Peculiarities of stock trading using leverage

The main advantage of modern stock trading is the ability to use leverage.

Margin trading allows you to increase your trade volume by tens, hundreds, or even thousands of times, while simultaneously increasing your potential profit.

Today, there are virtually no traders who refuse the opportunity of leverage, but at the same time, not everyone takes into account the specifics of trading using this instrument.

Beginners may think that if they open an account with 1:1000 leverage, they can trade using the unlimited features of margin trading .

Leverage size depending on the asset

Account leverage and available leverage for an asset are completely different things. Typically, a broker specifies the maximum available leverage in its trading conditions.

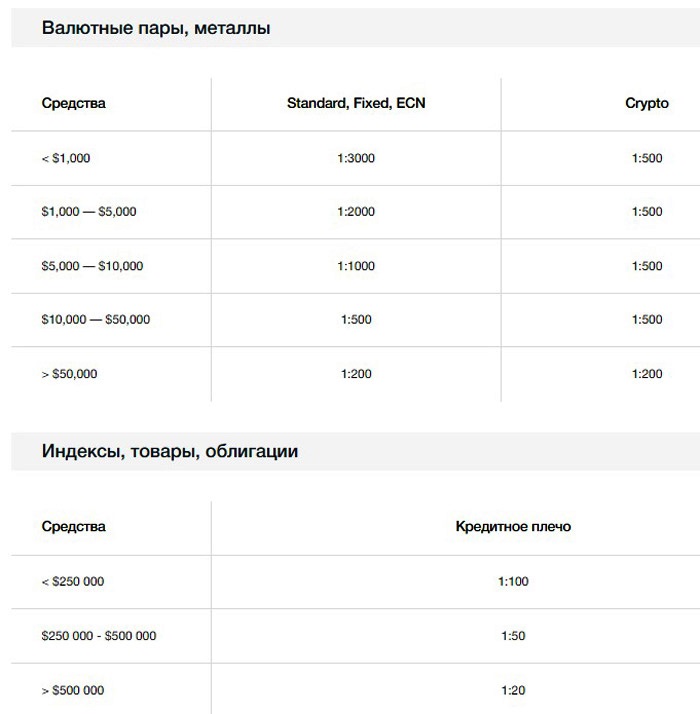

At the same time, the size varies significantly depending on the asset. While for regular currencies, leverage can actually be as high as 1:3000 , for cryptocurrencies, securities, and futures, the maximum leverage rarely exceeds 1:20.

If you try to open a larger trade, you will be rejected and receive a message about insufficient funds.

It's also worth noting that some brokers' leverage depends on the size of the trader's deposit; the larger the trader's deposit, the lower the leverage they are offered. For example, with a $1,000 deposit, you can use 1:3,000 leverage, but with a $100,000 deposit, you can only use 1:100.

Commissions increase with leverage

By using leverage, not only the transaction volume and potential profit increase, but also all types of commissions charged by the broker .

For example, when you open a $1,000 trade using your own funds, the spread is $0.10. However, using 1:100 leverage, you'd have to pay $10 on the same deposit amount.

This rule also applies to all other fees charged by the broker for opening or maintaining positions. Therefore, using high leverage is not beneficial for certain assets.

Another unpleasant feature is opening short stock trades. In this case, when dividends are accrued, their amount is debited from your account. This means that if you opened a short stock trade with 1:10 leverage and dividends accrue at 3% per annum, you could lose 30% of your deposit.

The higher the leverage, the shorter the trade

If you open positions with leverage greater than 1:500, you will have to forget about long-term trades, as your orders will be closed at the slightest trend correction .

That is, when trading on margin, the rule is that the higher the leverage, the shorter the duration of the transaction can be.

This is due to the peculiarity of price movement, which never moves in a straight line, since after a movement in the direction of the trend there always follows a rollback in the opposite direction.

For this reason, leverage greater than 1:100 is used for intraday trading, while for long-term trades lasting more than a month, it is advisable to use a leverage of no more than 1:3.

None of the above should scare you off when using leverage; you just need to take these nuances into account when planning your trading on the exchange.