How risky is your trading strategy?

The dismal statistics of Forex trading are familiar to almost every novice trader.

According to available data, no more than 3-5 percent of all those who try their hand at stock trading become successful investors.

Moreover, many are familiar with this statistic firsthand; almost every newbie has lost their deposit as a result of unsuccessful trades.

There are many reasons why this happens, but the primary one is the riskiness of the strategy used.

It is the incorrectness of the chosen strategy, and sometimes its improper application in real trading, that leads to irreparable losses.

How do you determine the risk level of your strategy?

First of all, it's important to note that if you trade using strategies such as scalping and martingale, your trading will undoubtedly involve high risk.

This rule also applies to the use of expert advisors based on these strategies.

Trading methods that don't allow for stop orders are also high-risk, and unfortunately, such methods do exist.

Another indicator of high risk is if the strategy involves holding positions open over weekends; this often leads to stop losses not being triggered, resulting in more significant losses.

The expected loss at which your position will be closed is also important; methods that involve a loss of more than 5% on a single trade are definitely risky.

After ensuring that your strategy doesn't fall into the above categories, you should pay attention to the risk level you take when opening trades.

Simply put, this is the ratio between the size of your deposit and the size of the position you're opening, although the strategy itself isn't always to blame.

We often see in the instructions for using an advisor or strategy that the recommended deposit is, for example, $5,000. However, the account only has $500, and the lack of funds for opening a position is compensated for by leverage. In other words, in the given example, the risk of transactions increases tenfold.

And the author of the strategy is not at fault for this; the fault lies with those who do not follow the written recommendations.

There are also special scripts that allow you to independently determine your risk level; there are several of them on our website:

• Trader Assistant - http://time-forex.com/skripty/trade-assistant helps set the parameters of opened orders, including adjusting the volume of transactions depending on the planned risk:

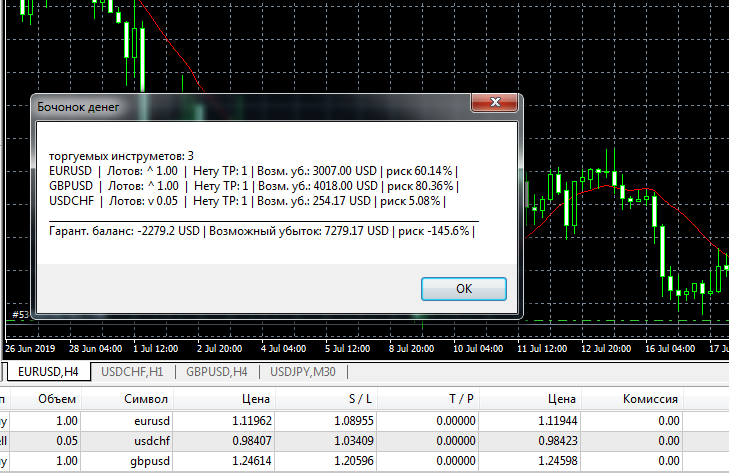

• Money management script - http://time-forex.com/skripty/skript-mani-menedzhment A simpler option, which after installation shows the risk level in percentage and probable losses on your transactions in dollars:

• Money management script - http://time-forex.com/skripty/skript-mani-menedzhment A simpler option, which after installation shows the risk level in percentage and probable losses on your transactions in dollars:

Using these scripts, you can calculate the risk of your strategy, taking into account your planned trade volumes, even on a demo account. You can then decide whether to use it or reduce the size of future orders. After that, all you have to do is rely on a favorable trend.

Using these scripts, you can calculate the risk of your strategy, taking into account your planned trade volumes, even on a demo account. You can then decide whether to use it or reduce the size of future orders. After that, all you have to do is rely on a favorable trend.