The best swap-free forex and stock market brokers

As you already know, in addition to the main commission of forex brokers - the spread, which is taken when opening each transaction - there is also a swap.

A swap is a fee charged for holding a position overnight. This type of commission is calculated as the difference between the interest rates of the currencies that form the quote.

A swap is a fee charged for holding a position overnight. This type of commission is calculated as the difference between the interest rates of the currencies that form the quote.

Some traders, for religious or other reasons, prefer not to use accounts that incur a swap fee.

Unfortunately, not all brokerage firms offer so-called Islamic accounts, and finding the most suitable option requires considerable time.

Here are companies that can be confidently recommended for this type of trading.

Recommended swap-free brokers for Forex trading

RoboForex is one of the best companies currently available, offering a highly developed service that allows for comfortable trading.

Three account types are available for swap-free trading: Pro-Standard and Pro-Affiliate. You can also test the service with a Pro-Cent account.

You can trade assets such as currency pairs, cryptocurrency pairs, and company stocks.

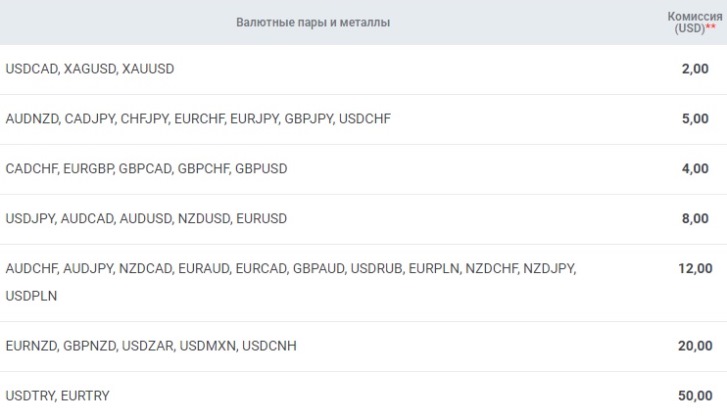

Commissions start at $2 per lot, depending on the selected trading asset.

Commissions start at $2 per lot, depending on the selected trading asset.

RoboForex website: www.roboforex.com

Amarkets is also a fairly good broker, allowing you to activate swap-free and pay a fixed amount per transfer.

What sets this broker apart from other companies are its low spreads, tolerance for various trading types, and high-quality trading terminal operation.

This service is available on Standard and Fixed accounts, as well as on some other accounts if you have the Gold and Platinum packages.

Amarkets' website is

www.amarkets.biz . There's no need to look for special swap-free accounts; the service is available on regular broker accounts; you just need to submit a request to activate it.

Which is more profitable – swap or commission?

It's difficult to give a definitive answer to this question, as it all depends on the broker, the currency pair, and the commission amounts charged.

We've studied both options on various currency pairs; the difference is typically 0.30-0.40 cents per lot in either direction, but there are exceptions.

For the EURUSD currency pair, the negative swap was $1.50 per lot higher than the commission.

It's also important to remember that with swap-free broker accounts, you pay a commission regardless of the trade direction, while the swap can also be positive, sometimes reaching $10 per lot.

You can perform all calculations using the trader's calculator - http://time-forex.com/sovet/kalkul-alpari