The best ECN brokers for stock trading

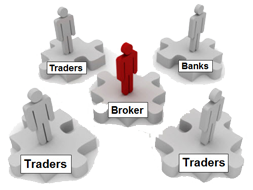

Electronic Communication Network is an electronic system for conducting exchange transactions, designed specifically to eliminate the possibility of broker interference in the exchange trading process.

ECN brokers are brokerage companies that use a similar system for carrying out transactions in their trading. When carrying out this type of trading, an ordinary trader independently enters the market, and not under the name of an intermediary organizing dealing.

The advantages of this method of trading are obvious, so it would be useful to know who provides services under this scheme.

Currently, there are brokers with separate ECN accounts or fully dealing with this system; below you can see the current list.

By choosing a partner to work with from those listed below, you receive a guarantee of stable access to the foreign exchange market and stock exchange, and at the same time more comfortable trading conditions.

Brokers with low spreads

If you're scalping, the concept of spread is especially important. In this case, the trade size is hundreds of times larger than the trader's deposit, which naturally increases the broker's commission.

In this case, the trade size is hundreds of times larger than the trader's deposit, which naturally increases the broker's commission.

That's why it's so important to find brokers with low spreads for your chosen trading instrument.

This article will present forex brokers with the lowest spreads for the EUR/USD currency pair, the most popular trading instrument.

Typically, such companies also charge significantly lower fees on other assets than their competitors. This also applies to fees for rolling swap positions.

As an experiment, I personally checked to what extent the information in the specifications corresponds to reality.

Stock brokers' commissions for opening trades on the exchange

When starting forex trading, you should know how much you'll have to pay and what you'll pay for it—that is, what brokerage commissions are available.

is, what brokerage commissions are available.

Surprisingly, many traders are simply unaware of the number of additional costs they may face.

Sometimes this information isn't always disclosed transparently, so be especially careful when reading trading terms and agreements.

A forex broker's commission can include the following: spread, lot fee, swap for rolling over positions, and SMS for withdrawing positions.

There may also be other fees that may apply depending on the company you are trading with.

Forex broker spreads

As we know, the spread size always depends on several parameters—the currency pair, the brokerage company, and the market situation. While we can't control the latter, we can certainly determine which broker offers the lowest commission and for which currency pair.

While we can't control the latter, we can certainly determine which broker offers the lowest commission and for which currency pair.

Below I will indicate the average spread depending on the specific broker, for the most popular currency pairs and the Bitcoin cryptocurrency.

To make it easier to compare indicators, I have highlighted brokerage companies with the smallest spreads.

Forex brokers

Forex trading is governed by specific rules, and forex brokers play a significant role in shaping these rules.

Brokerage firms create a set of specific rules that their clients—traders—must adhere to. These rules aren't always uniform and vary depending on the company, so it's important to be careful when choosing and using certain trading strategies.

These companies are divided into several categories, and depending on which one you end up with, you can expect a certain reaction to your success.

Moreover, this reaction may not always be positive or pleasant for you.

At the moment, the situation is quite interesting, especially when viewed from a slightly unconventional angle:

The best swap-free forex and stock market brokers

As you already know, in addition to the main commission of forex brokers - the spread, which is taken when opening each transaction - there is also a swap.

A swap is a fee charged for holding a position overnight. This type of commission is calculated as the difference between the interest rates of the currencies that form the quote.

A swap is a fee charged for holding a position overnight. This type of commission is calculated as the difference between the interest rates of the currencies that form the quote.

Some traders, for religious or other reasons, prefer not to use accounts that incur a swap fee.

Unfortunately, not all brokerage firms offer so-called Islamic accounts, and finding the most suitable option requires considerable time.

Here are companies that can be confidently recommended for this type of trading.

Best Stock Broker for Big Trading

Most people don't realize that large sums of money, while offering advantages, also bring additional complications.

additional complications.

Trading on the stock exchange is no exception. If you only have a few hundred dollars in your account, it's much easier to find a broker to organize your trading. However, if you have more substantial sums, unexpected problems can arise.

These problems typically arise when the brokerage company can't accommodate the required trading volumes or when withdrawing large sums.

