Setting Take Profit for sell trades

Using safety orders is an integral part of trading. It allows traders to precisely implement their trading plan.

In many trading strategy descriptions, the authors recommend setting Stop Loss and Take Profit at important local levels.

Finding the right level that matches the current market situation is crucial.

Therefore, various analytical tools are used to accurately determine these levels:

• Bill Williams fractals;

Fibonacci grid ;

• cluster charts combined with volume delta.

The latter tool is quite complex and is only available on paid analytical platforms. MetaTrader terminal developers do not provide cluster charts.

Key features of asset value formation

In fact, there is an unspoken pattern in the pricing of financial instruments, confirmed by statistical data.

To understand the specifics of correctly placing orders to secure a trade's outcome, it's important to familiarize yourself with the specifics of pricing in general:

1. The price chart is always constructed in waves. Impulse movements in the direction of the current trend are followed by corrections and periods of consolidation (flat).

2. Breaking through a local level by the price does not always indicate a trend reversal.

3. The decline in the value of an asset is in most cases more rapid than its growth.

When entering the market correctly to sell, most traders aim to lock in profits when the price reaches the nearest local level.

As a result, the expected income is either less than or equal to the potential loss opening sell transactions It is recommended to set take profit 7-15 points below the local level.

The exact order value depends on market sentiment and other factors that caused the asset's price decline. To understand the rationale for such actions, consider a few examples:

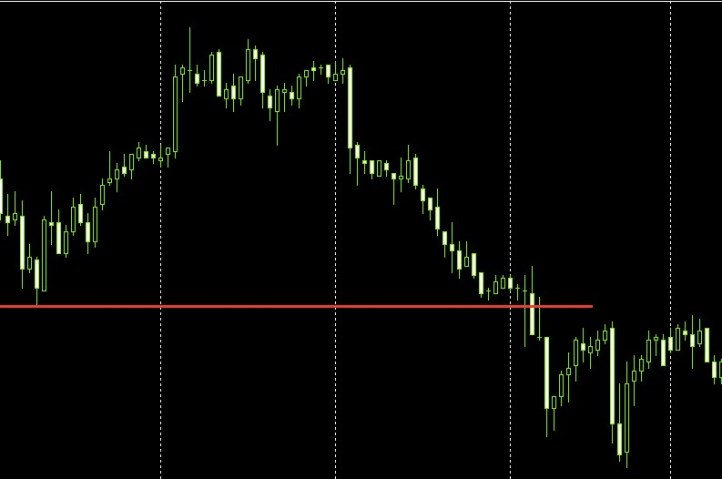

In this section of the chart, the uptrend, influenced by the release of macroeconomic data, gave way to a short-term correction.

In this section of the chart, the uptrend, influenced by the release of macroeconomic data, gave way to a short-term correction.

It's worth noting that the chart broke above the local price level. In this case, setting a take-profit 15 pips lower than usual would have significantly increased the profit from the trade.

This isn't a coincidence, but a pattern that holds true 80% of the time. To confirm this, consider a couple more examples:

In each case, during a downward trend, the price falls below the local level.

In each case, during a downward trend, the price falls below the local level.

Important! Fundamental factors are not currently the primary market driver. Trading volumes play a key role in financial instrument pricing.

Important! Fundamental factors are not currently the primary market driver. Trading volumes play a key role in financial instrument pricing.

Therefore, if a trend reverses after significant news releases, it is most likely only a short-term correction. This assumption is supported by statistics.

Where should you set your take profit when selling?

It's recommended to set take-profit orders for sell trades at an average of 10 pips below the local level.

If you're nervous about making such changes to your usual trading strategy, you can close 50% of the order when the price reaches its usual level or simply move the stop-loss order 7-10 pips below the current price.

Important! Putting these recommendations into practice will increase your potential monthly profit by 30-70 pips, depending on your trading style.

Related articles:

- Stop order indicator - http://time-forex.com/indikators/ind-stop-loss-teyk-profit

- Automatic take-profit script - http://time-forex.com/skripty/automatic-stop

- How to set a take profit - http://time-forex.com/praktika/kak-vystavit-tejk-profit