All about Forex orders - basic types, sizes, and triggering features

Forex orders are the main instrument used to conduct transactions on the foreign exchange market. There are several types of orders, all of which are grouped by execution time and type.

Each one performs its own functions and is triggered only when certain rules are met.

The main task of a trader is to correctly determine the time to use a particular order and set the initial parameters.

In addition, there is a certain category of orders that do not open trades on their own, but serve only as an addition to already open positions.

Proper use of all available options can significantly improve the efficiency of Forex trading.

Types of Forex trading orders

1. By execution time – Forex orders are divided into instant (market) and pending:

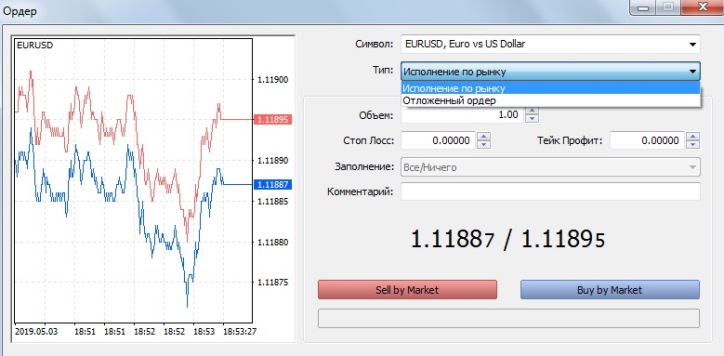

Instant – execution occurs immediately after the trader submits the order. The execution speed of such an order depends solely on the technical parameters of the line provided by your trader, typically between 0.1 and 1 second.

Depending on the execution type set by your broker, an order to open a trade may be executed at the market price or only at the stated price.

In the first option, you set the planned deviation level yourself, while in the second, the transaction is opened only if the currency pair quote has not yet changed.

When opening a Forex order, you can sometimes specify an acceptable deviation from the stated price, for example, 5 points. In this case, the position will open even if the price changes, but not by more than 5 points.

Pending – Forex orders are executed only after certain conditions are met, which can be time or price level.

When placing this type of order, in addition to the direction of the transaction, a price level is also set, upon crossing which the transaction will be opened.

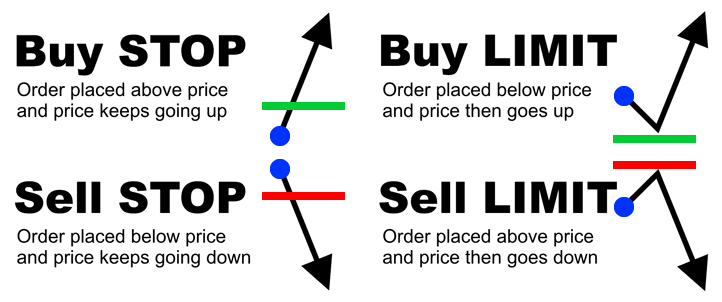

Such orders can be of several types:

- According to the trend - Buy Stop and Sell Stop, which are set in the direction of the existing trend.

- Against the trend - Buy Limit and Sell Limit in anticipation of a reversal or the end of a correction.

- Buy Stop Limit and Sell Stop Limit are combined forex orders that combine the properties of the two above-mentioned ones.

2. Forex stop orders – their main purpose is to reduce potential losses on already open positions or to lock in profits.

2. Forex stop orders – their main purpose is to reduce potential losses on already open positions or to lock in profits.

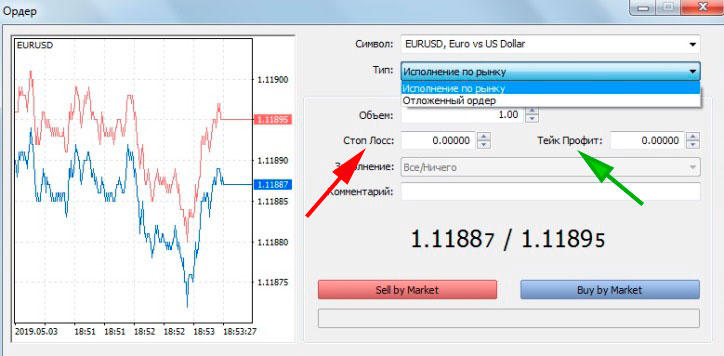

Stop loss is the most popular and most frequently used order; its purpose is to immediately close a losing trade, thereby reducing the size of potential losses.

Once set, a price level is set at which the position will be closed. For long positions, the order is placed below the opening level, and for short positions, above this level.

It should be noted that most traders limit the minimum stop loss size to 20-30 points.

A trailing stop is a type of floating stop-loss order with a minimum value of 15 pips. It helps maximize profits if a trade enters the breakeven zone.

This order allows you to move the stop in the direction of profit; the order is triggered if the price starts to move against the open position.

This stop-loss option only works when the trader's terminal is enabled. For standalone operation, a standard stop-loss order should be placed. Alternatively, use a trading platform installed on a virtual server.

More information on setting a trailing stop can be found here: http://time-forex.com/praktika/kak-vystavit-trejling-stop

Take profit – used to secure the profit already made; the amount is calculated based on the price movement dynamics and the results of the forecasts.

When placing pending orders on Forex, keep in mind that different brokers use different execution techniques. Sometimes, for an order to be executed, the price must cross the planned level at least several times.