The Wolfen indicator. Automatically plots Wolfe waves

Unlike other methods of market analysis, wave theory allows for clear predictions of future price movements and long-term forecasts.

Inspired traders and followers of the wave theory developed their own approaches, and one of the most popular wave offshoots became the famous "Wolfe Waves".

The Wolfnen indicator is a technical analysis tool that allows you to plot Wolfe waves completely automatically.

It is worth noting that Wolfe Waves are equally effective on any time frame you use.

Given that the wave structure is present on any timeframe, it's also worth mentioning that the tool is multi-currency and allows for automatic marking not only on currency pairs but also on CFDs.

The Wolfnen indicator is a relatively new custom development, so this tool is not included by default in any trading platform.

Therefore, in order to use the indicator, you will need to go to the end of the article and download the tool, then install it in your MT4 trading terminal.

The installation process for the Wolfnen indicator follows a standard procedure and is no different from installing any other custom indicator. Specifically, you'll need to copy the downloaded file to the appropriate folder in your terminal's data directory.

After restarting the platform, Wolfnen will appear in the list of custom indicators, and to start using it, simply drag the instrument name onto the chart.

Indicator signals

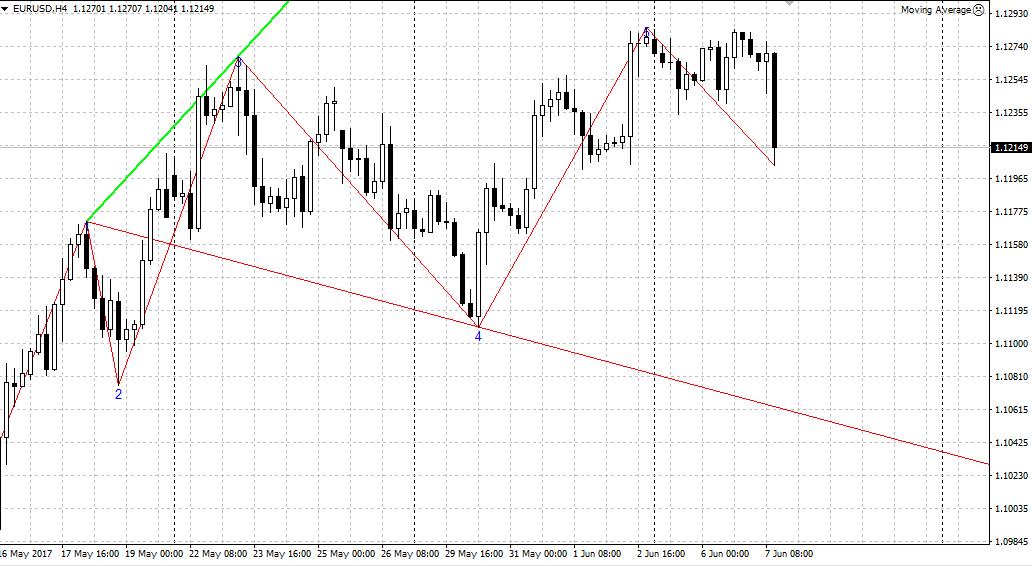

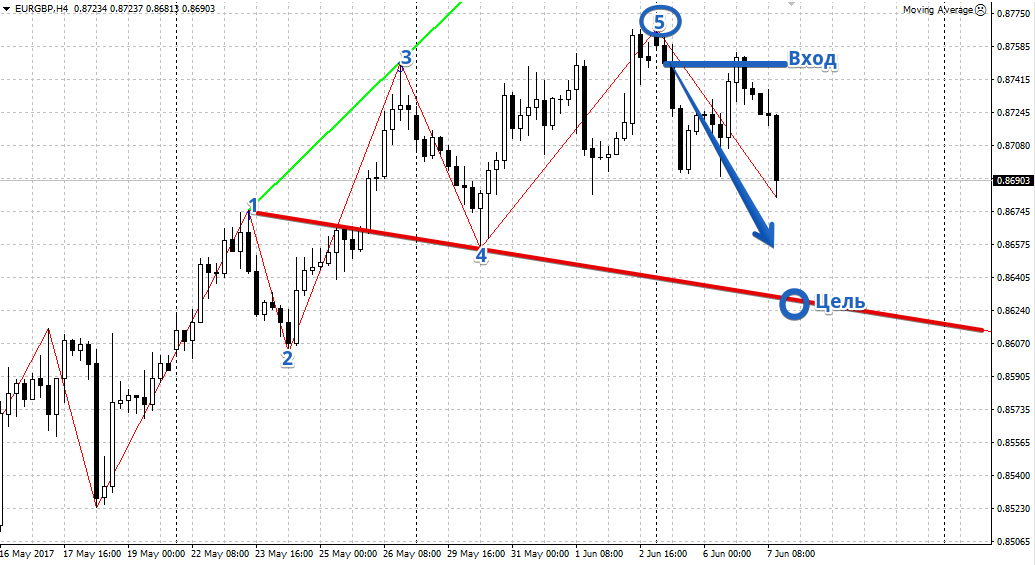

When working with Wolfe waves, it is important to understand that only the fifth wave is taken into account, which connects points 5 and 6 and is the very reversal wave symbolizing a change in trend.

It is worth understanding that there are both bullish and bearish Wolfe wave formations, and the fundamental difference between them is only in the sections of the trend on which they are built (upward or downward trend).

A sell or buy position (depending on whether the formation is bullish or bearish) should be opened only after the fifth point has formed and a small pullback has occurred.

When opening a position, the reference point and target is the red line, which is drawn through points 1 and 4. Example:

The principle of constructing the indicator. Settings

The biggest drawback of any wave theory is the subjectivity of its construction. This is because each trader may see and identify extreme points differently, and as a result, even using the same construction method, traders may make completely different forecasts.

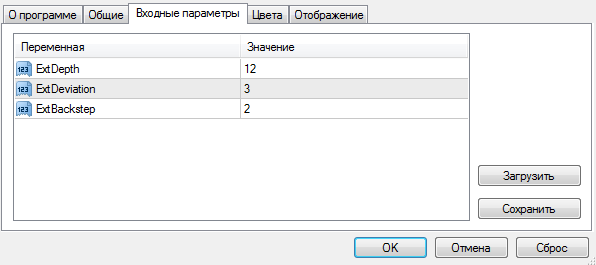

This is why the Wolfnen indicator is based on an algorithm for determining extreme points using the ZigZag indicator, which eliminates subjectivity in the search for extremes.

In the ExtDepth line, you can specify the ZigZag indicator depth value, and in the ExtDeviation line, you can set the deviation. In the ExtDeviation line, you can set the minimum number of candles between the local minimum and maximum for plotting the ZigZag indicator ray.

In conclusion, it is worth noting that the Wolfnen indicator is primarily an assistant that allows you to very quickly build Wolfe waves.

However, like any technical indicator based on wave theory, it can often produce incorrect markings, so it's best to double-check everything before taking signals into account.

Download the Wolfnen indicator.