Forex Margin Calculator: A simple calculation of the funds required for collateral

You've probably often encountered a situation when opening a transaction, where your attempt to open an order is rejected.

And in the window for opening a new order, an unpleasant message appears: “Not enough money”, the culprit in this case is the excessively large volume of the position being opened.

Or, to be more precise, there is not enough money on deposit to open a new trade, even taking into account the available leverage.

The collateral funds that are blocked for a new transaction are called margin, and it is better to know in advance how much funds are required to avoid a refusal.

For example, the EUR/USD currency pair, current rate 1.10, volume 1 lot, leverage 1:100, for this trading position volume the margin will be 110,000/100 = 1,100 US dollars.

In this case, everything is quite simple, but situations and figures vary, so a more effective option is to use a forex margin calculator.

How to Use a Forex Margin Calculator

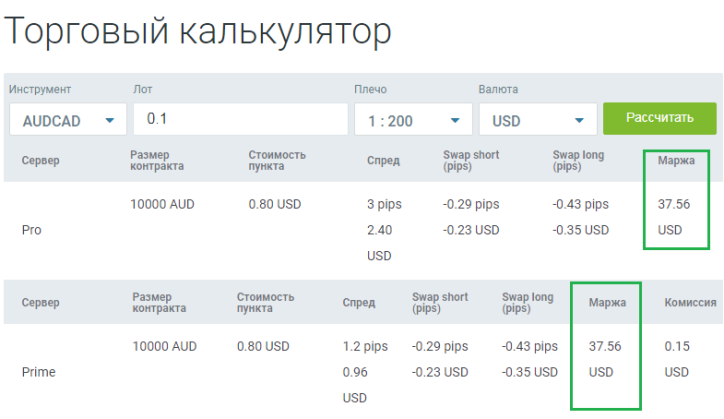

Currently, there are a variety of calculators available that can be used to calculate all the necessary transaction parameters—the pip value, the swap fee for rolling over a position, the spread size, and the actual margin size:

An example of a universal calculator: https://time-forex.com/praktika/kalkulator-stoimosti-punkta

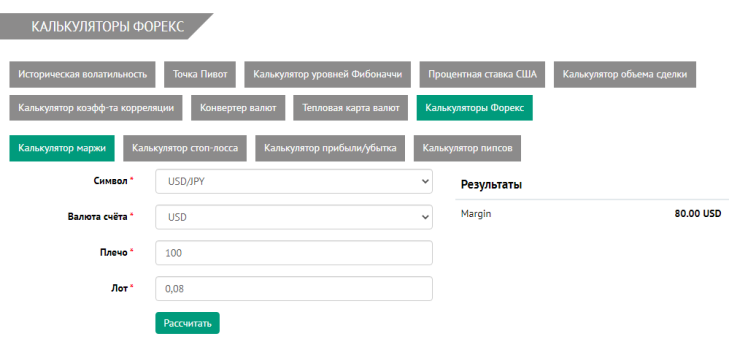

There are also calculators designed specifically for calculating the margin required to open a Forex trade:

They calculate one parameter: margin. To perform the calculation, you need to specify the Symbol (in our example, USD/JPY is the US dollar and Japanese yen), the settlement currency, the leverage in your account, and the planned trade size in lots.

The Forex margin calculator described above is located in the trader's personal account with the NPBFX broker . To use it and other useful tools, you must register; no account funding is required.

Unlike forex margin calculators that are installed directly into the trading platform, this tool operates more accurately and reliably.