Short position ban for Muslims and other Sharia-compliant trading considerations

Islam is one of the few world religions that still strictly adheres to the laws set out in its fundamental dogmas and the decisions of its spiritual councils.

Sharia law applies to virtually all areas of the lives of believers, including stock trading.

One of the latest innovations is a ban on short, uncovered positions and the use of leverage for Muslims in the Russian Federation.

This means that believers who practice this religion in the Russian Federation will no longer be able to make unsecured sales transactions or trade using borrowed funds from a broker.

It should be clarified that we are only talking about unsecured short positions , where a trader sells an asset that was not previously purchased.

This type of transaction is purely speculative in nature; one could say that the product being sold is borrowed, and after the price falls, the asset is purchased at a lower price and the transaction is closed.

Therefore, the ban does not apply to sales transactions if a previously purchased asset is being sold; for example, you bought shares and sold these securities a few days later.

The essence of the ban on margin trading

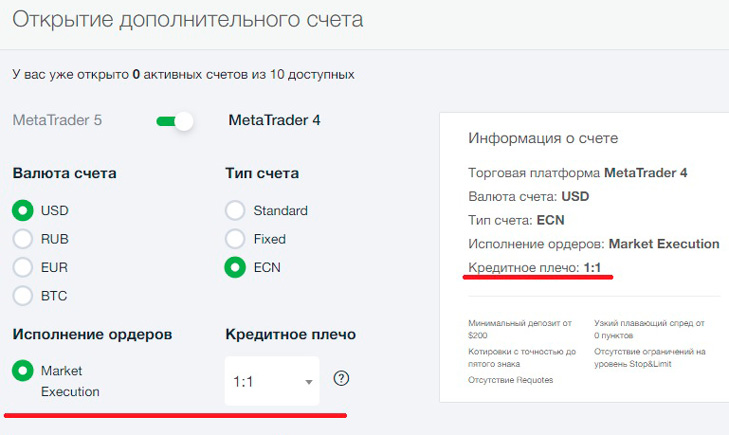

Following the decision by the Council of Ulema of the Spiritual Administration of Muslims of the Russian Federation to impose restrictions, Muslims can only open trades with leverage equal to 1:1.

Now, the volume of an opened position on Forex or another market must not exceed the amount of funds in the trader's deposit.

This means that you can only trade using your own funds, without using funds from a brokerage company.

The ban also affected stock futures, as well as transactions involving securities of companies whose activities are related to goods or activities prohibited by Sharia law, such as alcohol, pork, gambling, etc.

How will such innovations impact the market?

It cannot be said that the bans will have a significant impact on the stock market or other assets, but it will still reduce the number of short transactions.

Which in turn will reduce supply and will help support the upward trend .

How to increase profits without leverage?

If this innovation applies to you and you are accustomed to using leverage, you will have to look for an alternative option to increase your profits.

Trading cryptocurrencies can be an option, as this asset has high volatility and can be used to make good money even without using leverage or short positions.

Cryptocurrency brokers that offer 1:1 leverage allow you to open an account. This step will completely eliminate margin trading:

If you plan to carry over trades to the next day, don't forget about swap-free accounts , as Muslims are prohibited from trading on swap-accrued accounts.