Therefore, if you expect to trade amounts over $10,000 and volumes exceeding 100 lots per day, when choosing a forex broker, you should consider not only trading conditions but also a few other factors:

Brokers for trading advisors with the best trading conditions

Not long ago, while testing a Forex advisor, I received a message from my broker: "You are using a third-party script for trading, thereby violating the terms of the agreement, etc."

a third-party script for trading, thereby violating the terms of the agreement, etc."

It turned out that not all brokerage companies are indifferent to the use of expert advisors on their trading platforms.

Therefore, it was decided to clarify this issue directly with customer support. Of the 25 companies surveyed, only 7 responded completely affirmatively.

Five responded that it was possible, but only if it didn't interfere with their servers. Based on this research, it can be concluded that to prevent problems, it's important to clearly understand which forex brokers allow trading with expert advisors.

Forex brokers with minimum deposits

A minimum deposit

A minimum deposit

will help you try your hand at this challenging endeavor without losing a lot of money Furthermore, trading with a large amount right away isn't advisable; you should first test the broker's trading conditions and the speed of the trading terminal.

Forex brokers with minimum deposits allow their clients to evaluate the quality of services provided with minimal risk to their own funds. When choosing a company, it's also important to consider the minimum possible transaction volume.

Minimum deposits and trading volumes for various forex brokers:

The best brokers for online Forex trading

With so many brokerage companies offering forex trading services available , it can be difficult for the average trader to choose the most suitable option.

, it can be difficult for the average trader to choose the most suitable option.

The best forex dealing centers must meet the following criteria: reliability, acceptable trading conditions, stable trading terminal operation, and high order execution speed.

After conducting a comparative analysis of over three dozen forex dealing centers, we identified the top five that fully meet all the requirements:

Russian Forex brokers for online earnings on the foreign exchange market

Recently, stock trading has been rapidly gaining popularity in Russia. During the crisis, the number of people seeking to earn money without moving is significantly increasing, and online trading offers just such an opportunity.

the number of people seeking to earn money without moving is significantly increasing, and online trading offers just such an opportunity.

Dealing centers act as intermediaries in this regard There are no significant differences between these two types of companies; both organize dealing services.

Russian brokers—those companies that target Russian-speaking clients—typically have a Russian-language website, Russian-language support, and the appropriate licenses to operate.

They often independently withhold income tax from the trader's profits and submit reports on clients' income to the Russian tax service.

Segregated account: what it is and how necessary it is, brokers with such accounts

A segregated account is a bank account that differs from a regular account in that it holds funds allocated for specific purposes.

This may be an account where money is held for specific purposes or obligations, such as an account for paying taxes, an account for holding customer funds at a financial institution, or an account for stock trading.

Often, when describing the benefits of a Forex broker, you'll find a note that the company also offers a service called "Segregated Accounts." What is this service and what advantages does it offer traders over regular accounts?

A segregated account in stock trading is a type of trader's deposit where a portion of the funds is held outside the brokerage company, significantly reducing the client's operational risks.

For example, if you plan to trade $200,000, you open a segregated account, sign an agreement with the company, and deposit only half of the $100,000.

Reliable brokerage companies with access to Forex

Choosing a broker has always been a top priority in trading, as in addition to reliability, other factors such as the size of the initial deposit, the spread, the speed of order execution, and other parameters also play an important role.

It's especially important to note that not all forex brokerage firms offering trading services allow their clients to use strategies that put a strain on their servers and communication lines.

Finding a happy medium is always a good idea, and this list includes reliable brokerage firms with optimal parameters and a good reputation.

From my personal experience, I can say that I have never had any problems with withdrawals from any of these companies, and no manipulation of quotes has been observed, and this is sometimes more important than attractive trading conditions and huge bonuses.

So, here are some reliable brokerage companies for Forex trading where you can open an account online and get started in just a few minutes:

Banking Forex, online trading through bank brokers

The forex market is home to many participants who conduct currency transactions for their own needs or provide intermediary services to traders.

Banks are among these participants; they don't simply execute the market; they shape it thanks to their available funds.

