Advanced order management system

Trading in financial markets is a competition between exchange participants, where money flows between them based on the results achieved.

Therefore, traders constantly seek trading advantages that will allow them to stay one step ahead.

Some find this advantage in a unique system that provides signals slightly earlier than others or is highly accurate, while others gain it through excellent trading conditions.

Regardless, hundreds of factors can influence a trader's performance, and any advantage you gain can dramatically improve your trading.

Alpari 's advanced order management system .

It allows you to use additional functionality when working with orders, which is so necessary when implementing certain trading tactics.

Order settings

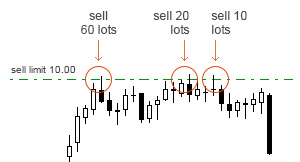

1. Partial opening of limit orders.

It's no secret that when working with limit orders at all brokerage firms, the order is either opened in full immediately or not opened at all if there is insufficient liquidity in the market.

Essentially, by enabling this feature, you can expand your position as liquidity becomes available.

This means that if the market only offers a few contracts at the stated price, instead of canceling the order, the broker will purchase the available quantity and hold the order until it has acquired the required number of lots or contracts at the stated price.

This means that if the market only offers a few contracts at the stated price, instead of canceling the order, the broker will purchase the available quantity and hold the order until it has acquired the required number of lots or contracts at the stated price.

This feature will be especially useful for large players and PAMM account holders who lack liquidity when trading exotic instruments.

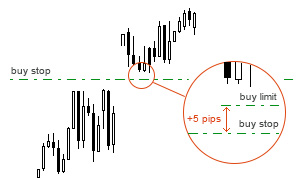

2. Option to enable market execution for pending orders.

It's no secret that market execution has both advantages and disadvantages.

The key disadvantage is that during a sharp price movement, the order may be executed at a price significantly worse than the stated price.

One problem with pending orders is that they may not be executed or simply canceled by the broker if slippage occurs unexpectedly.

One problem with pending orders is that they may not be executed or simply canceled by the broker if slippage occurs unexpectedly.

Market execution for limit orders guarantees that the trade will be opened regardless, even if the price is less favorable.

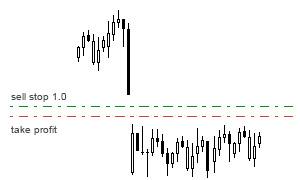

3. Protecting the opening of a pending order during a gap.

A gap , or more commonly known as a price gap, is one of the most unpredictable phenomena, which can have unimaginable consequences.

While price gaps are typically small, exceptions to the rule can sometimes occur, sometimes reaching tens or even hundreds of pips.

The problem is that if you place a supposedly pending order in the middle of this gap, your trade will be opened not at the price of the gap, but at the opening price after the gap.

The problem is that if you place a supposedly pending order in the middle of this gap, your trade will be opened not at the price of the gap, but at the opening price after the gap.

Therefore, to avoid this situation, you can enable the function to cancel the execution of pending orders located within this price gap.

4. Automatic cancellation of a pending order upon slippage of a specified number of points.

It's no secret that slippage is present at any broker, as it often occurs due to significantly increased volatility.

Naturally, if the amount of slippage is significant, a small trader doesn't incur any losses. However, there are situations where the execution price and the price of the gap differ so much that executing such a trade is completely pointless.

This problem is especially common among scalpers and pipsers. By enabling this feature, you can set an acceptable slippage level and limit trade openings if it exceeds it.

This problem is especially common among scalpers and pipsers. By enabling this feature, you can set an acceptable slippage level and limit trade openings if it exceeds it.

5. Recording slippage in the comments.

Price slippage can be a real drag on your trading and significantly impact your profitability, especially when it comes to scalping strategies.

Therefore, to understand how critical this phenomenon is, it's important to see its level and monitor its changes.

The slippage recording feature allows you to see this value without having to calculate it yourself, and also to accumulate statistics to understand and evaluate its impact on the effectiveness of your strategy.

The slippage recording feature allows you to see this value without having to calculate it yourself, and also to accumulate statistics to understand and evaluate its impact on the effectiveness of your strategy.

Of course, most traders likely won't need an advanced order management system.

Alpari offers over other traders .

You might also find this useful:

Trailing stop script - http://time-forex.com/skripty/trailing-stop

Stop-loss and take-profit calculation script - http://time-forex.com/skripty/skript-risk