Grand Master Advisor

Pair trading, unlike trading using a standard strategy on a specific currency pair, requires the trader to carefully select two assets that exhibit a consistent price movement pattern.

So, almost any strategy for pair trading involves searching for a high direct or reverse correlations between currency pairsCorrect order placement, based on correlation across different assets, minimizes risks and utilizes hedging.

Unlike simple trading tactics, when trading pair strategies, profit is derived not only from correct speculation in a certain direction, but also from the accrual of swaps.

Thus, pairs trading combines the opportunity for maximum profit with minimal risk, with each trader earning at least bank interest while holding a set of neutral positions, and this does not include winning trades.

The Grand Master Advisor is a combination of two independent trading advisors that operate based on correlation and pair trading on Forex. Advisors can be used on virtually any time frame, since it is based on a mathematical calculation with elements of averaging and hedging, so the expert will work the same on all time frames.

Installing the Grand Master Advisor

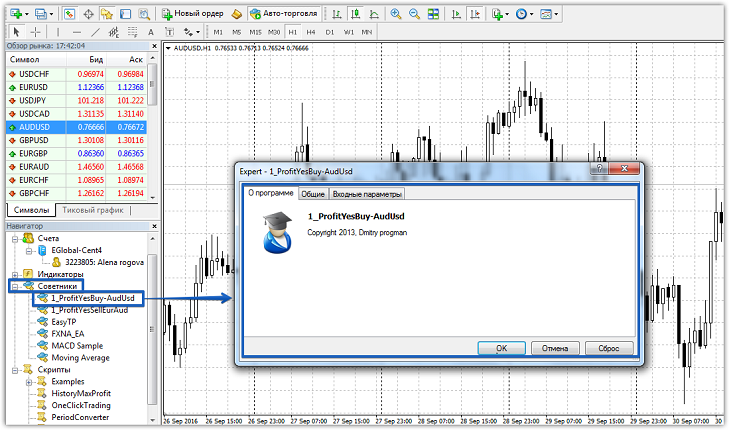

Before installing Expert Advisors in your trading terminal, you should go to the end of the article and download the archive containing two different robots. After downloading and unzipping the archives, you'll have access to your terminal's data directory. To do this, open the trading terminal and select "Data Directory" from the list of options that appears.The trading terminal's system folders will be displayed. Be sure to find the "Expert" folder and add both advisors to it. After you've added the advisors, close the data folder and go directly to the trading terminal. In the running platform, find the navigator panel and perform updates by opening the additional menu in the "Advisors" section.

After updating the platform, the advisors will appear in the appropriate section. To start trading, drag the robot with the corresponding name onto the same currency pair:

Robot Strategy Settings

The two experts are based on the renowned Grand Master strategy, first published in 2013. The strategy relies on the inverse correlation between two currency pairs, AUDUSD and EURAUD. These two instruments have exhibited a global trend for over 10 years: an upward trend for AUDUSD and a downward trend for EURAUD.

If you compare the two charts and observe the movements of these two Forex currency pairs, you'll see that when AUDUSD rises, EURAUD falls, and vice versa. Naturally, the correlation between the instruments can't be 100%, so a martingale is used to generate profit. According to the strategy, a buy order for AUDUSD and a sell order for EURAUD of the same lot size are opened simultaneously.

Thus, it happens hedging In pairs trading, there's no stop loss in the strategy. However, if the price moves against you, you should average at 120 pips from the position opening point. Averaging occurs with the same lot. The profit for both positions is 20 pips. If the price closes in profit, you reopen the position. It's worth noting that you will be charged a positive swap on both positions.

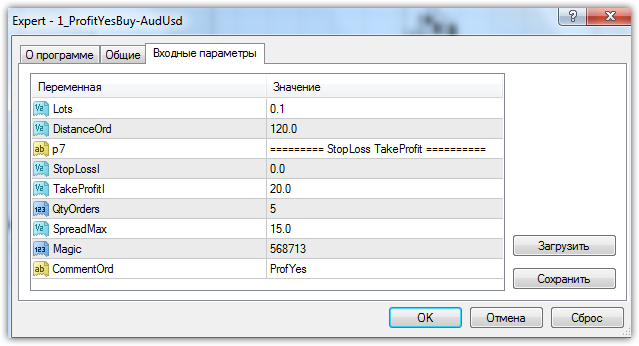

Both experts have identical settings, except that one will only buy the AUDUSD currency pair, while the other will sell EURAUD. In the "Lots" field, you must specify the lot for the expert. According to the strategy, the lot is calculated using a simple formula: 0.01 lot per 1,000 deposit units.

In the Distance Ord line, you can change the distance in points between orders in the averaging grid, and in the QtyOrders line, you can limit the number of orders in the averaging grid. In the TakeProfit line, you can set the profit level in points for each trade, and in the StopLoss line, you can limit the loss in points (the strategy does not apply a stop order).

Testing the Grand Master Strategy

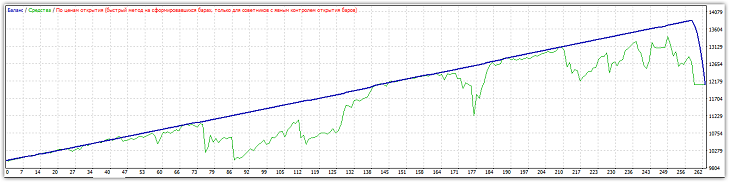

To draw objective conclusions about the performance of the forex strategy, we must conduct separate testing on the AUDUSD and EURAUD currency pairs. The strategy tester's testing period is 2015. The results were tested on the EURAUD currency pair:

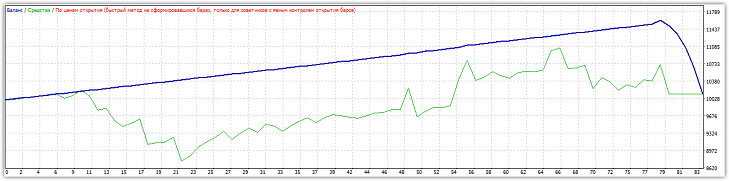

Testing the AUDUSD currency pair:

As you can see, despite the strategy being more than three years old, it's showing quite a good return. It's worth noting that the tester doesn't display swap accruals for each currency pair, so you can safely add at least 10 percent of your deposit for each test.

Download Grand Master Advisor