Bank-based forex, on the other hand, is when a bank acts as an intermediary, providing its clients with access to currency transactions.

Essentially, it assumes the responsibilities of a dealing center, sending clients' trades to the market and charging a commission for doing so, which is the primary purpose of such activity.

Many people associate banks with reliability and security, which is why they are tempted to trade through them. However, in reality, this approach also has its pros and cons.

What is the difference between a broker and a dealing center?

Some traders open an account with the company they like without even thinking about who the broker or DC is, while others persistently look for a broker-agent, believing that this option is much more reliable.

look for a broker-agent, believing that this option is much more reliable.

So what is the difference between a real broker and a dealing center?

Is this difference so significant that it is worth taking it into account when choosing a company that will bring your transactions to the foreign exchange market?

Currently, several types of companies provide their services to Russian traders:

Brokers for trading gold and silver

Some traders claim that trading precious metals brings them the greatest profits. It's best to test this claim in practice, but for this purpose, you'll need brokers specializing in gold and silver trading.

profits. It's best to test this claim in practice, but for this purpose, you'll need brokers specializing in gold and silver trading.

I'll provide a list of such companies below, along with spreads for the required instruments. Before I do, let's discuss the selection process itself.

When taking such a crucial step, it's essential to know what to look for first.

Fixed Spread Brokers

There's a saying, "There are so many opinions," and in Forex, some people prefer a floating spread, while others prefer a fixed spread.

a fixed spread.

The main advantage of a fixed spread is its stable size, eliminating the need to constantly monitor it.

Over time, fewer forex brokers remain that guarantee a spread. Below are companies offering fixed spreads and the most favorable trading conditions.

But they still exist, or rather, they have certain types of accounts with the point that interests us.

Frequently asked questions about brokers

Discussions about choosing a broker are a common topic on forums and blogs, but beyond the specific discussion of which forex broker is best for trading, there are a host of questions that arise for almost every trader.

for trading, there are a host of questions that arise for almost every trader.

Besides reliability, there are a host of other factors to consider. While they don't have a dramatic impact on trading, it's useful to know them.

So, what's useful for any trader to know?

1. Spread size – this is a good indicator of a broker's greed. The average spread for EURUSD shouldn't exceed 0.5 pips. However, if it's significantly smaller than this, your broker is profiting from wasting deposits.

A broker for professionals, VIP service, and no restrictions

Not every Forex broker is suitable for large-scale trading. Some have maximum trade volume limits, others can't provide the required quality of dealing, and still others are simply afraid to entrust large sums of money to.

others can't provide the required quality of dealing, and still others are simply afraid to entrust large sums of money to.

Choosing a broker for trading $50,000-$100,000 is much more difficult than for trading $50,000-$100,000.

A large sum, and therefore a large trade volume, imposes certain obligations on the brokerage company itself, and not every DC can handle them. Therefore, the main criteria for choosing a broker for large-scale trading are:

Disadvantages of Forex brokers or how to avoid problems.

Anyone who's ever traded Forex can tell you that choosing the right broker is crucial to successful trading. No matter how well you understand the market, poor trading can ruin all your efforts in an instant.

matter how well you understand the market, poor trading can ruin all your efforts in an instant.

Therefore, it's crucial to know the shortcomings of some brokers, the potential consequences, and how to avoid them.

The current structure of the trading system means that virtually no one is immune to failures, but brokers also face the following problems:

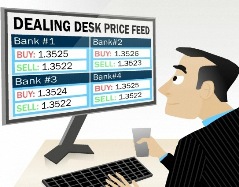

Dealing Desk, intra-company trading

Many traders, upon hearing that their broker offers dealing services using the Dealing Desk system, immediately panic, expecting various problems from the broker.

panic, expecting various problems from the broker.

Dealing Desk (DD) is a system for organizing trading in currency or other financial assets, in which an internal platform is created, the liquidity of trading instruments on which is provided by the dealing center itself.

In other words, everything is as simple as possible here: if you submit a request to buy the EURUSD currency pair, the system begins to search for a counter-order to sell it. If one does not exist, your brokerage company will act as the second party to the transaction.

Page 2 of 3