Forex trading without a broker: available options, advantages, and disadvantages

Many of those who have tried their hand at currency trading believe that the main reason for their failures is brokers who interfere with the trading process.

Therefore, you can often hear the question, "Is it possible to trade Forex without a broker?" In their opinion, the absence of intermediaries will improve trading results.

Everyone has the right to their own opinion, so we will try to answer this question.

Yes, today there are several options for trading Forex without brokers, and they are quite accessible to anyone.

But, first of all, it should be noted that in any case, you will have to work through an intermediary; you will only be able to conduct direct currency transactions if the transaction takes place directly with the seller or buyer.

Available Forex trading options without brokers

Online banking is one of the most accessible options, available at most banks. To use it, you only need several accounts and online banking access:

To exchange one currency for another, you need to open accounts in the required currencies, for example, an account in dollars, euros, and Russian rubles.

The exchange is made instantly and the money appears in the corresponding account.

However, it is worth noting the following disadvantages of this option: a large commission and a limited choice of currencies that can be exchanged.

Electronic payment systems – such as Yandex money (Yumani), WebMoney and other similar electronic money options:

Here, everything is a little more complicated; for operations, you need to use the appropriate application, which must be installed on your computer or phone.

After this, you can exchange one currency for another in just a couple of clicks, after which the purchased currency will appear in the corresponding wallet.

As for the disadvantages, there are quite a few. First and foremost, there's the exchange rate, which can range from 1 to 3 percent. There are also additional costs when topping up your e-wallet and withdrawing funds to a bank card.

Phone applications – or in other words, electronic payment systems that have their own plastic card:

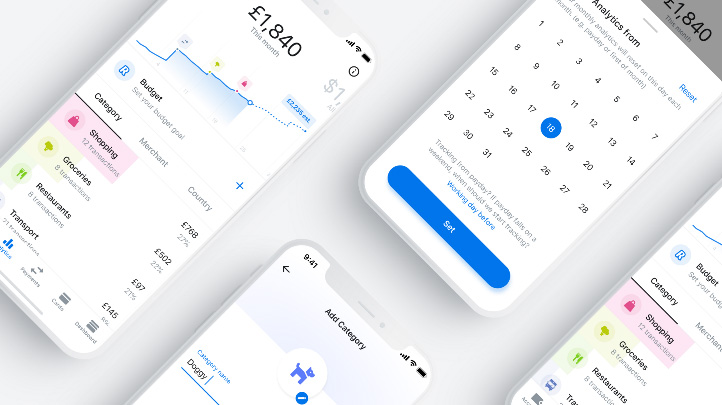

The best example of this option, in my opinion, is Revolut. To use this app, you first need to register on the Revolut website and then install their app on your phone.

Revolut's exchange functionality is much more comprehensive than the other options described above. Not only can you quickly exchange dozens of currencies, but you can also trade cryptocurrencies and securities.

There are also charts of exchange rate movements and the ability to place pending orders, and profits can be withdrawn directly from the Revolut card, which is issued free of charge.

However, this option is not without its drawbacks: firstly, Revolut is not available in all countries, there are limits on free withdrawals, and the commission sometimes leaves much to be desired.

As they say, everything is relative. Try trading Forex without brokers and the tools they provide, and you'll decide for yourself whether this option is worth your attention or whether you should use traditional trading through a brokerage company .