The best ECN brokers for stock trading

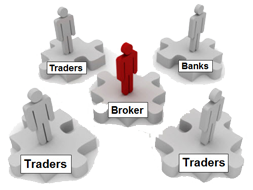

Electronic Communication Network is an electronic system for conducting exchange transactions, designed specifically to eliminate the possibility of broker interference in the exchange trading process.

ECN brokers are brokerage companies that use a similar system for carrying out transactions in their trading. When carrying out this type of trading, an ordinary trader independently enters the market, and not under the name of an intermediary organizing dealing.

The advantages of this method of trading are obvious, so it would be useful to know who provides services under this scheme.

Currently, there are brokers with separate ECN accounts or fully dealing with this system; below you can see the current list.

By choosing a partner to work with from those listed below, you receive a guarantee of stable access to the foreign exchange market and stock exchange, and at the same time more comfortable trading conditions.

Brokers with low spread

If you trade scalping, then the concept of a spread takes on special meaning for you. Since in this case the size of transactions is hundreds of times greater than the trader’s deposit, which naturally causes an increase in the broker’s commission.

Since in this case the size of transactions is hundreds of times greater than the trader’s deposit, which naturally causes an increase in the broker’s commission.

This is why it is so important to find brokers with low spreads for the chosen trading instrument.

This article will present forex brokers with the lowest performance for the EUR/USD currency pair, which is the most popular trading tool.

As a rule, such companies have commissions on other assets that are also much lower than their competitors. The same applies to the fee for transferring swap positions.

As an experiment, I personally checked to what extent the information in the specifications corresponds to reality.

Commissions of stock brokers for opening transactions on the stock exchange

When starting trading on the forex currency exchange, you should know how much and what you will have to pay for, that is, what the commissions of stock brokers are.

is, what the commissions of stock brokers are.

Surprisingly, many traders are simply unaware of the number of additional costs they may have to face.

Sometimes this data is not always provided in clear form, so you should be especially careful when reading trading conditions and contracts.

A stockbroker's commission on Forex can be of the following types - spread, fee per lot, swap for transferring positions, SMS for withdrawing neighbors.

Sometimes other fees may also apply, depending on the company you are trading with.

Forex broker spreads

As you know, the spread size always depends on several parameters - currency pair, brokerage company, market situation. And if we are not able to control the latter, then we are quite capable of determining which broker and for which currency pair offers the lowest commission.

And if we are not able to control the latter, then we are quite capable of determining which broker and for which currency pair offers the lowest commission.

Below I will indicate the average spread depending on the specific broker, for the most popular currency pairs and the Bitcoin cryptocurrency.

To make it easier to compare indicators, for convenience, I have highlighted brokerage companies with the smallest spread.

Forex brokers

Trading on the forex exchange occurs according to unique rules, in the formation of which forex market brokers play an important role.

It is brokerage companies that create a set of specific rules that their client, the trader, must obey, and the rules are not always the same and vary depending on the company, so you should be careful in choosing and using certain operating strategies.

These companies are divided into several categories, and depending on who you work with, you can expect a certain reaction to your success.

Moreover, this reaction may not always be positive and pleasant for you.

At the moment, the situation is quite interesting, especially if we look at it from a slightly unusual angle:

The best swap free brokers for forex and stock market

As you already know, in addition to the main commission of forex brokers - the spread, which is taken when opening each transaction, there is also a swap.

Swap is a fee for transferring a position to the next day; this type of commission is calculated as the difference between discount rates for the currencies that form the quote.

Swap is a fee for transferring a position to the next day; this type of commission is calculated as the difference between discount rates for the currencies that form the quote.

There is a category of traders who, for religious or other reasons, prefer not to use accounts in their trading from which fees are charged for transferring positions.

Unfortunately, not all brokerage companies have so-called Islamic accounts; in addition, you need to spend a lot of time to find the most suitable option.

Here are the companies that can be safely recommended for this type of trading.

Best Stock Broker for Big Trade

Most people don’t even realize that big money, in addition to advantages, also causes additional difficulties.

additional difficulties.

Trading on the stock exchange was no exception; if you have only a few hundred dollars in your account, it is much easier to find a broker to organize trading, but if you have more significant amounts, unforeseen troubles may arise.

Typically, troubles arise when a brokerage company cannot provide the required trading volumes or when large sums of money are withdrawn.

