How realistic is Bitcoin scalping? The specifics of using the strategy

Scalping is one of the most attractive trends in trading, providing traders with a fairly high return, which can be several times higher than the average return of any trend or intraday trading strategy .

However, having a clear algorithm, or strategy, is far from sufficient for using this market analysis method.

The fact is that scalping's effectiveness depends largely on the broker's trading conditions, as well as the specifics of the chosen asset.

While one strategy may show excellent results on one currency pair, it's far from certain that the same strategy will show consistent losses on a completely different trading asset.

There's a direct correlation between asset selection and strategy effectiveness, and in this article, you'll learn how promising Bitcoin scalping is and whether it's advisable to trade this cryptocurrency using scalping strategies.

Key points when scalping Bitcoin.

When selecting an asset for short-term strategies, there are a number of criteria, including the number of pips the price moves per day (also known as volatility) , the asset price and margin, leverage, and the value of one pip.

So, when it comes to asset volatility, that is, the number of pips the price moves on average per day, Bitcoin has phenomenal performance.

According to the latest data, the price moves an average of 19,000 pips in a single trading day, a figure unmatched by any other major currency pair.

This is primarily due to the enormous hype, which has led to this instrument's immense popularity among investors.

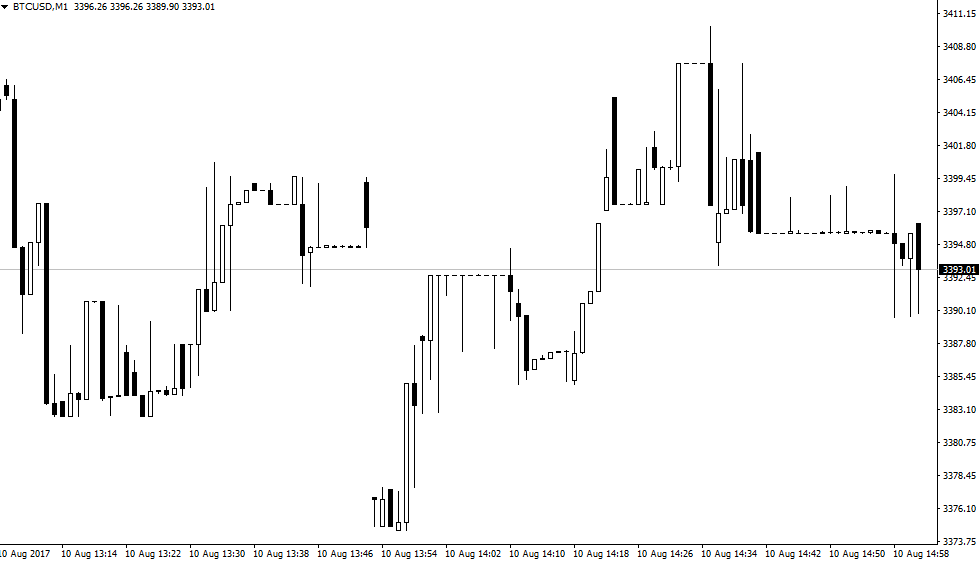

However, due to the lack of large market makers who provide liquidity, as well as Bitcoin's weak market capitalization compared to major currencies, traders can experience constant price gaps and the appearance of incomplete candlesticks.

This situation occurs because any significant inflow or outflow of money from Bitcoin inevitably impacts the market, which can be clearly seen by looking at the minute chart of any scalper:

Naturally, in such conditions, it's quite difficult to counter the market, as any technical analysis tools will provide a biased picture of what's happening.

Looking at the Bitcoin trading conditions of two of the largest brokers, RoboForex and AMarkets , it turns out that the maximum leverage a trader can use is 1:50, while the minimum volume for opening a position is one Bitcoin.

Therefore, with 1:50 leverage, opening a single trade at a price of 40,000 would require a margin of approximately $800.

Naturally, such trading conditions immediately weed out traders with small capital, who typically turn to scalping to build up their deposits .

Also, the rather large spread, which typically fluctuates around 1,000 pips, is a disincentive for Bitcoin scalping.

Considering that a pip is worth 1 cent, when opening a position, the trader will see a loss of -$10 on their balance, which is quite a significant amount.

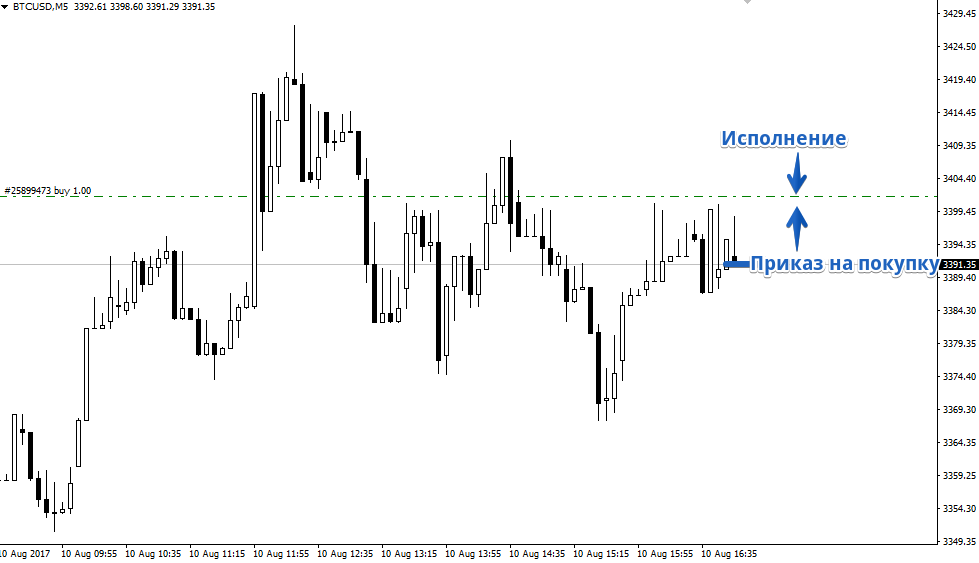

It's also worth noting that, due to the large spread, the trade's opening price will be far from the price at which you receive the market signal.

As an example, I suggest looking at the last candle on the chart, where we received the market signal, and the point where the position was activated due to the large spread. The price on the chart is not current at this point.

In conclusion, we must acknowledge the fact that Bitcoin scalping, in the classic sense, is simply impossible on a one-minute or five-minute timeframe. This is

because the enormous spread for potential small targets (a few pips or a couple of candles) ruins the overall picture from a mathematical perspective.

It's also important to mention the margin requirements and the lack of significant leverage , which would compensate for the lack of deposits for most traders.

Nevertheless, for intraday trading with reasonable goals, Bitcoin can be a very good choice; an intraday strategy using it can easily double your deposit in a short period of time.

It should also be noted that brokers' trading conditions are constantly changing, and you can find out the current state of affairs by following the links to cryptocurrency brokers' websites - https://time-forex.com/kriptovaluty/brokery-kriptovalut