Lamm or Pamm account?

Today, it's not just traders who can make money on the Forex market, but anyone who considers themselves an investor. And you don't have to be a billionaire like Buffett or Bill Gates, as the brokerage industry has developed so much these days that investing even just $1 can make you feel like an investor.

you don't have to be a billionaire like Buffett or Bill Gates, as the brokerage industry has developed so much these days that investing even just $1 can make you feel like an investor.

This became possible thanks to the emergence of PAMM and LAMM accounts, where you can both invest in a specific trader's account and easily copy the trading signals of a good manager.

Today, there are very few brokers that offer both PAMM and LAMM accounts. This allows you to invest your money in a manager or simply copy their operations proportionally into your account.

For those new to the subject, I'll try to explain the difference between PAMM and LAMM accounts, as well as the pitfalls they can pose.

A PAMM account is a special type of account where a trader operates publicly and accepts investments from various clients. Essentially, you invest directly in the trader through the system, who can manage the investors' combined capital and their own, but cannot withdraw the investor's funds.

Profits are generally split evenly, but the management fee can be either yours or the manager's. Undoubtedly, PAMM accounts are very attractive to investors because you can invest and take profits without doing anything. But beneath the veneer, there are many pitfalls.

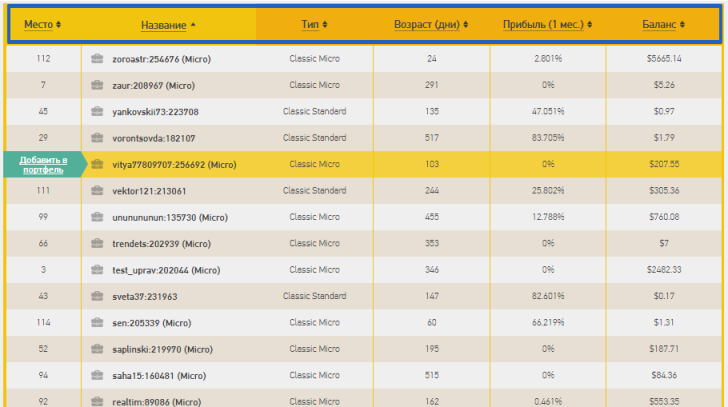

For example, many beginners open PAMM accounts to attract a large pool of investors, but ultimately, through their own stupidity, they simply destroy both their investors' money and their own. To avoid such troubles, you should monitor the trader's profitability and experience. For example, at Grand Capital, you can filter accounts by age, profitability, and balance. The longer a trader has been trading and the smoother their growth curve, the better off you'll be.

Unlike a PAMM account, a LAMM account is designed for copying a specific trader, selected from a list provided by the broker. The unique feature of this type of investment is that the system will automatically open trades identical to those of the trader, but these trades will occur in your account, which you can either intervene in or conduct simultaneously while copying signals.

Essentially, this type of investing is suitable for those with some trading experience, but even a complete beginner can handle it. This type of investing also has its pitfalls. For example, it often happens that the trader's balance does not match the investor's balance. While the trader opens a series of orders, what might seem like a tolerable drawdown for them can, unfortunately, prove fatal for your deposit.

To select a trader to copy signals from, visit the LAMM manager rating. You'll see a list of accounts that you can filter by profitability, age, account type (micro or classic), ranking, or balance.

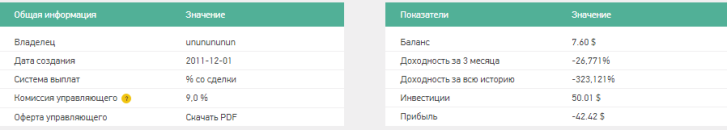

Once you've found a trader you like, it's time to review their account information. To do this, click on the name of the account you like. A chart with three lines will appear.

The blue line represents your account profit, the red line represents deposits and withdrawals, and the yellow line represents your balance. If you scroll down, you can also see a summary of your account information:

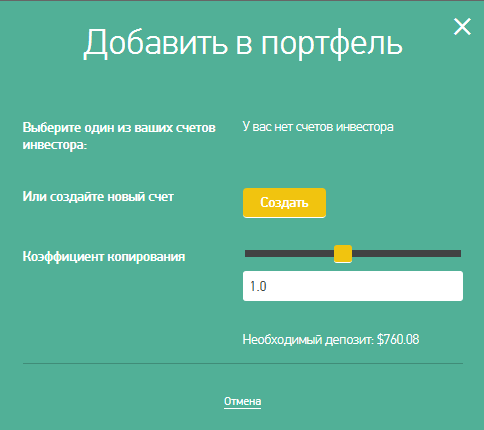

You can also communicate with the manager using the "Ask a Question" form, which will redirect you to the manager's forum thread. This thread is assigned to each LAMM account holder, so you can ask any of the managers any questions you may have. If you're happy with an account and want to copy its trades, simply click "Invest in this account." A window will appear where you can set the copy ratio.

This is necessary so you can manage your risks. By decreasing the coefficient, the system will open trades with a lot size smaller than the coefficient, while increasing it will increase the lot size relative to the manager's trade. If you leave it at 1, you will open a trade with the same lot size as the manager.

In general, both PAMM and LAMM accounts can be profitable if you choose the right manager. Since the broker only recently introduced this service, you may find yourself without sufficient tools to analyze the manager's trading system. However, if LAMM accounts are still actively developing and you have some choice of managers, the company's list of PAMM accounts is truly a sight to behold.

Of course, communicating with a trader on a forum is convenient, but where's the guarantee that they're telling the truth? Therefore, I believe it's best to refrain from investing until the broker adds new analysis tools, especially since you can choose another broker for PAMM investments: http://time-forex.com/vsebrokery/pamm-brokery