Which session should I choose for trading on the stock exchange?

When starting to trade on the stock exchange, a trader faces a lot of questions, one of which is: During which session is it better to trade?.

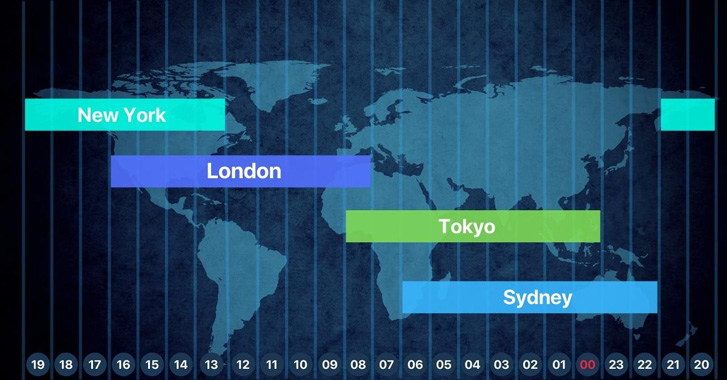

Trading session schedule – https://time-forex.com/torgovye-sessii-forex

After all, a lot depends on trading time, from market volatility to the ability to open trades.

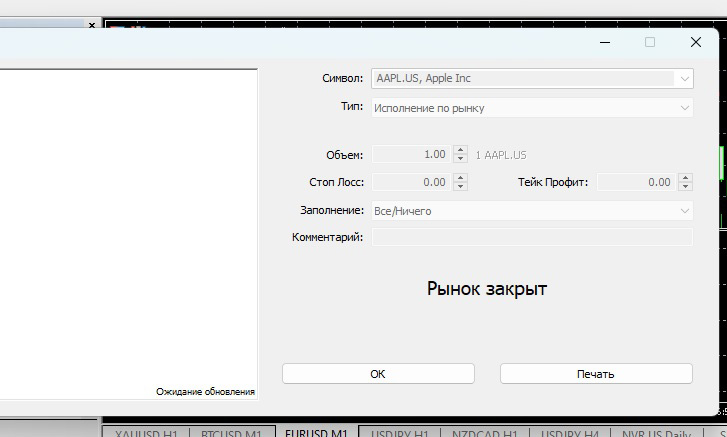

When answering this question, one must first consider the availability of opening transactions for a particular asset.

For example, you can trade cryptocurrencies 24/7 (at any time), regular currencies 24/5 (around the clock on weekdays), precious metals 24/5, stocks 8/5 (only during stock exchange hours), and commodity futures during exchange hours, but there may be some nuances.

In this case, you won't even be able to place a pending order, as the trading platform rejects this action as well. This is understandable, as trading is not ongoing and there is no current price for the asset.

The situation is similar with shares of companies from other countries: European companies are traded during the European session , and Asian companies during the Asian session .

Cryptocurrency trading

Cryptocurrencies are arguably the most convenient asset to trade, as they can be traded at any time, even on weekends.

News affecting the price of digital currencies can also appear during any trading session, but news from the US has the greatest impact on the crypto market. Typically, this news is negative.

Trading currency pairs

Currencies can be traded at any time of the day except Saturdays, Sundays, and holidays, especially if you are opening long-term or medium-term trades.

But in general, currency volatility depends on the trading session. For example, the EURUSD pair is most volatile during the American and European trading sessions. However, trades can be opened at any time of day.

Precious metals and energy resources

The trading schedule for gold and silver is virtually identical to that for currency pairs, meaning trades can be opened on weekdays, 24 hours a day.

In most cases, brokers use contracts for difference (CFDs) , which eliminates the need to pay attention to which exchange the trading is conducted.

A similar situation applies to oil trading. This asset can be traded on weekdays, without regard to contract expiration dates, if trading is conducted using CFDs.

In conclusion, we can draw the following conclusion:

The choice of session for exchange trading depends on the following factors:

- Asset, since for some instruments trading time is limited by the exchange's opening hours.

- Strategies - For a news trading strategy, you should select those sessions during which news is released that influences the price of the selected asset.

- The type of contracts you intend to trade

Last but not least, the convenience of the chosen time is a factor. If it's 3 a.m. in your country, you're unlikely to trade effectively just because you need that trading session. It's better to switch to a more convenient asset.