Therefore, if you expect to trade amounts of more than $10,000 and volumes of more than 100 lots per day, when choosing forex brokers, you should take into account not only trading conditions, but also some other parameters:

Brokers for trading advisors with the best trading conditions

Not long ago, while testing one of the Forex advisors, I received a message from my broker “You are using a third-party script for trading, thereby violating the terms of the agreement, etc.”

a third-party script for trading, thereby violating the terms of the agreement, etc.”

It turned out that not all brokerage companies are indifferent to the use of advisors on their trading platforms.

Therefore, it was decided to clarify this issue directly with the support service; as a result of a survey of 25 companies, only 7 of them gave a completely affirmative answer.

Five responded that, in principle, it is possible, but only if it does not interfere with the operation of their servers. Based on the research, we can conclude that in order to prevent troubles, you should clearly know which forex brokers allow trading with advisors.

Forex brokers with minimum deposit

Trading on the currency exchange involves high risks; a minimum deposit will help you try your hand at this difficult task and not lose a lot of money.

minimum deposit will help you try your hand at this difficult task and not lose a lot of money.

In addition, it is not rational to trade with a large amount at once, because first you should test the broker for compliance with trading conditions and the speed of the trading terminal.

Forex brokers with a minimum deposit allow their clients to evaluate the quality of the services provided with the least risk to their own funds; in addition, when choosing a company, you should pay attention to the minimum possible volume of transactions.

Minimum deposit and trading volumes at various forex brokers:

The best dealing centers for online Forex trading

At the moment, there are a lot of brokerage companies providing dealing services on the Forex exchange, so it can be difficult for the average trader to choose the most suitable option.

Forex exchange, so it can be difficult for the average trader to choose the most suitable option.

The best Forex dealing centers must meet the following criteria: to be reliable, have acceptable trading conditions, ensure stable operation of the trading terminal and high speed of order execution.

After conducting a comparative analysis of more than three dozen Forex DCs, we were able to identify five leaders that fully meet all the requirements:

Russian Forex brokers for online earnings on the currency exchange

Recently, the popularization of stock exchange trading has been taking place in Russia at an active pace; during the crisis, the number of people wishing to earn money without changing their place of residence has increased significantly; online trading provides such an opportunity.

the number of people wishing to earn money without changing their place of residence has increased significantly; online trading provides such an opportunity.

Dealing centers serve as intermediaries in this matter ; there are no big differences between these two types of companies, both of them organize dealing.

Russian brokers - those companies that are focused on Russian-speaking clients, usually have a website in Russian, Russian-language support and appropriate licenses to operate.

Often they independently withhold income tax from the profit received by the trader and submit reports on client income to the Russian tax service.

Segregated account, what is it and how necessary is it, brokers with similar accounts

A segregated account is a bank account that differs from a regular account in that it stores funds allocated for specific purposes.

This may be an account that holds money for specific purposes or obligations, such as an account for paying taxes, an account for holding customer funds at a financial institution, or an account for stock trading.

Very often in the description of the advantages of a Forex broker there is a note that the company also provides a service - “Segregated accounts”, what is this service and what advantages does it give the trader over regular accounts?

A segregated account in exchange trading is a type of trader’s deposit in which part of the funds is stored outside the brokerage company, which significantly reduces the client’s operational risks.

That is, for example, you plan to trade an amount of $200,000, open a segregated account, enter into an agreement with the company and deposit only half of the amount of $100,000 into your deposit.

Reliable brokerage companies with access to Forex

Choosing a broker has always been a primary task in trading, because in addition to reliability criteria, such factors as the size of the initial deposit, the size of the spread, the speed of order execution and some other parameters also play an important role.

I would like to draw special attention to the fact that not all Forex brokerage companies providing trading services allow their clients to use strategies that create a load on servers and communication lines.

You always want to find a middle ground; this list includes reliable brokerage companies that have optimal parameters and a good reputation.

From my personal experience, I can say that with none of these companies there were problems with withdrawals of funds, no manipulations with quotes were noticed, and this is sometimes more important than attractive trading conditions and huge bonuses.

And so, reliable brokerage companies for Forex trading where you can open an account online and start working in just a few minutes:

Banking Forex, online trading through bank brokers

There are quite a few participants in the Forex market who carry out currency transactions for their own needs or provide intermediary services to traders.

