How to Learn to Forecast the Forex Market

Those new to the exchange often think that the main thing is to trade with the trend, that is, open orders in the direction of the existing trend.

In reality, it's not the current trend that matters, but what it will be in a minute, an hour, or a day.

This means predicting future price movements and then deciding on the direction of a future trade based on that forecast.

Therefore, before starting Forex trading, it's crucial to learn how to forecast exchange rates; this is the key to successful trading.

A novice trader should at least know the basics of this science; without it, most trades will be unprofitable.

• Fundamental – these are significant economic, political and social events that influence the value of a certain monetary unit.

For example, the value of the ruble is influenced by the price of oil, since revenues from oil sales make up a significant share of the Russian budget.

Changes in indicators such as GDP, balance of payments, unemployment, prices for other budget-forming goods, and the imposition of sanctions have a similar impact on the exchange rate.

Changes in indicators such as GDP, balance of payments, unemployment, prices for other budget-forming goods, and the imposition of sanctions have a similar impact on the exchange rate.

Economic and political events in the country also play a significant role; although the influence of these factors is short-term, they can still cause a significant change in the exchange rate and provide an opportunity to earn money.

For more information on these factors, read: http://time-forex.com/fundamental/faktory-vliyayushchie-na-kursy-valyut

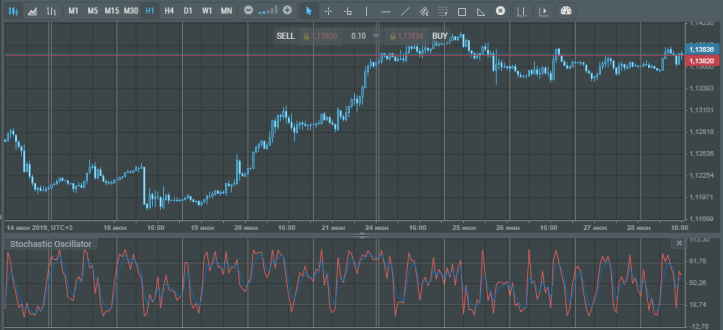

• Technical approach – the entire history of trend movement is recorded on currency pair charts; with careful study, you can find a variety of patterns .

These patterns become the basis for future forecasts; the main thing is to learn to see them on the charts.

Technical analysis isn't as straightforward as fundamental analysis. Price action doesn't always follow a predictable pattern, even if a specific chart pattern appears or a similar situation develops.

Technical analysis isn't as straightforward as fundamental analysis. Price action doesn't always follow a predictable pattern, even if a specific chart pattern appears or a similar situation develops.

However, in most cases, chart data can be used to generate a fairly accurate forecast.

Read more about technical analysis here: http://time-forex.com/tehanaliz

In conclusion, I'd like to say that there are no 100% accurate forecasts; a trader's task is to detect errors in time and close the trade.