How to open a Forex account in just a few minutes

Many people looking to open a Forex account don't realize that there are several key points to consider when doing so that make trading on the foreign exchange market much more convenient.

This step is quite important for a novice trader, as it allows you to avoid a lot of unpleasant surprises and saves a lot of time.

To complete your registration, you may need a scanned copy of your passport and proof of registration (place of residence), so make copies of these documents in advance.

It's also a good idea to open an e-wallet in one of the payment systems, preferably WebMoney. This is quite simple, allowing you to quickly deposit and withdraw funds from your trading account and make exchanges at a more favorable rate.

There are also traditional ways to deposit and withdraw profits: bank account, credit card, cash, Bitcoin, Yandex Money, etc.

See all available top-up options .

Once you've chosen your forex broker, you need to register on their website. To do this, follow these steps:

To open a Forex trading account you need to:

1. Register as a client, providing your personal information—last name, first name, patronymic, sometimes year of birth, and passport details. Remember that you must be 18 years of age to trade and open a Forex account, but you can register on behalf of an immediate family member if you wish.

2. Verification – confirmation of completed data. To do this, you need to send copies of your passport and registration page. It is also advisable to confirm your phone number and email address.

The address is often the most problematic. To confirm it, you need a utility bill no older than three months. Some brokers also require this document to have a wet stamp, meaning online bills are not suitable.

You can open an account with a Forex broker without verification, but then there's a high risk of problems with withdrawals.

3. Agreement – some companies require agreement confirmation before opening a forex account. This can be done online, but sometimes you have to print the agreement, sign it, scan it, and send it back to the broker.

Alternatively, you can send a photo of the signed agreement. Fortunately, modern phones have a document scanning function that makes a photo virtually indistinguishable from a scan.

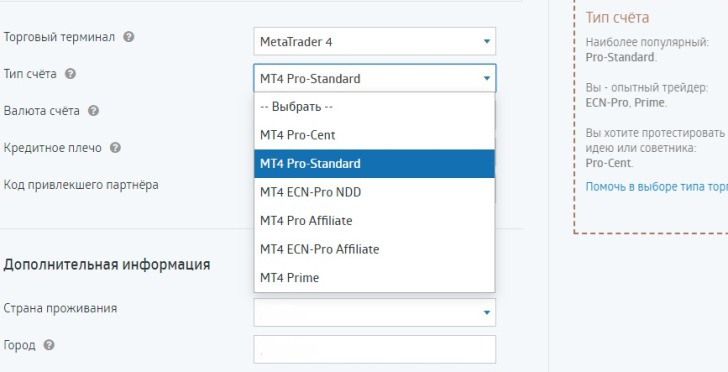

4. Opening an account is one of the most important steps. Before opening a forex account, you need to consider the following parameters:

• Account type – standard, cent, or demo. Trading conditions and additional commissions may vary significantly. Cent accounts allow micro-lot trading, while a demo forex account can be opened for learning trading or testing strategies.

Choosing an account type is quite simple: the larger your capital, the more favorable the terms you'll be able to open a Forex account with. However, don't forget to check whether the assets you plan to trade are available on the account.

• Receiving bonuses – when opening an account, you are sometimes required to indicate the type of bonus you will receive, so you should be especially careful here, as many of the bonuses are only available upon opening.

• Account currency – we indicate the currency in which it is more convenient for us to make deposits and carry out trading; the best choice in this case is the US dollar.

• Leverage – typically ranges from 1:1 to 1:1000. The key is to use leverage when choosing a leverage ratio: the smaller the deposit, the higher the leverage used, and vice versa. Traders most often use leverage of 1:50, as this is the optimal ratio of profit to risk. For trading on cent accounts and scalping, a leverage of 1:500 is recommended.

• Account replenishment – there are usually quite enough replenishment options, this is done using a debit or credit card, electronic money or bank transfer, as well as in cash at any of the broker’s offices.

Once you've opened a Forex account, you'll receive access details. Be careful when storing passwords. It's best to use a dedicated flash drive for these purposes rather than storing them openly on your computer.

Now let's move on to real trading. For this, you can use a trader's terminal or a web terminal. In the first case, you'll need to download the program to your computer; in the second, trading is available directly on the broker's website using a browser.

Opening a Forex account is much easier than making money with it, so before you start trading, take a training course. There are currently quite a few free training courses available from brokerage companies.