy to market volatility.

If we talk about automatic methods, there are only two of them: a trailing stop directly in the trading terminal as a basic function or special advanced assistant advisors.

Trailing Stop Method

The essence of this profit-taking method is that the trading terminal automatically moves your stop order a specified number of pips along the price movement. This way, after a certain increment, your protective order is moved and profit is locked in. The more straightforward the market trend, the greater the distance in pips you can take from it.

The downside of standard trailing is its crudeness, so various scripts and expert advisors allow for more flexible trailing using various parameters (offset from the entry point, trailing step, and so on). However, it's important to understand that increased volatility can knock you out of the market much earlier than you would have if you'd set a simple profit.

Which method to choose?

As you can see, each of the methods described above has its own advantages and disadvantages. When choosing a particular method, you should primarily consider your trading strategy. However, it's worth understanding that if you can't control your emotions, a trailing stop, either in the terminal or using specialized advisors, is an excellent solution.