Effectiveness of the news strategy as applied to futures

The use of fundamental analysis in stock trading has many supporters who prefer it to technical market research.

However, the impact of news on asset prices is quite ambiguous; often, after a news release, the price remains stagnant or moves in an unexpected direction.

This is especially common in forex trading, but what about futures?

The futures market operates under its own laws, and fundamental analysis is often more effective than technical analysis.

This is true because futures prices often directly correlate with news, and news taken into account in currency trading generally impacts the economy of the issuing country, not the currency itself.

The easiest way to assess this impact is through specific examples.

How the price of Brent crude oil futures reacted to this news can be seen on the chart:

As a result of the attack, Saudi Arabia was forced to halve its oil supplies, which led to a rapid market reaction.

As a result of the attack, Saudi Arabia was forced to halve its oil supplies, which led to a rapid market reaction.

The price of Brent crude gapped and jumped from $60 to $68 per barrel, meaning the supply reduction immediately led to a price increase.

A similar reaction can be observed in other futures trading.

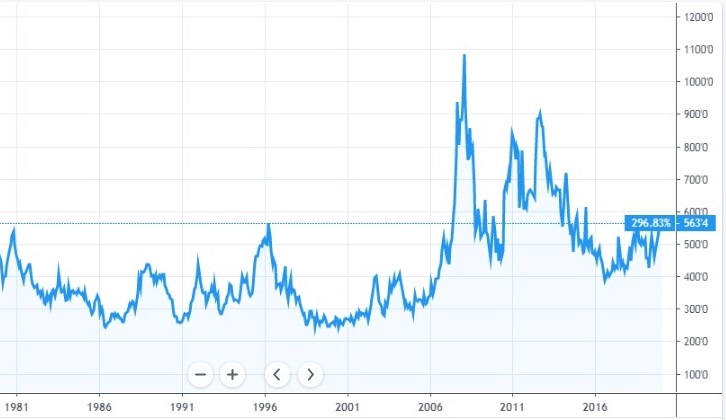

For example, news of a wheat crop failure and reduced grain harvest volumes can increase the price of this commodity on global markets severalfold. This situation was observed in 2010, 2011, and 2012:

Moreover, the market reacts not only to the publication of data on grain harvest volumes, but even to expert forecasts and meteorological statements.

Moreover, the market reacts not only to the publication of data on grain harvest volumes, but even to expert forecasts and meteorological statements.

The reason for this reaction in futures prices is obvious: news indicates a possible change in commodity supply, which inevitably affects the market.

Therefore, news trading in the futures market is always more effective than a similar strategy in currency trading.

The only drawback is that the exact time of the news release is never known, since no one plans a drought or a hurricane, and only those who carry out terrorist attacks know about them.

Read also:

Scalping in the futures market - http://time-forex.com/skalping/skalp-fucners

Futures in the trader's terminal - http://time-forex.com/praktika/fuchers-metatreyder