Forex Combo

The Forex Combo trading advisor is one of the most exciting new products of 2012. Its algorithm included four different strategies. You'll agree that the market often alternates between flat and trending. So why not add a flat trading strategy?

strategies. You'll agree that the market often alternates between flat and trending. So why not add a flat trading strategy?

Of course, one could say that a flat strategy doesn't work during a trend, but the developers went further and added a scalping strategy and a strategy for breaking out levels.

Perhaps, individually, the strategies would be unprofitable at different periods, but by combining them, the author of the advisor achieved a kind of hedging.

While one strategy fails, the other three are profitable. I've also personally encountered many modifications of the expert advisor, where some skilled traders have added a martingale , making it extremely profitable.

Before you begin, you need to install the Expert Advisor on your Meta Trader 4 trading terminal. To do this, download the Expert Advisor from the end of this article and place it in the Expert folder in your trading terminal's data directory. Afterward, restart the terminal. Next, find the Expert Advisor in the list and place it on a five-minute chart.

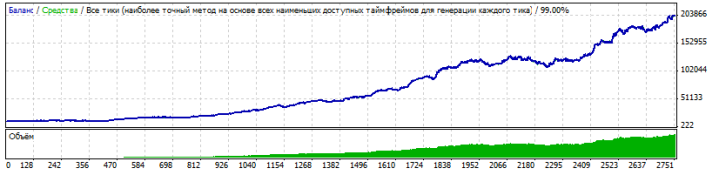

The EA works with the EUR/USD and GBP/USD pairs on a five-minute chart. However, I've also conducted various tests on higher timeframes, and it seems to me that the EA performs better on them. Another important feature of this EA is that it reliably passes testing from 2007 to 2012. The period from 2007 to 2010 is considered particularly difficult, as very few EAs survive on it. The test results for this period are below:

In the EA settings, you can enable or disable various strategies. In the "Use FX Combo Scalping" line, you can disable the scalping strategy. In the "Use FX Combo Breakout" line, you can enable or disable the breakout strategy. In the "Use FX Combo Reversal" line, you can enable or disable the counter-trend strategy. The "Use FX Combo EuroRange" line is responsible for trading in flat markets. You can also change the money management by enabling risky money management . If you enable the "UseAgresiveMM" line, you allow the EA to double the lot size in the event of a losing position. However, for this to happen, you must set the initial lot size in the TradeMMSys parameters.

In the EA settings, you can enable or disable various strategies. In the "Use FX Combo Scalping" line, you can disable the scalping strategy. In the "Use FX Combo Breakout" line, you can enable or disable the breakout strategy. In the "Use FX Combo Reversal" line, you can enable or disable the counter-trend strategy. The "Use FX Combo EuroRange" line is responsible for trading in flat markets. You can also change the money management by enabling risky money management . If you enable the "UseAgresiveMM" line, you allow the EA to double the lot size in the event of a losing position. However, for this to happen, you must set the initial lot size in the TradeMMSys parameters.

To begin, I decided to conduct a test on the EUR/USD currency pair with the default settings (2012) for the period from January 1, 2015, to May 14, 2015. You can see the results on the chart:

As you can see, the EA not only didn't lose money on the old settings over five months, but even managed to make some money. Next, I decided to run the same test, but with UseAgresiveMM enabled and the initial lot size set to 2. The results were even more surprising:

The profit over four months was 124 percent, but the drawdown also reached 65 percent. This method is very risky, so I recommend you avoid it.

Of course, if you optimize the EA's settings, it will show more consistent profits, but the very fact that an EA with outdated settings didn't wipe out your account speaks volumes about its potential profitability. Before you decide to test the EA on a real account, I recommend monitoring its trading for a week on a cent account . Only a real-money test can truly reveal the true state of affairs. Thank you for your attention, and may the trend continue.