Trading bonds on the MetaTrader 5 trading platform

Stock trading is much more diverse than most people think; it is not limited to currency pairs and company stocks.

There are many other equally interesting and profitable assets on the modern stock exchange, for example, the same bonds or, to be more precise, Eurobonds.

Eurobonds are bearer securities issued for a specified period.

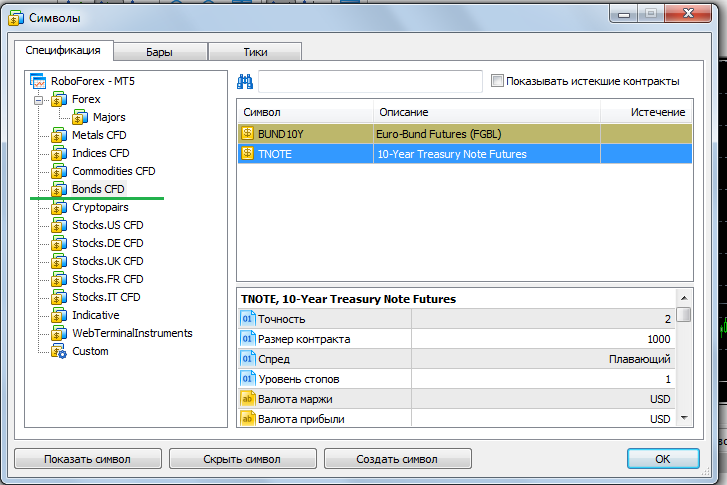

The MetaTrader 5 trading platform currently offers two such assets: ten-year bonds BUND10Y and TNOTE.

They are traded using futures contracts, so the trading conditions are the same as for other similar instruments.

Since there is currently a stable upward trend, it is recommended to open buy trades, which is quite simple to do.

To do this, launch the MT5 trading platform and right-click on the Market Watch window, select Bonds CFD under Symbols, and then add it to the Market Watch:

Then, for clarity, we open the chart of the selected Eurobond, analyze the price (if it continues to rise), and open a new buy transaction:

To open a 1-lot trade with 1:100 leverage, you'll need a deposit of $2,500. Micro lots of 0.01 of the volume are also available, reducing the minimum trade amount to just $25 if you choose to trade with 1:100 leverage.

Trading BUND10Y and TNOTE bonds does not guarantee you a 100% return, but at the moment it is a pretty good option with a high chance of success.

When opening a trade, don't forget to set the stop loss size to protect your deposit from unexpected events.