Scalping on the order book: a simple and effective strategy for making money

Scalping is one of the most common trading tactics in both the stock exchange and the forex market.

Many traders confuse scalping with day trading, believing that opening orders with small targets and stops is the foundation of this strategy.

In fact, this blurring of the scalping concept occurs because the Forex market lacks a proper order book, which has led to a simple confusion of concepts.

Stock exchanges do have a proper order book, which allows for assessing the actual market situation and placing trades with a target of a few ticks.

Scalping platforms for the glass

It's no secret to most traders that the MT4 and MT5 trading platforms feature a fictitious order book, which never displays the volume of trades or the cash flows behind buyers or sellers.

To achieve this, a completely new, progressive ECN platform, cTrader, was developed, which for the first time features a trading order book, where money turnover is visible.

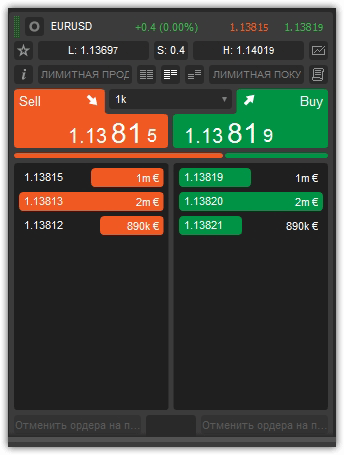

The cTrader trading platform offers three different tools: the standard order book, the price chart, and the VWAP chart. There's no fundamental difference between these tools; the only difference is how the information is presented.

See the example from Trader below:

If you want to participate in trading on the Moscow Stock Exchange, you'll need the QUIK Junior trading platform.

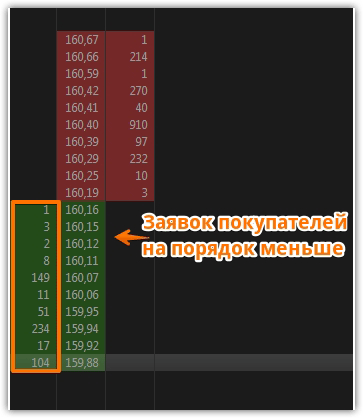

You can access the stock market through a specialized broker, but the order book is the most informative only on the stock exchange. Therefore, if you're interested in real order book scalping, the QUIK trading terminal is a must.

The QUIK terminal is shown below:

The basic principle of operation

: The order book is a table where you can monitor orders from both sellers and buyers at a specific price. At the top, price values are shown in red, representing seller orders, while at the bottom, values are highlighted in green, representing buyer orders.

It's no secret that market price movements are always driven by either sellers or buyers, so tracking specific orders helps maintain a certain direction.

Basics of scalping using the order book:

Before you begin scalping, you need to understand that all orders in the order book are driven by real people pursuing their own goals. When scalping, in our case, as strange as it may sound, forget about the chart, as you'll be getting all the information you need directly from the order book.

When scalping using the order book, your main goal is to determine whether demand or supply is higher. To do this, you need to look directly at the red or green area of the order book and the number of orders.

As a rule, the market moves toward a thinner order book, namely, the direction where the number of orders is significantly lower.

When implementing a strategy, your main task, after identifying the market leaders in a given situation, is to identify the major players. A major player is a kind of anchor for a trader, from which all trading will be conducted. A scalper's main goal is to replicate the major player's plan.

Once you've determined which side clearly has the advantage and identified a major player based on their order, you should place an order ahead of the major player to not only replicate their plan but also to get ahead of the game.

A logical question arises: why place an order ahead of a major player? First, you must understand that by placing an order ahead of a major player, you have a kind of support in the form of their orders. If the price moves against you, it will primarily hit their orders, which will likely lead to a rebound in your desired direction.

Target Determination.

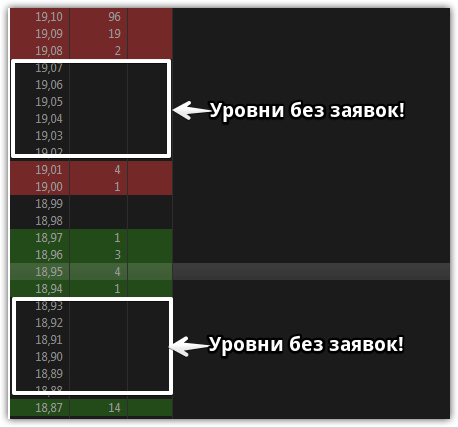

To understand what target your scalping operations can easily achieve in the event of a strong move, you should enable the sparse order book feature. Unlike the standard order book, the sparse order book displays areas where there are no orders from either sellers or buyers.

Therefore, if you see such zones, you can be absolutely sure they are not protected by any orders, and the market will easily overcome them. An example of the sparse order book and unprotected zones is shown below:

It's worth noting that when implementing the "DOM Scalping" strategy, it's crucial not only to stay immersed in the process, as order changes are indeed rapid, but also to monitor risks, specifically using specialized scripts and scalping tools.

Also, remember that when catching a major player, they may, in turn, place false orders and quickly cancel them to deceive the crowd. Therefore, be very careful about such phenomena and don't jump into the market at the sight of every major investor.