Best stop loss size

One of the most important aspects of Forex trading is risk reduction. Untimely exits are the main cause of large losses.

To combat losses, a familiar tool to every trader was invented: a stop-loss order.

More precisely, it's one of the settings set when opening a trade in the new order panel of the trading platform.

The importance of setting a stop-loss is clear; the key is the size of the order.

There are many options, and each trader chooses the one that best suits their strategy .

Today we will get to know some of them:

- Correct stop loss size

- Based on loss planning

- At strong levels

Correct stop loss size

One of the rules for placing this order is that its size must correspond to the market situation, otherwise the trade will be closed prematurely.

Therefore, proponents of this method set the stop-loss size based on the correction , so that a short-term pullback doesn't force the closure of a promising trade:

Price channel lines, created based on the price highs and lows on a given time frame, can also serve as reference points.

Price channel lines, created based on the price highs and lows on a given time frame, can also serve as reference points.

This is essentially the most appropriate option, as you're setting your stop loss not based on your beliefs or preferences, but on the market.

However, this leads to the conclusion that you need to monitor the market situation, and if it changes, you can adjust the size of your stop loss.

Based on loss planning

Essentially, this is the simplest option, based on planning for acceptable losses per trade, for example, no more than 1%.

In this case, there's no need to analyze the market situation; it's enough to calculate the percentage of the deposit in pips for the current currency pair.

For example, if we have $10,000 in our account, 1% of this amount is equal to $100, and 1 pip for the EURUSD currency pair with a volume of 1 lot is equal to $1.

For example, if we have $10,000 in our account, 1% of this amount is equal to $100, and 1 pip for the EURUSD currency pair with a volume of 1 lot is equal to $1.

Therefore, based on our strategy, the stop loss size should be 100 pips.

Clearly, this method isn't entirely scientific, but it is often applicable in practice, especially when there's no time to analyze the market situation.

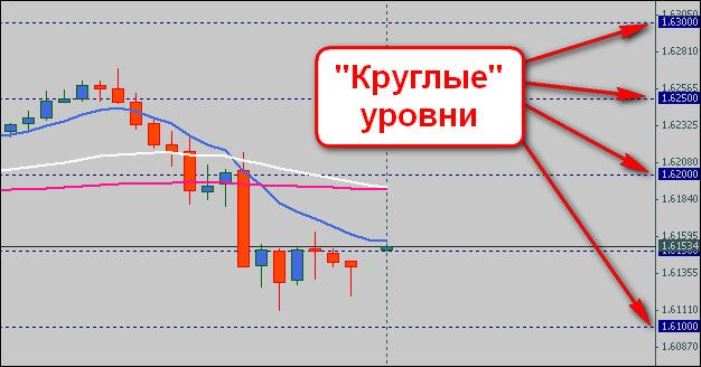

At strong levels

This option is suitable for long-term trading, when using breakout strategies, or when the price is near a strong level.

The stop loss is set not by the price level, but by the level beyond which the price is likely to continue moving.

These levels can be simple round price values—1.20; 2.00—or price values at which the price has frequently reversed.

Stop-loss orders are typically placed slightly beyond a strong level to avoid being triggered by a false breakout.

Stop-loss orders are typically placed slightly beyond a strong level to avoid being triggered by a false breakout.

For example, the current EURUSD exchange rate is 1.21325 and the market is in an uptrend. We open a buy trade and set the stop-loss at 1.19900 dollars per euro.

When using one of the presented methods, you should not forget that the price moves, and the size of the stop loss should change along with it.

Why lose your profit if the highs and lows have changed and the price has moved far from the opening point? In such cases, it's recommended to use a trailing stop or manually adjust the stop-loss size.

Related articles:

- Automatic stop-loss installer - http://time-forex.com/skripty/automatic-stop

- Stop-loss moving script - http://time-forex.com/skripty/stop-loss-move

- Stop loss technique http://time-forex.com/praktika/tehnik-stop-loss