Buying company shares before the cutoff date or before the dividend announcement

Buying company shares is a rather complicated process; it is not enough to simply choose a company you like and purchase its securities.

There are things to look out for when buying a stock, and one of those things is the cutoff date.

Cut-off date - A cut-off date is a fixed date on which the list of persons entitled to receive a particular right or payment (e.g., dividends) is fixed.

If the asset is owned by you on that date, the right is retained; if acquired later, the right does not arise.

This moment is often also referred to as the register closing date.

So, if the Pfizer is November 7, and you buy these shares on November 5, you'll receive your quarterly dividends in just four weeks, even though you held the stock for less than a month. To ensure your shares are included in the shareholder register, it's best to make your purchase 1-2 business days before the cutoff date.

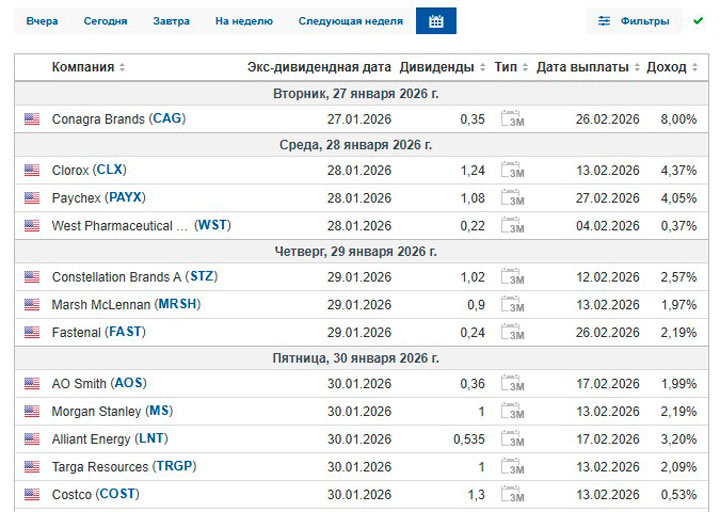

You can view the cutoff dates and dividend payouts here - https://ru.investing.com/

When is the best time to buy shares? Price behavior analysis

Typically, the price begins to rise immediately after the announcement of a dividend payment, and the larger the size of this payment, the faster the price rises.

Most professional investors buy shares before news breaks, analyze the company's financial condition, revenue and profit levels, and then make a decision.

While many investors start buying shares several weeks before the ex-division date, this creates increased demand that drives the price up.

After the payment, the stock price falls, and the losses from the fall exceed the amount of dividends received.

Therefore, the best time to buy is immediately after the announcement of dividend payments or after the payment itself, when the price of the security falls.

| Event | How the stock price behaves | Rational actions of an investor |

|---|---|---|

| Period before dividend announcement | Price is often undervalued, movement is weak or sideways | Analyzing a company's finances and buying without hype |

| Dividend announcement | Price growth, especially with a high dividend yield | Buy immediately after the news if the growth has not yet been exhausted |

| Period before the cut-off date | Increased demand and accelerating price growth | Cautious entry or profit taking |

| Cut-off date (register closing) |

Fixing the right to dividends, the price is often at local highs | Purchase only with clear calculations and strategy |

| After dividend payment | A fall in price that often exceeds the dividend amount | Finding an entry point for medium-term investments |

There are sometimes exceptions to this rule, when the price pulls back just before the cutoff, giving you the opportunity to buy at a favorable price and then receive dividends.

To find the best moment, it's best to create a list of attractive stocks in advance and monitor the news on them.

The right strategy when investing in shares can sometimes allow you not only to save a few percent on the price, but also to earn good money on dividends.