One of these participants are banks; they not only make the market, but thanks to the availability of free funds, they form the market.

At the same time, bank forex is when a bank begins to act as an intermediary, providing its clients with access to currency transactions.

In essence, he takes on the responsibilities of a dealing center by sending clients' transactions to the market and charging a commission for this, which is the main purpose of such activities.

Many people associate a bank with reliability and security, so there is a desire to trade on the stock exchange through this institution, but in fact, it also has its pros and cons.

What is the difference between a broker and a dealing center?

Some traders open an account with the company they like without even thinking about who the broker or DC is, while others persistently look for a broker-agent, believing that this option is much more reliable.

look for a broker-agent, believing that this option is much more reliable.

So what is the difference between a real broker and a dealing center?

Is this difference so significant that it is worth taking it into account when choosing a company that will bring your transactions to the foreign exchange market?

Currently, several types of companies provide their services to Russian traders:

Brokers for trading gold and silver

According to some traders, it is trading in precious metals that brings them the greatest profit. It is best to verify this statement in practice, but for these purposes you will need brokers for trading gold and silver.

profit. It is best to verify this statement in practice, but for these purposes you will need brokers for trading gold and silver.

I will provide a list of similar companies indicating spreads for the required instruments below, and before that, a little about the very features of the choice.

When taking such a responsible step, you should definitely know what you should pay attention to first.

Brokers with fixed spread

There is such a saying - “How many people, so many opinions”, and in Forex, some people prefer a floating spread, while others prefer a fixed one.

fixed one.

The main advantage of a fixed environment is its stable size; there is practically no need to constantly monitor this indicator.

Over time, there are not many forex brokers left that guarantee the size of the spread; below are companies with a fixed spread and the most favorable trading conditions.

But they still exist, or rather, they have certain types of accounts with the moment that interests us.

Most frequently asked questions about brokers

Discussions about choosing a broker are the most common topic on forums and blogs, but besides a specific discussion about which forex broker is best to choose for trading, there are a lot of questions that arise in almost every trader.

for trading, there are a lot of questions that arise in almost every trader.

In addition to reliability, there are a lot of other points that you should pay attention to, not to say that they radically affect trading, but it will not be superfluous to know them.

So, what would be useful for any trader to know?

1. The size of the spread - this is how you can evaluate the greed of the broker; the average size of the spread on EURUSD should not exceed 0.5 points. True, if it is much less than this indicator, then your intermediary makes money by draining deposits.

Broker for a professional, VIP service and no restrictions

Not every Forex broker is suitable for large-scale trading; some have restrictions on maximum transaction volumes, others cannot provide the appropriate quality of dealing, and others are simply afraid to entrust a large amount of money.

others cannot provide the appropriate quality of dealing, and others are simply afraid to entrust a large amount of money.

Choosing a broker for trading with an amount of 50-100 thousand dollars is much more difficult than for working with 50-100 dollars.

A large amount and, accordingly, a large volume of transactions impose certain obligations on the brokerage company itself; not every DC can cope with them, therefore the main criteria for choosing a broker for large-scale trading are:

Disadvantages of Forex brokers or how to avoid getting into trouble.

Anyone who has traded Forex can say that the right broker is not the least important factor in successful trading. It doesn’t matter how professionally you feel about the market, poor-quality dealing can ruin all your efforts in an instant.

It doesn’t matter how professionally you feel about the market, poor-quality dealing can ruin all your efforts in an instant.

Therefore, it is so important to know what shortcomings some brokers have, what they can lead to and how to prevent troubles from occurring.

The dealing system is currently organized in such a way that practically no one is immune from failures, but in addition to this, brokers have the following problems:

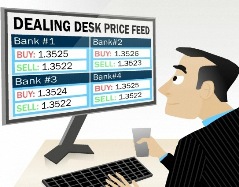

Dealing Desk, intra-company trading

Many traders, having heard that their broker provides dealing services using the Dealing Desk system, immediately panic, expecting various troubles from the broker.

panic, expecting various troubles from the broker.

Dealing Desk (DD) is a system for organizing trading in currencies or other financial assets, in which an internal platform is created, the liquidity of trading instruments on which is provided by the dealing center itself.

That is, everything here is as simple as possible, if you submit an application to buy the EURUSD currency pair, the system begins to look for a counter application to sell it, if one does not exist, your brokerage company will act as the second party to the transaction.

Page 2 of 3