A simple script that allows you to determine volatility over a period

Volatility , an indicator such as a currency pair or other trading asset, often raises many questions among traders.

Its value helps when planning future profits and finding better market entry points.

Volatility can also be used to select the most dynamic trading instrument.

Determining volatility is a painstaking and time-consuming process, but thanks to specialized scripts, it can be done in minutes.

We previously provided a similar Forex script on the page: http://time-forex.com/skripty/skr-volotilnost; it provides data by hour and day of the week.

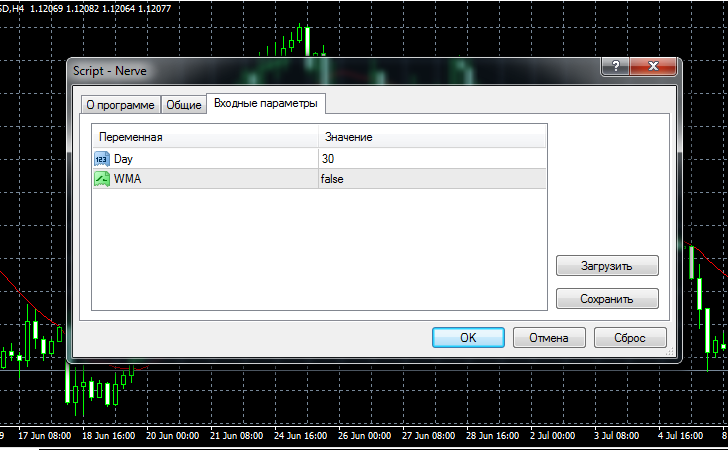

After downloading and adding to the trading terminal, you can configure the settings:

In essence, there are only two parameters:

• Day - the number of days that will be used in the analysis.

• Day - the number of days that will be used in the analysis.

• WMA - the calculations use false - a simple moving average or true - a weighted moving average.

After you have added a currency pair to the chart, you will see the image:

Day - Average volatility for the entered number of days.

Day - Average volatility for the entered number of days.

DayMax - Maximum volatility recorded for the day and period.

PerMax - Maximum volatility when evaluating a single candle.

Trend data is only taken for days when trading is conducted on the exchange.

Based on the data obtained, you can determine the trading strategy and select the most suitable asset.

Download the script for determining average volatility