Frequently asked questions about currency exchange on the Forex market

Nowadays, people increasingly have to resort to exchanging one currency for another; some exchange money for their own needs, and others for speculative purposes.

At the same time, everyone understands that the most favorable exchange rate should be directly on the Forex currency exchange, since this involves a minimum number of intermediaries in the process.

Moreover, due to the current situation, it is sometimes simply impossible to exchange currencies at a bank or exchange office, so many are asking the question: Why not exchange money on Forex?

Indeed, currency exchange on the Forex market has many advantages: minimal commissions, a wide selection of currencies, and the ability to complete transactions online.

The nuances of currency exchange on the Forex market

Registration – firstly, in order to make an exchange, you will need to open an account with a broker , only after that can you carry out a transaction.

In addition, you will need to confirm your identity with relevant documents – passport, place of residence.

You can't withdraw exchanged currency —that is, if you exchange US dollars for Japanese yen on the trading platform, this doesn't mean you can easily withdraw the purchased yen to your bank account.

In practice, things are much more complicated. The transaction is considered complete only after it's closed—in our case, selling yen for dollars. As a result, your account will once again be in US dollars. Therefore, currency purchased on Forex cannot be withdrawn to your bank account or cashed out

You can only make money on the exchange rate if the yen you bought appreciates in price during the period of the transaction, then when you close the position, you will receive a profit from the increase in the exchange rate.

It should be noted, however, that most brokers offer the ability to perform internal exchanges in the trader's personal account. However, currently, only the following assets can be used as account currencies: the dollar, euro, ruble, gold, and Bitcoin. Exchanges are only possible between these assets.

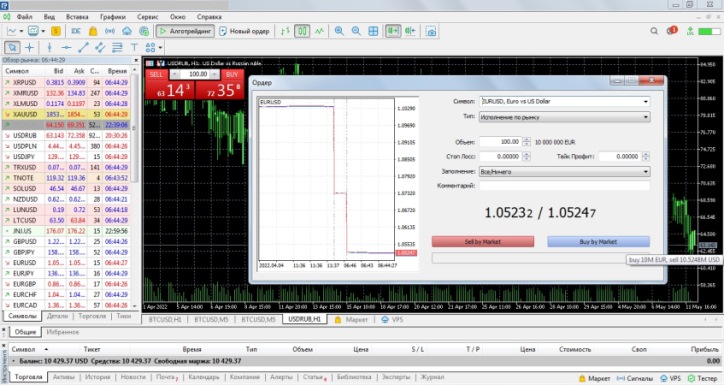

Trading platform – technically, currency exchange on the Forex exchange is more complex than at a bank. To complete a transaction, you'll need to use a trading platform:

The software is free and fairly simple, but it does take some time to master. However, it's worth noting that the trading platform offers much broader trading options than simply exchanging one asset for another—leverage, pending orders, open trades, and so on.

Therefore, in conclusion, it can be said that currency exchange on Forex is more suitable for non-cash, speculative, or investment transactions, but it will not allow you to buy currency and hide it under your mattress at home.

This means you can exchange your national currency for a stronger one and hold your funds with the broker for the required amount of time, then exchange them again and withdraw them if needed. A nice bonus is the high interest rate on foreign currency deposits, sometimes reaching 20% per annum - https://time-forex.com/inv/depozit-bolshoy-procent

Brokers where you can open an account - https://time-forex.com/reyting-dilingovyh-centrov