How to use cryptocurrency averaging for maximum results

Averaging is a way to enter a position not with one purchase, but with several, in order to smooth out the impact of an unsuccessful entry moment.

In a volatile market, using such a tactic is entirely appropriate, as purchases are not always made at the lowest price, and the trader wants to correct the current situation.

Averaging cryptocurrencies allows you to partially correct the situation and often even turn the financial result into a profit.

The method doesn't eliminate risk or "cure" weak projects, but it does help you build a disciplined position in liquid coins with clear principles.

What is averaging in cryptocurrencies?

Essentially, you divide the planned transaction amount into several parts and buy the same coin at different points—either on dips ("down") or on confirmed growth ("up," pyramiding). However, you need to be sure of the trend direction.

There are also "time-based acquisitions" (DCA)—a fixed amount once a day/week without trying to catch the perfect price. In all cases, a pre-defined plan is key.

An example of the practical application of cryptocurrency averaging

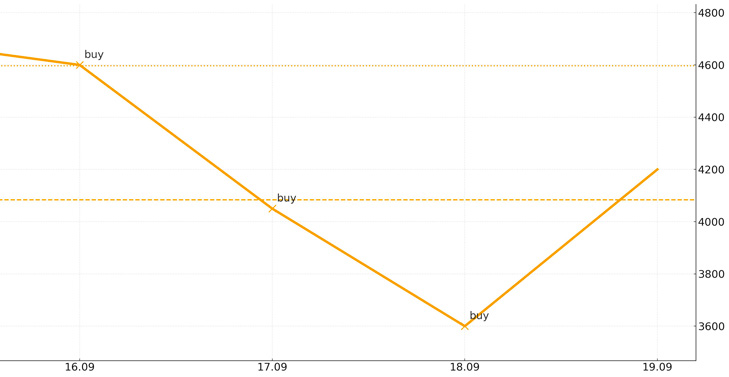

Settlement date: September 19, 2025. Estimated market price of ETH ≈ $4,596.66

ETH averaging down scenario:

Purchase #1: 1 ETH at $4,600 → costs $4,600.

The price dropped by about 12%. Purchase #2: 1 ETH at $4,050 → costs $4,050.

The drawdown deepened to ~22% from the start. Purchase #3: 1 ETH at $3,600 → costs $3,600.

In total, you bought 3 ETH for $12,250.

Average position price: $12,250 / 3 ETH = $4,083.33 per ETH.

If the market then returns to the current price area (≈ $4,596.66), the position will be in profit due to the lower average: difference ≈ (4,596.66 − 4,083.33) × 3 ETH ≈ $1,540.

It's important to understand that before opening your first position, you should determine the trade size so that you have funds left over for averaging. Averaging is applicable to liquid cryptocurrencies ; for weaker coins, adding funds only increases the risk, especially when it comes to long trades.

The pros and cons of averaging, as well as a possible alternative

Averaging reduces the likelihood of “entering at the peak,” introduces order instead of emotions, and makes the budget manageable over time.

The downsides include the potential for increasing your position in a falling market and the associated costs (commissions, spreads ). Furthermore, if you start by averaging long, after the uptrend reverses, this will only increase your losses. The same applies to short trades and uptrends.

Therefore, during intraday trading, it is better to immediately close losing trades and enter the market at a more attractive price.

Alternatively, you can use cryptocurrency hedging , this method is more reliable and allows you to minimize the risk of losses.

Cryptocurrency trading brokers

Averaging is discipline and a pre-planned approach. It yields results when the asset is high-quality and entry and exit rules are predetermined. The "maximum result" is achieved not by the number of "top-ups," but by a sensible choice of coin, capital limits, and a clear stop-loss point.